The Silcon Valley Bank Saga is Hurting the Dollar

- Written by: Gary Howes

Above: File image, Silicon Valley Bank Elevator Pitch Competition. Photo by Michael Kellet. Sourced: Flickr. Licensing Conditions: Creative Commons 2.0.

The Dollar has retreated amidst a recent rout in bank stocks as investors fear signs of distress in the sector are starting to emerge, something that could convince the Fed it has done enough on interest rates.

Silicon Valley Bank (SVB) sent shockwaves through the global banking sector after it went to the market looking for fresh funding, following losses on its major investment portfolio.

These losses are linked to the underperformance of the technology sector in the current environment of rising interest rates.

The Dollar - a typical safe haven - would be expected to advance strongly under such circumstances.

But investors could be betting the developments, when combined with Friday's labour market report, could convince the Fed now is not the time to step on the interest rate accelerator. The fear of 'breaking' something in the financial system could yet prove a key consideration at upcoming FOMC meetings.

"The probability of a 50bps hike next week rose from less than 10% to close to 50%, according to rate futures markets. Yet in the aftermath of the SVB news, the federal funds futures markets reigned in rate fears by downgrading the odds to below 50%," says Christian Gattiker, Head of Research at Julius Baer.

The Dollar's recent run of strength could therefore be due a pause.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

CNBC reports on Friday that efforts to raise capital have however failed and it SVB has now put itself up for sale.

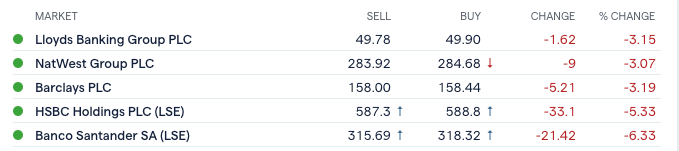

Banking stocks came under pressure after SVB Financial Group - the owner of SVB, which specialises in venture-capital financing - announced a stock offering and offloaded securities to raise much-needed cash amid falling deposits.

SVB that it was issuing $2.25BN of shares to bolster its capital position after a significant loss on its investment portfolio

The selloff extended to European names on Friday as traders worried the rapid pace of interest rate hikes at global central banks would ultimately cause stresses in the financial system.

Above: The major UK banking names are under pressure. Image: IG.

SVB's woes are symptomatic of the steady withdrawal of excess liquidity from the global financial system following the largesse of the Covid years and its shares collapsed 60% in New York trade as it said it lost $1.8BN following the sale of its investment portfolio.

Global equity markets have meanwhile recorded notable losses as investor caution rises.

The Dollar, Yen and Franc would be the typical beneficiaries of such a development owing to their traditional 'safe haven' characteristics.

"In 2008 during the global financial crisis the dollar soared," says Jeremy Boulton, an analyst at Reuters. "As with current problems U.S. banks were at heart of concerns."

The Australian Dollar, New Zealand Dollar and Krone would typically be expected to fall in high-risk market conditions.

The Pound meanwhile tends to lose against the aforementioned safe havens - as well as the Euro - but gain against the 'high beta' names such as AUD, NZD and NOK.

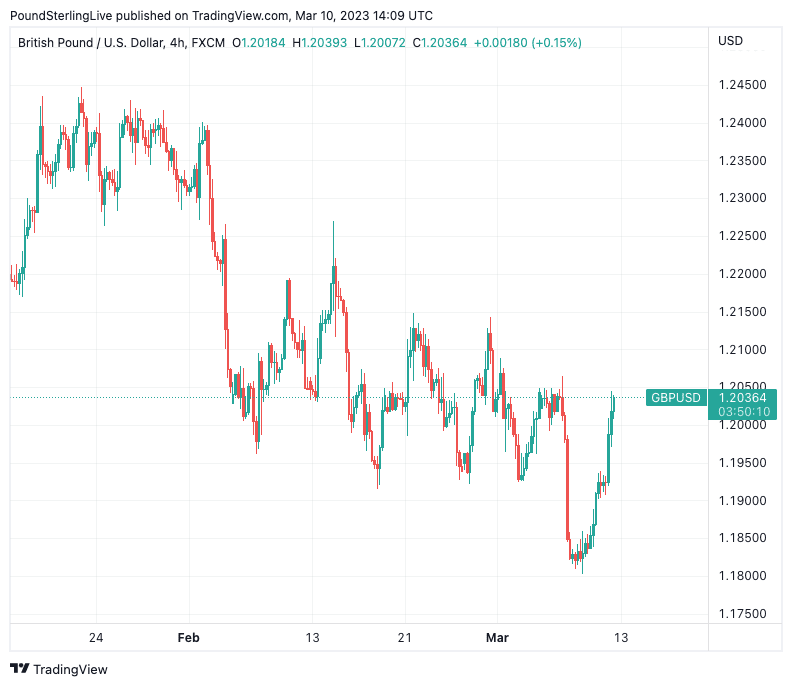

But the Pound to Dollar exchange rate (GBP/USD) is now quoted one per cent higher on the day at 1.2040, a performance the defies the typical narrative and suggests financial market stress could in fact convince the Fed to slow down on rate hikes.

The rally in GBP/USD spot takes bank transfer rates to 1.1608-1.1788, competitive cash and holiday money rates to 1.1857 and competitive transfer rates to around 1.1990.

Above: GBP/USD at 15-minute intervals showing a recent uptick but downside pressures on a multi-day basis. GBP also got a lift from a beat in UK GDP for January.

The lacklustre response of the foreign exchange market to the news reflects expectations that the SVB news will remain contained.

Silicon Valley Bank was highly leveraged to the technology sector, which has come under strain since central banks started raising interest rates.

"SVB does not represent the wider US banking sector, albeit the plummet in SVB stock clearly hit sentiment. It seems as though SVB was just gripping the wrong end of the stick with regards to rising interest rates," says Neil Wilson, Chief Market Analyst at Finalto.

Mohamed A. El-Erian, Advisor to Allianz and Gramercy, says the possibility of generalized U.S. banking system stress due to SVB troubles is limited.

"While the US banking system as a whole is solid, and it is, that does not mean that every bank is. Due to the volatility in yields after the prior protracted period of leverage-enabling policy, the most vulnerable currently are those vulnerable to both interest rate and credit risk," he says.

But, "contagion risk and the systemic threat can be easily contained by careful balance sheet management and avoiding more policy mistakes."

The outlook does however remain uncertain and fears will grow that the rapid pace of rate hiking will 'break' some elements of the financial system.

This would likely keep the Dollar broadly supported and there is very little prospect of a recovery in the British Pound under such a time as fears ease.

The Federal Reserve is expected to hike rates by a further 50 basis points later in March as it confronts stronger-than-expected economic data that is consistent with above-target inflation readings.

With this in mind, Friday's jobs report will be key: a softer-than-expected report could challenge these expectations and provide some relief for financial markets.

Under such a scenario the Pound, Euro and other currencies could recapture recently lost value to the Dollar.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks