GBP/USD Tops 1.21 as Red-hot U.S. Jobs Report is Tempered by Softer Wage Figures

- Written by: Gary Howes

- USD under pressure despite strong jobs reading

- Rise in unemployment rate and softer wage rises weigh

- Need for aggressive Fed rate hikes is easing

- Banking sector stress also to pressure Fed into a pause

Image © Adobe Images

The U.S. Dollar has come under significant pressure following the latest U.S. jobs report and news a U.S. bank is in financial difficulty, developments that suggest the Federal Reserve does not need to pursue materially higher interest rates.

Bond yields fell and the Dollar was softer against the Pound, Euro and other major currencies after the U.S. economy created over 300K jobs but the rate of increase in wages was softer than the consensus was anticipating:

Nonfarm Payrolls (Feb)

» Actual:

» What was forecast: 311K

» Last month's print: 504K

Unemployment Rate (Feb)

» Actual: 3.6%

» What was forecast: 3.4%

» Last month's print: 3.4%

Average Hourly Earnings (MoM) (Feb)

» Actual: 0.2%

» What was forecast: 0.3%

» Last month's print: 0.3%

The above tells us the headline print for job increases was exceptionally hot, but there was little support for the Dollar and yields owing to the softer wage figures and the tick higher in the unemployment rate.

The rise in the unemployment rate, amidst an increase in job creation, suggests an increase in labour supply to the U.S. economy.

This also explains the contained wage figures.

In short, the data is not entirely consistent with recent fears that a tight labour market would generate above-target inflation rates and Dollar exchange rates have accordingly retreated.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

The Federal Reserve could, therefore, temper its ambitions when it comes to raising interest rates much further beyond the current levels.

The Dollar rallied earlier this week after Fed Chair Jerome Powell said rates might have to rise further than previously anticipated, but Friday's data pushes back against this view somewhat.

The Pound to Dollar exchange rate extended earlier gains and pushed the daily advance to 1.21 following a one per cent advance in the half hour following the release.

This took typical bank international payment rates to 1.1673-1.1854 competitive cash and holiday rates to approximately 1.1940 and competitive transfer rates to approximately 1.2060.

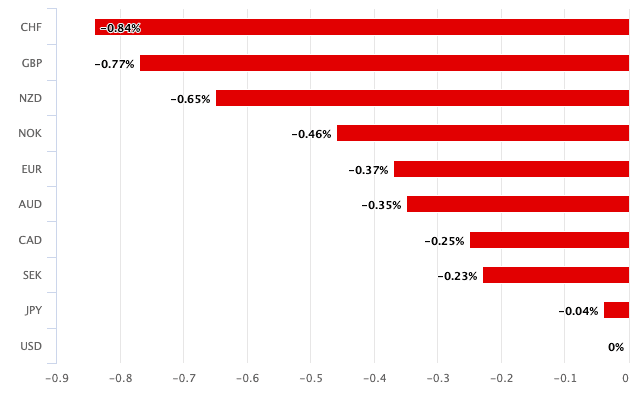

The Dollar was in fact the clear underperformer on March 10, going lower against all its major peers:

Above: USD performance on March 10.

The U.S. jobs report comes amidst a major rout in bank stocks as investors fear signs of distress in the sector are starting to emerge, something that could convince the Fed it has done enough on interest rates.

Silicon Valley Bank sent shockwaves through the global banking sector after it went to the market looking for fresh funding, following losses on its major investment portfolio.

These losses are linked to the underperformance of the technology sector in the current environment of rising interest rates.

Investors are betting the developments, when combined with the current jobs market dynamics, could convince the Fed now is not the time to step on the interest rate accelerator.

The Dollar's recent run of strength could therefore be due a pause.

"We have been experiencing the most aggressive period of monetary policy tightening for 40 years and our long-term fears have been that the harder and faster you go into what we would term “restrictive” territory, the less control over the outcome," says James Knightley, Chief International Economist at ING Bank.

"We are constantly looking for signs of stress and clearly concerns about the stability of Silicon Valley Bank (SVB) and potentially other institutions are making investors nervous right now," adds Knightley.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks