Dollar Hits 3-week High on Consensus-busting U.S. Job Report

- Written by: Gary Howes

Image: Official White House Photo by Adam Schultz.

The Dollar rises as the odds of a 50 basis point interest rate cut in November are all but dead.

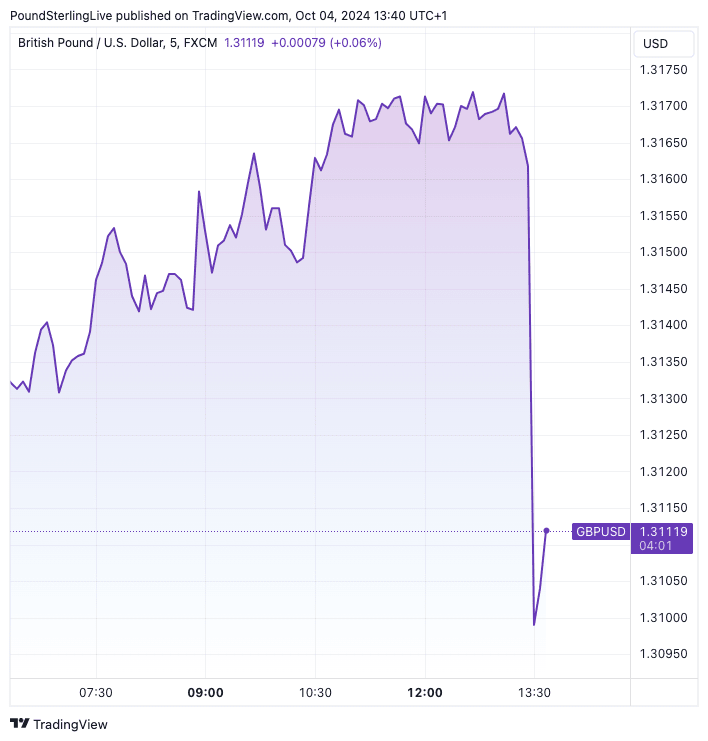

The Pound to Dollar exchange rate (GBP/USD) fell to its lowest level since mid-September at 1.3098 after it was reported the U.S. economy added 254k non-farm jobs in September, smashing expectations for a 147K reading.

The report from the U.S. Bureau of Labor Statistics was strong across the board, with August's report seeing a significant upgrade from 142k to 159k. The unemployment rate fell from 4.2% to 4.1%.

Is this the sign of an economy that needs a fresh injection of stimulus? The market is having its doubts as the OIS measure of expectations shows investors now see just a 5% chance of a 50bp cut in November.

Easing expectations for cuts are, in turn, bolstering U.S. bond yields and the Dollar.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

"Remember that weak summer job market? Well, there were no traces of it in the September jobs report," says Ali Jaffery, an economist at CIBC Capital Markets.

"We expect the Fed will cut by a quarter basis point at both the November and December meeting now. Prior to today, we expected the Fed to continue front-loading with another 50bps cut in November and then subsequently ease by 25bps increments," he adds.

The Federal Reserve cut interest rates in September on the basis that the U.S. job market was slowing down and that inflation was on target to fall to 2.0%. Jaffery says the decision was still correct as the Fed couldn't risk letting the labour market slip away.

The jobs market now looks to have turned a corner for the better. Longview Economics says today's strong payroll report, with upward revisions, makes "a 'mini' uptrend" in non-farm payroll numbers in recent months."

Average hourly earnings climbed 0.4% m/m in September, down from 0.5%, and are up 4% y/y. Economists say strong wage trends can bolster inflation as they buttress demand in the economy.

"A "no landing" scenario for the United States has suddenly become far more plausible, suggesting that expectations for aggressive monetary easing should be ratcheted back across most major economies," says Karl Schamotta, Chief Market Strategist at Corpay.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The payroll data comes a day after the Bank of England's Governor, Andrew Bailey, felt he could signal the Bank could now step up the speed it cuts rates. We noted that his pivot came despite a dearth of data behind it.

Instead, it looked like the Governor saw the Fed's 50bp cut in September, and the ECB's recent allusion to a second subsequent rate cut in October, as providing the cover needed to accelerate its own rate cuts.

These U.S. data and subsequent market developments blow Bailey's cover.

"Central banks in the euro area, United Kingdom, and Canada are all now likely to move more cautiously," says Schamotta.