Inflation Slides, Pound Sterling Sent Lower against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Images

The British Pound fell against the Euro and Dollar following the release of inflation figures that notably undershot expectations and suggest the pressure on the Bank of England to raise interest rates has receded notably.

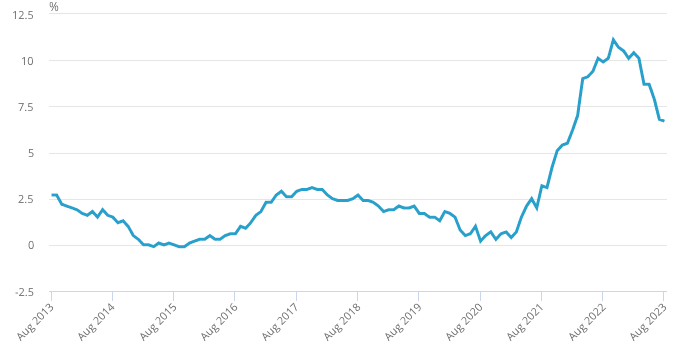

Headline CPI inflation rose 6.7% year-on-year in August said the ONS, which was well under the 7.0% the market was expecting and below July's 6.8%. The month-on-month rise stood at 0.3%, which was less than half the expected 0.7%, albeit up on the -0.4% of July.

But for the Pound, it is the core inflation figure that is of particular relevance given the Bank of England judges it to be more relevant from a policy perspective: core rose just 0.1% m/m, below the 0.6% expected and 0.3% of July. The y/y increase measured 6.2%, which is below the 6.8% expected and 6.9% of July.

The annual CPI inflation rate in services slowed from 7.4% to 6.8%, something that will be particularly welcomed by the Bank of England given it has expressed concern over price rises in this particular section of the price basket.

The Pound to Euro exchange rate dropped sharply (-0.37% to 1.1559) on the figures as markets bet there was enough in them to prompt the Bank of England to pause its interest rate hiking cycle on Thursday.

The Pound to Dollar exchange rate was lower by a similar margin at 1.2354.

"With wage growth too strong and the labour market tight, the Bank of England’s MPC is unlikely to decide to leave rates on hold tomorrow, but the market has scaled back expectations of a further hike later in the year and that has added to downward pressure on the pound. GBP/USD has 1.20 in its sights, and EUR/GBP may have another go at breaking above 0.87," says Kit Juckes, head of FX research at Société Générale.

Above: UK CPI inflation continues to fall. Image: ONS.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Today’s inflation news has prompted a further initial fall in sterling as markets anticipate a potentially more dovish update tomorrow on interest rates from the Bank of England," says Rhys Herbert, an economist at Lloyds Bank.

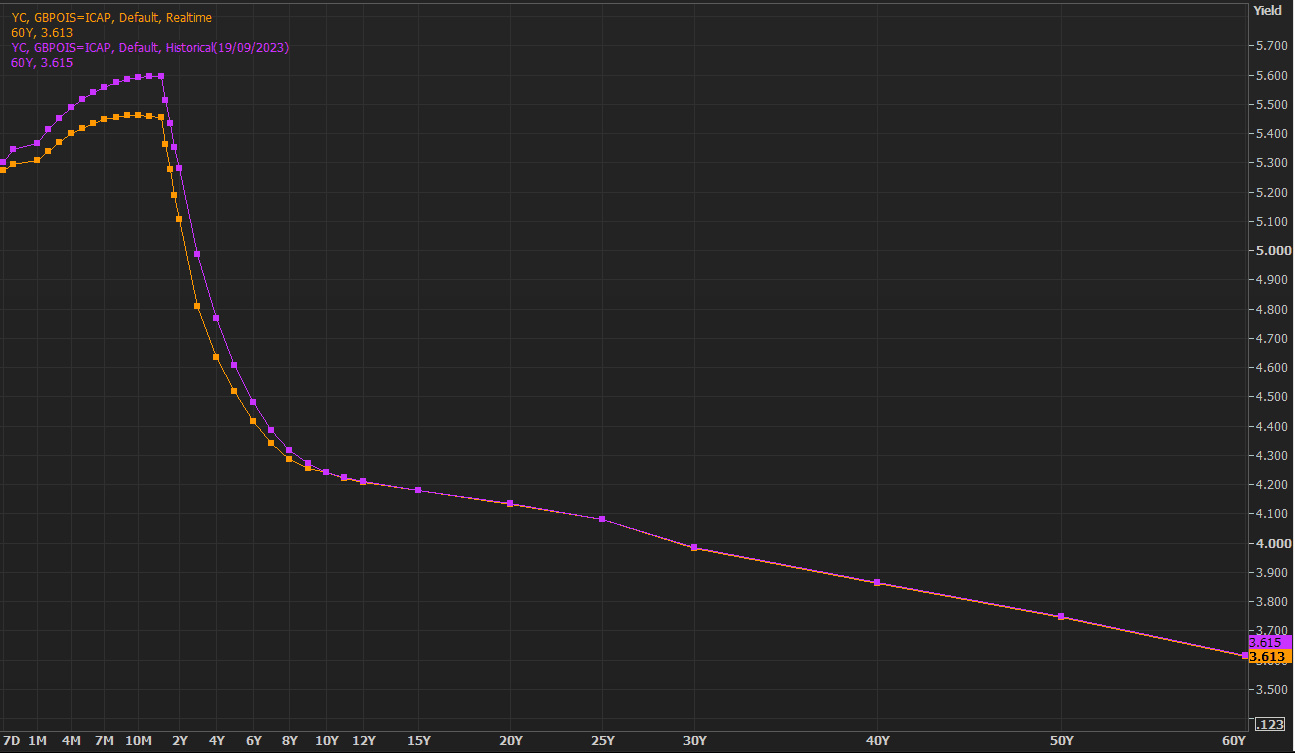

The market had entered this week pricing 80% odds of another Bank of England interest rate rise of 25 basis points being delivered on Thursday, but the sharp fall in the numbers has lowered such a prospect to around 50% at the time of writing.

"The drop in the headline rate of CPI inflation in August probably won’t stop the MPC from pressing ahead and raising Bank Rate to 5.50%, from 5.25%, this week, but it will support the case for more neutral language regarding further tightening in the minutes and a pause in November," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

The fall in UK gilt yields in response to the figures helps explain the weaker Pound and signals the market's belief that the UK's 'exceptional' inflation problem is fading.

Above: "Very sharp repricing of BoE rate expectations in the market this morning: 45% chance of a pause tomorrow (20% on Tuesday), less than 20% chance of eventually going above 5.5% (42% yesterday). Purple line is yesterday's OIS curve" - Andy Bruce, Reuters.

Indeed, UK workers are now seeing real terms increases in pay given pay rates are now well above the rate of inflation.

The fall in inflation when compared to July is all the more remarkable as economists had expected an increase owing to the recent rise in fuel prices, indeed the ONS said rising prices for motor fuel led to the largest upward contribution to the change in the annual rates.

But the impact of rising fuel prices was overshadowed by the fall in food prices, which contributed the largest downward pull, followed by accommodation services.

Above: GBPUSD (top) and GBPEUR at 30-minute intervals showing the effect of the inflation undershoot.

The impact on the Pound of the inflation undershoot is clear to be seen, but from a longer-term perspective, the prospects for the UK consumer, businesses and economy as a whole are greatly improved if inflation continues to decline.

Should foreign exchange markets become increasingly sensitive to growth dynamics - as some analysts are now arguing - then a more constructive outlook begins to emerge for the Pound.

"Inflation fell again in August, defying expectations of a slight uptick. We expect inflation to continue falling over the rest of this year," says Alpesh Paleja, Lead Economist at the CBI.

The Bank of England has said it is close to the point where it can consider ending its interest rate hiking cycle as it expects inflation to fall notably through to the end of the year, although it warns rates will stay elevated for a prolonged period.

But for the Pound, there are dangers in how the Bank communicates a pause, as any misstep could prompt the market to bring forward expectations for rate cuts, which would result in significant downside momentum building.

"A rate hike would not be definitively positive for GBP, especially if the BoE signals that this is the last one and it adds to the gloomy thinking about growth. We view GBP as being in a bind," says Paul Mackel, Global Head of FX Research at HSBC.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes