GBP/USD Rate 5-Day Forecast: Path of Least Resistance Remains Lower

- Written by: Gary Howes

- GBPUSD on course for 1.20

- But coming week could see some relief

- U.S. PCE inflation data on tap

- UK will release GDP figures for Q2

Image © Adobe Images

The British Pound has now been subjected to 11 weeks of relentless pressure against the Dollar and there is little to suggest the selloff is about to end with most analysts saying 1.20 will be targetted over the coming weeks, although near-term some stabilisation can be expected.

The Pound's selloff accelerated last week after the Bank of England paused its interest rate hiking cycle while offering no clear evidence it was intending to hike rates again.

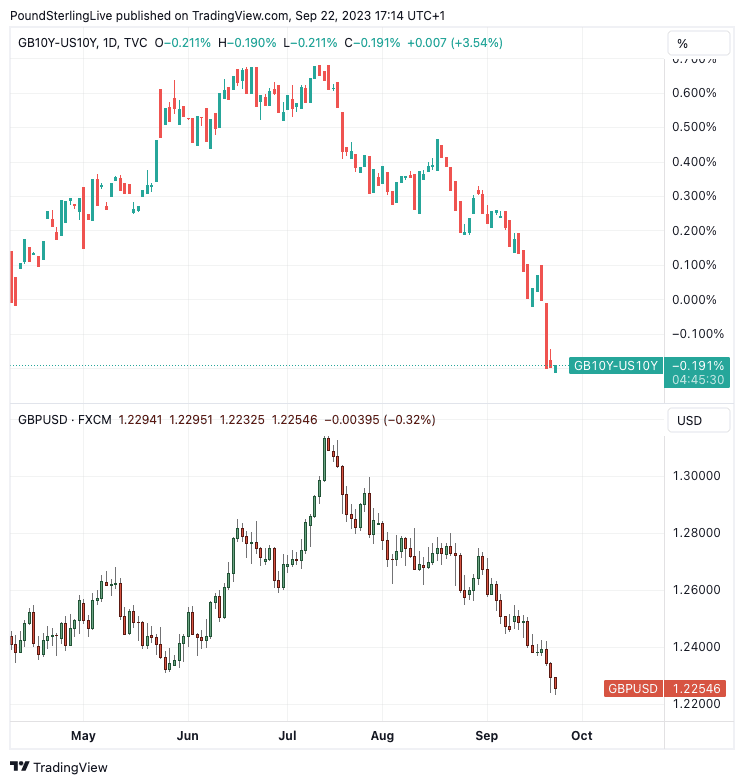

The net result was a further fall in UK bond yields at a time of rising U.S. bond yields, creating a scenario where the gap between the two - known as the spread - widened in favour of the Dollar.

To be sure, the Dollar has been pressuring most of its G10 rivals as investors sell bonds as U.S. economic strength prompts investor wariness of a potential November interest rate hike at the Federal Reserve, while at the same time lowering expectations for cuts in 2024.

"The dollar continues to find support across the board, especially against the yen, pound and the euro, currencies where the central banks are comparatively more dovish than the Fed," says Fawad Razaqzada, an analyst at City Index.

Image courtesy of City Index.

