Trump Doubles Down on Dollar-supportive Policies

- Written by: Gary Howes

Official White House Photo by Tia Dufour.

Donald Trump, the favourite to win the White House in November, has doubled down on a number of policies seen as supportive of the Dollar.

In a new interview, Trump dismissed economist warnings that his proposed tariffs would have a negative impact on the economy and raise inflation.

“To me the most beautiful word in the dictionary is 'tariff,'" he said.

He wants to place a 60% levy on imports from China and a flat 10% duty on the rest of the world.

Economists say raising the cost of imports would have a knock-on effect of raising domestic retail prices.

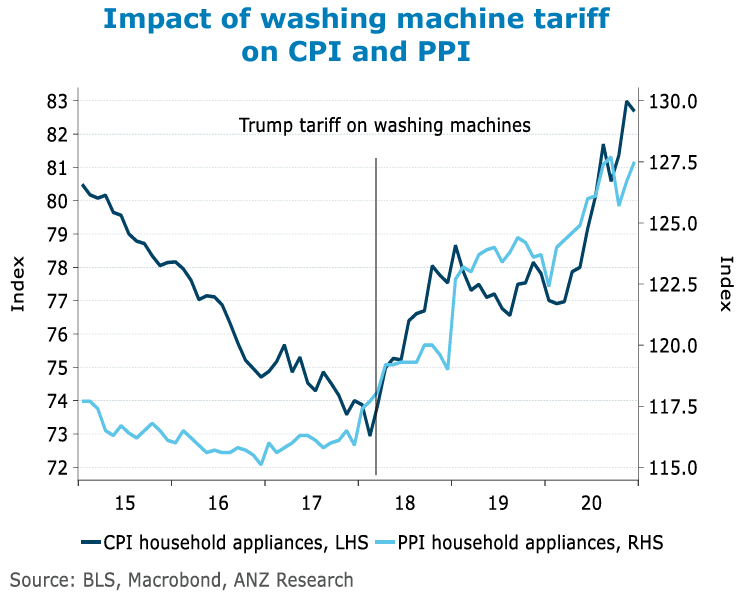

"The proposed 10–20% increase in tariffs across the board has the potential to be inflationary," says Tom Kenny, Senior International Economist at ANZ Bank.

Above: When Trump enacted a tariff on washing machines in his first term, the cost of washing machines rose. Image courtesy of ANZ Bank.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Tariffs tend to be inflationary which should lift the USD and for this reason we would expect the USD to be stronger in the early months of a Trump presidency than a Harris one," says Jane Foley, Senior FX Strategist at Rabobank.

"Over time, however, tariffs can reduce productivity and growth potential," she cautions.

Inflationary tariffs imply the Federal Reserve would need to exercise greater caution in cutting interest rates.

Trump's answer? Convince the Fed it needs to cut rates anyway.

In his interview with Bloomberg, Trump indicated he seeks greater influence at the Federal Reserve. However, he had no direct response to the question of whether he would seek to remove Fed Chairman Jerome Powell.

He said he believed it is the remit of the President to tell the Fed Chair how he thinks interest rates should change.

"If you’re a very good president with good sense, you should be able to at least talk to him," he said.

However, Trump confirmed the president should not be able to dictate policy to the Fed.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Trump is now the odds-on favourite to win with bookmakers and his policies risk higher-for-longer inflation levels, which would require higher-for-longer interest rates.

He is also proposing stimulatory tax cut measures that would boost growth and maintain the U.S. exceptionalism trade that sees stocks and the Dollar rise in tandem.

He proposes to lower the corporate tax rate to 15% from 21%, renew expiring tax cuts and offer fresh tax reductions.

The rub is that this would cost the Federal government much-needed revenues at a time when the U.S. annual deficit is close to $2 trillion.

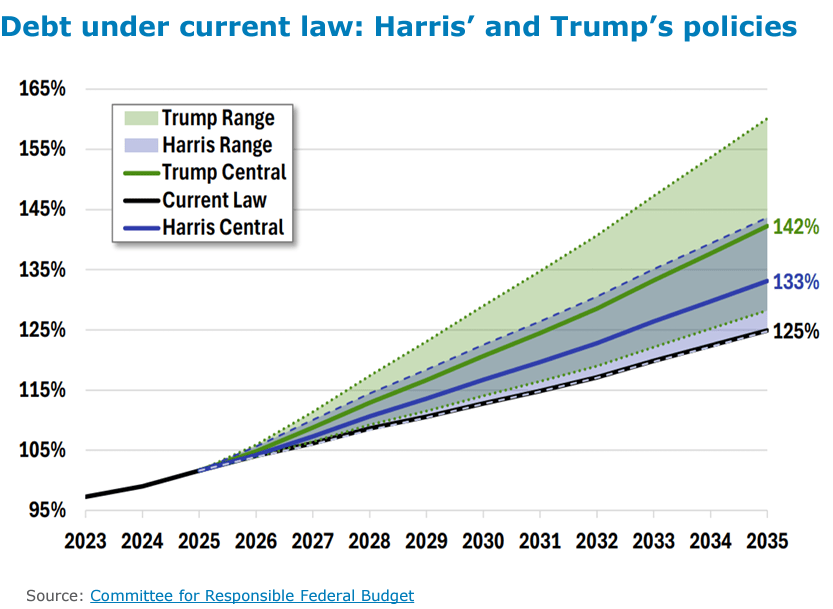

Image courtesy of ANZ Bank.

The Committee for a Responsible Federal Budget says both Trump and rival Kamala Harris will add to the national debt over the next decade.

Relative to a baseline scenario of a debt-to-GDP ratio of 125% in 2035, Harris’ plans would raise that level by 8ppt, and Trump’s would elevate it by 17ppt.