Political Stability Bags Pound Sterling an Upgrade against Euro and Dollar

- Written by: Gary Howes

Image: Keir Starmer campaign staff.

MUFG Bank says the UK's political outlook contrasts favourably with developments in Europe and a strengthening economy will limit the amount of interest rate cuts the Bank of England can deliver in 2024.

These developments are constructive for the Pound, according to MUFG Bank, which has upgraded its forecasts against the Euro and Dollar in a mid-year research update.

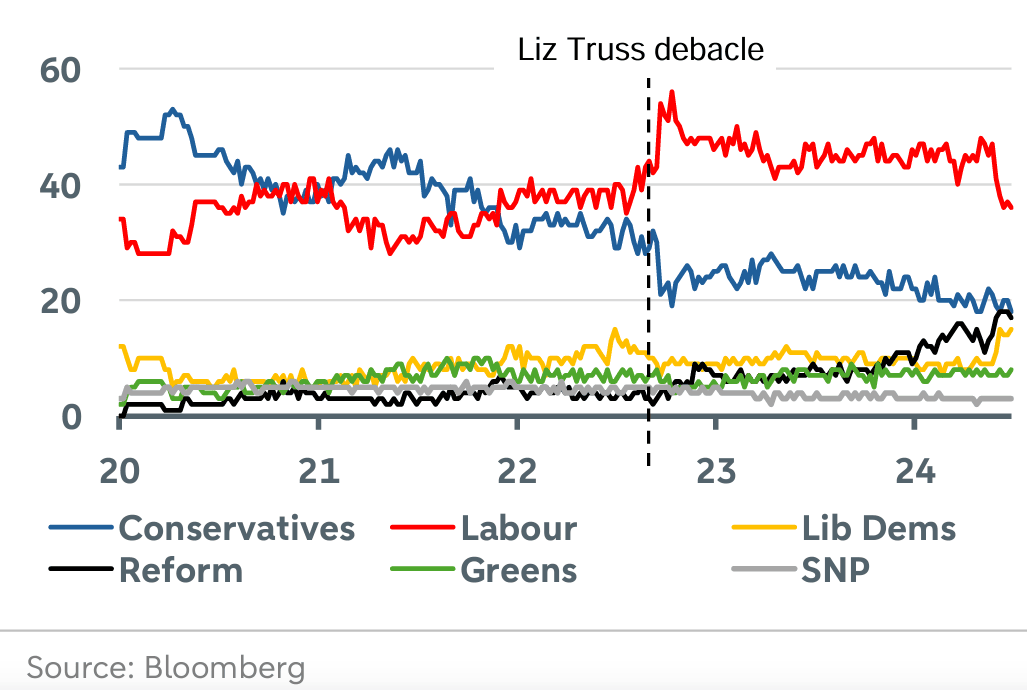

The UK has not typically been associated with political stability since 2016, to the detriment of the Pound. But that could be about to change.

"We see the Labour Party winning a large majority in the UK general election on 4th July. We have raised our GBP forecasts in part on better political stability ahead and in part on the signs of a stronger rebound in economic growth than we previously expected," says Derek Halpenny, head of FX research at MUFG Bank Ltd.

UK polls show the Labour Party's likely vote share has fallen in the past two weeks but by not nearly enough to prevent Keir Starmer from being installed as the next Prime Minister.

Unfortunately for Prime Minister Rishi Sunak, the Conservatives have not been the beneficiary of falling Labour support; instead, Reform UK and the Liberal Democrats have increased their vote share.

Nevertheless, households and businesses will now look to Labour to formulate a plan for an economy that has struggled over recent years.

Image courtesy of ABN Amro.

"The economic policies put forward by Labour are very cautious and the strategy is clearly to strengthen trust with voters that it can govern and manage the economy," says Halpenny. "We certainly assume better political stability is on its way with Labour intending to focus on ‘wealth creation’."

The Euro has recently struggled amid increased political uncertainties following the June EU Parliamentary elections. However, in France, Emmanuel Macron took a gamble by dissolving the legislature and calling a snap vote that has caused considerable anxiety for market participants.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The prospect of the Labour Party winning a large majority in the general election on 4th July is certainly helping to define a clear distinction with Europe," says Halpenny.

The UK economy is meanwhile expected to strengthen, which can prevent the Bank of England from cutting interest rates as fast as previously expected.

Like the consensus of investment banks, MUFG thinks the first rate cut will fall in August. What will matter for the Pound is how many subsequent rate cuts come after this.

The rule of thumb is that the Pound would appreciate against currencies belonging to central banks that cut deeper.

"We see one further cut this year, in November, one less than previously given the better growth pick-up than we previously assumed," says Halpenny.

MUFG thinks inflation rates will tick up towards the end of the year while real incomes rise and business and consumer confidence improve.

The investment bank raises its Pound to Euro forecast for end-Q3 from 1.17 to 1.19 (EUR/GBP: 0.8550 to 0.84). The year-end forecast is raised from 1.1630 to 1.19 (EUR/GBP: 0.86 to 0.84).

You can see how these forecasts compare to the median of all investment bank forecasts in the Pound Sterling Live / Corpay Q3 download.

The bank effectively maintains its Pound to Dollar forecast for end-Q3 (old: 1.2870, new: 1.2860), lowers its year-end target from 1.3020 to 1.2980, but there is a 3% uplift for the end-Q1 2025 forecast from 1.2870 to 1.3250.

To see how this contrasts with the consensus of the world's biggest investment banks, please see here.