GBP/USD Week Ahead Forecast: Notable Resistance Here

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling has now reached elevated levels against the U.S. Dollar and will need Thursday's U.S. inflation release to be soft if it is to break fresh ground.

The Pound to Dollar exchange rate (GBP/USD) rose 1.35% last week thanks to a reboot in expectations for an interest rate cut at the Federal Reserve in September. U.S. economic data, including Friday's job report, point to a slowing economy that could soon need a helping hand from lower rates.

Also on its side was the clear outcome from the UK General Election, which ushers in a period of relative UK political certainty.

"GBP/USD rose by 1.29% last week, in a sign that the pound could be about to stage a bigger recovery as it has momentum on its side, now that the UK’s political risk premium has been eradicated. The next key level is $1.30. Interestingly, the pound is rising, alongside expectations of a rate cut from the Bank of England next month, there is currently a 66% chance of a rate cut priced in by the OIS market," says Kathleen Brooks, an analyst at XTB.

"We have raised our GBP forecasts in part on better political stability ahead and in part on the signs of a stronger rebound in economic growth than we previously expected," says Derek Halpenny, head of FX research at MUFG Bank Ltd.

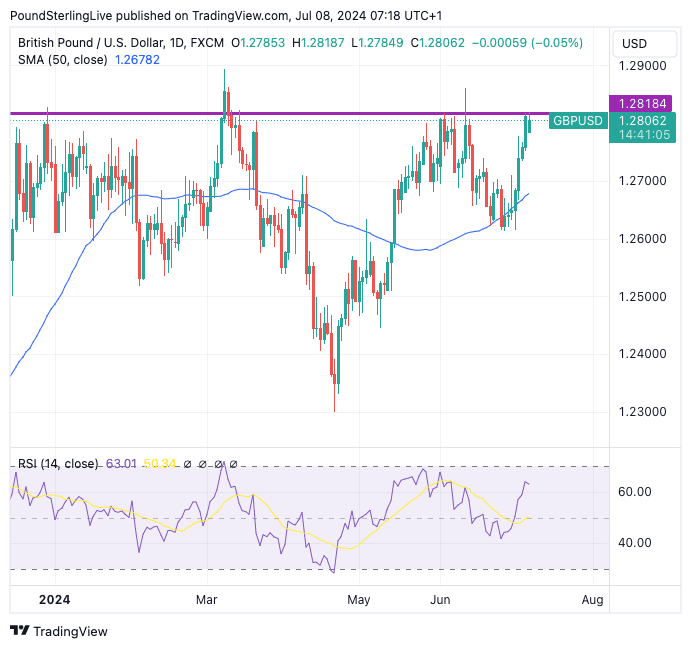

GBP/USD trades above its key moving averages, and the RSI is positive and pointed higher. The RSI is also not yet at overbought conditions.

But the daily chart does have one warning sign, and that is an area of resistance above 1.28: looking at the 2024 chart shows the exchange rate has been unable to hold anything above 1.28 for any sustained period:

Track GBP/USD with your own alerts, find out more here.

"The significant resistance at 1.2860 is highly unlikely to come under threat. Note that there is another resistance level at 1.2840," says Quek Ser Leang, Markets Strategist at UOB. "Support is at 1.2785; a breach of 1.2770 would mean that GBP is not advancing further."

The presence of this resistance could result in Pound-Dollar trading a tight range either side of 1.28 ahead of Thursday's important inflation reading from the U.S.

Headline CPI is expected to decline to 3.1% year-on-year, down from 3.3% in May, a level last seen in January.

Such an outcome would signal the disinflation process is underway again, having been disrupted by the price acceleration in H1. This will raise the odds that the Federal Reserve will cut interest rates in September and potentially weigh on the Dollar.

There are no major releases from the UK, apart from a GDP update on Thursday, which is unlikely to have a significant market impact ahead of next week's all-important inflation and labour market data prints.