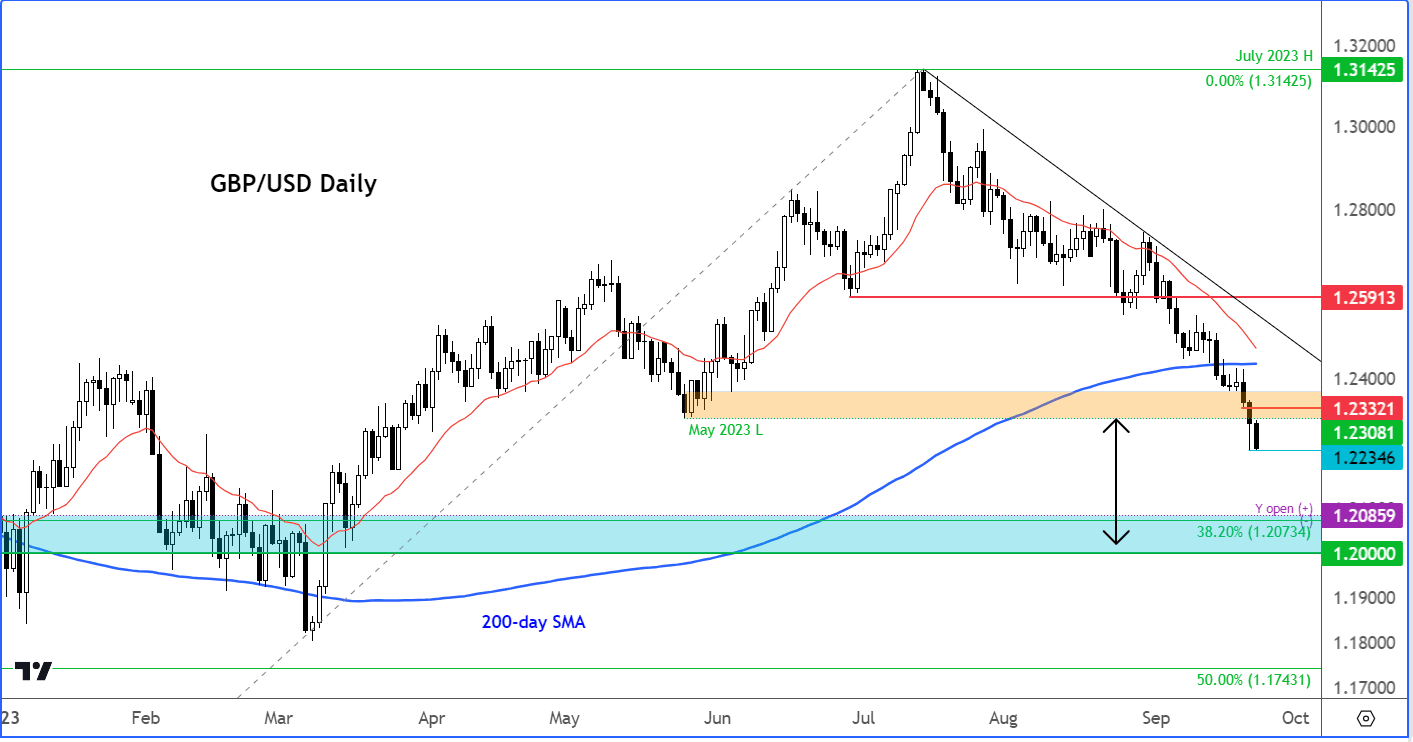

Razaqzada's analysis of the Pound-Dollar outlook reveals the potential for "further room to go on the downside."

The pair hit a fresh 6-month low near the 1.22 handle on Friday as momentum from Wednesday's soft inflation print and Thursday's Bank of England decision met a surprisingly weak UK PMI print.

"With support around 1.23ish broken, the path of least resistance remains to the downside for the cable. From here, we could see the rate decline towards 1.21 and possibly 1.20 in the week ahead. These levels were support earlier this year, and is where the long-term 38.2% Fibonacci retracement level comes into play," says Razaqzada.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Pound's selloff could soon reach overextended levels, at which point the prospect of a short-term and temporary rebound could transpire.

Looking at the resistance points to target, Razaqzada says the area between 1.2308 and 1.2332 is of significance as this forms the previously broken support area. "This zone needs to be defended by the bears now if they are to maintain control of price action," he says.

Turning to the data calendar, the two key releases in the coming week both fall on Friday, with a smattering of second-tier numbers coming through over the preceding days, none of which will offer too much excitement for Pound-Dollar.

Above: The spread between the UK 10-year yield and U.S. equivalent (top) has been falling, taking GBPUSD lower.

Friday's U.S. PCE inflation figure will be of note in that it can further support the recent trend of Dollar firmness if it comes in ahead of expectations.

Core PCE is expected at 0.2% month-on-month in August, with any undershoot potentially aiding a comeback in the Pound, particularly if UK GDP data beats expectations.

Friday sees the second release of Q2 UK GDP data, meaning the likely market impact of the numbers will be minimal.

Markets are nevertheless looking for GDP growth in Q2 to be at 0.4% year-on-year and 0.2% quarter-on-quarter. Any major deviations could offer some short-term volatility.

Note that revisions will also be made to previous data for 2022 and 2023. This is "particularly pertinent now that the ONS has indicated huge revisions to data for 2020 and 2021 that have altered history quite considerably," says Philip Shaw, an economist at Investec.

The ONS has updated its measure of UK GDP by incorporating a wider range of improvements to sources and methods to measure output. It says the new methods put it at the forefront of global efforts to improve accuracy in measuring national accounts.

These improvements will now come forward into the official data. When the results of the updated model were announced it was revealed current price GDP growth for the UK in 2021 was revised up 0.9 percentage points to an 8.5% increase; this follows an unrevised fall of 5.8% in 2020.

Annual volume GDP growth in 2021 was revised up 1.1 percentage points to an 8.7% increase; this follows an upwardly revised 10.4% fall in 2020 (previously an 11% fall).

This means the UK is no longer the laggard amongst major peers in the post-Covid era.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks