Collapse in Complexity Makes Pound-Dollar a Sell on 6-month View says BCA's Joshi

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling's decline against the Dollar is not a mere correction and looks set to run for at least half a year.

This is according to Dhaval Joshi, Chief Strategist at BCA Research, the independent strategy and research provider.

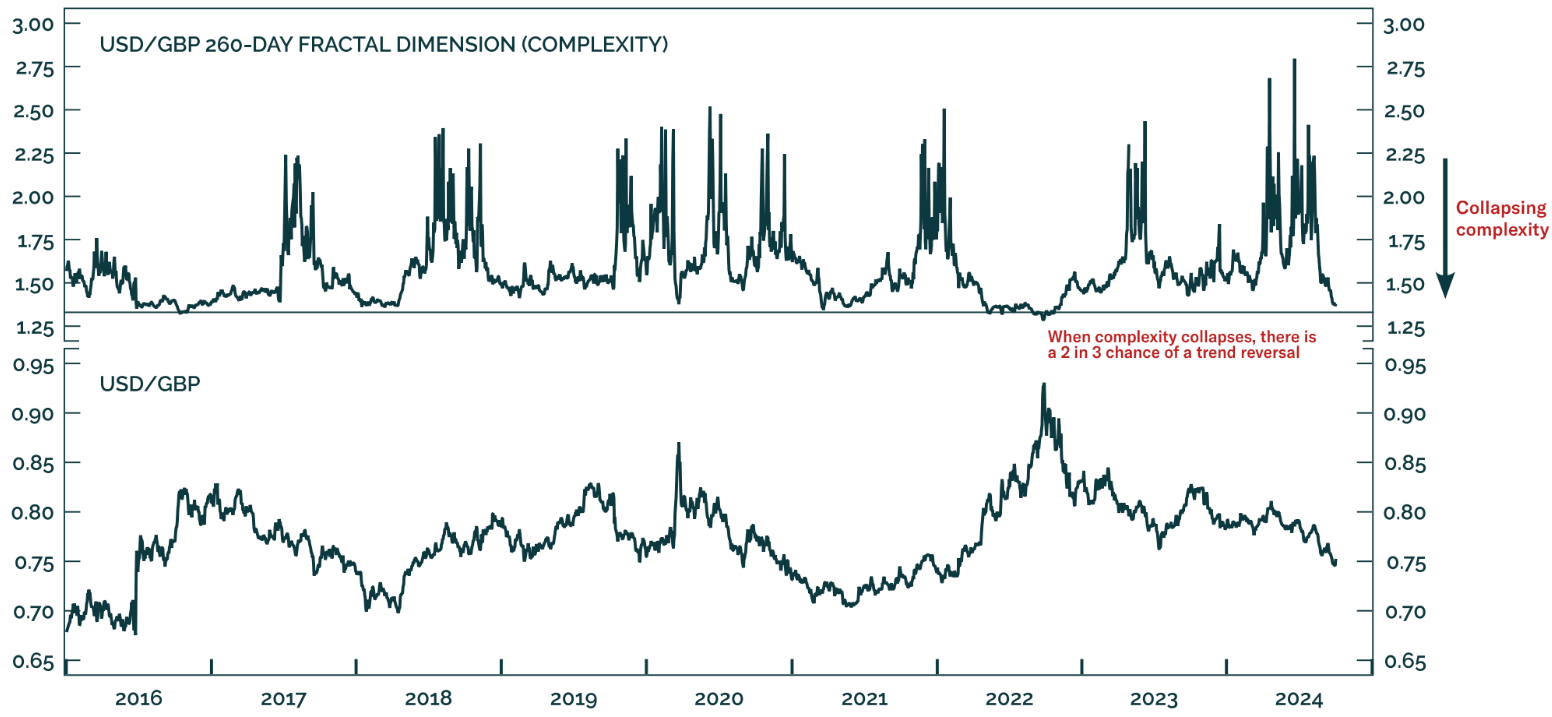

Joshi says he looks to go "long USD/GBP" on a combination of "collapsing complexity" - which is a technical consideration - and a fundamental view that the Bank of England will 'outcut' the Federal Reserve.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Among major investment price trends whose complexities have collapsed, presaging an imminent trend change, the 260-day downtrend in USD/GBP is approaching a bottom," says Joshi.

Joshi explains that when a financial market loses its complexity, it is a red flag that the preceding price trend is being set by investors with increasingly short-term time horizons.

He says this usually presages an imminent trend of exhaustion or change.

Image courtesy of BCA Research.

"This is because when one of these short-term investors wants to get off the trend, the only type of investor left to ‘take the other side’ is a long-term value investor who will only transact at a ‘fair value’ price which will require a significant reversal (down in an uptrend, up in a downtrend)," says Joshi.

The turning in the trend is further underpinned by Joshi's view that, through the next six months, the Fed will cut rates by less than is anticipated, while the BoE will cut rates by more than is anticipated.

Market expectations for the quantum of rate cuts to come from the Federal Reserve have receded over the course of the past week owing to a strong set of U.S. economic data that warns against a rapid stimulus from the Fed.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Where the market expected up to 75 basis points worth of cuts from the Fed it now expects 50.

At the same time, the Bank of England's Governor Andrew Bailey triggered a slump in the Pound last week when he appeared to signal the Bank was growing impatient in its wait for inflation to fall and the labour market to weaken.

He said the Bank could be more "activist" on cutting rates (if inflation allows).

"Accordingly, a new recommended trade on a 6-month horizon is to go long USD/GBP," says Joshi.