Hawkish Powell Halts Offers the Dollar Support

- Written by: Gary Howes

- Powell signals potential 50bp hikes ahead

- USD bid, stocks down

- 190 points of tightening now expected in 2022

File Image © Federal Reserve

Chairman of the Federal Reserve Jerome Powell opened the door to a 50 basis point rate hike at the next meeting of the Federal Open Market Committee in a speech that signalled an increasing unease at the Fed with surging U.S. inflation, comments that firmed the Dollar and sent stocks lower.

Powell said "there is an obvious need to move expeditiously to return the stance of monetary policy to a more neutral level and then to move to more restrictive levels if that is what is required to restore price stability."

In a speech to the National Association for Business Economics on Monday he added the U.S. labour market that looked "extremely tight" and inflation that was "much too high".

Dollar exchange rates lifted following the comments as markets braced for a more rapid ascent in U.S. interest rates than had previously been expected.

The ramping up of rate hike expectations has been a consistent source of support for the Dollar since May 2021, and it appears this trade has further to run.

The comments come following last week's decision to hike interest rates for the first time in the current cycle, and analysts at the time reflected on whether or not the Fed could become anymore 'hawkish' in stance, i.e. communicate the need for a more aggressive approach to raising rates.

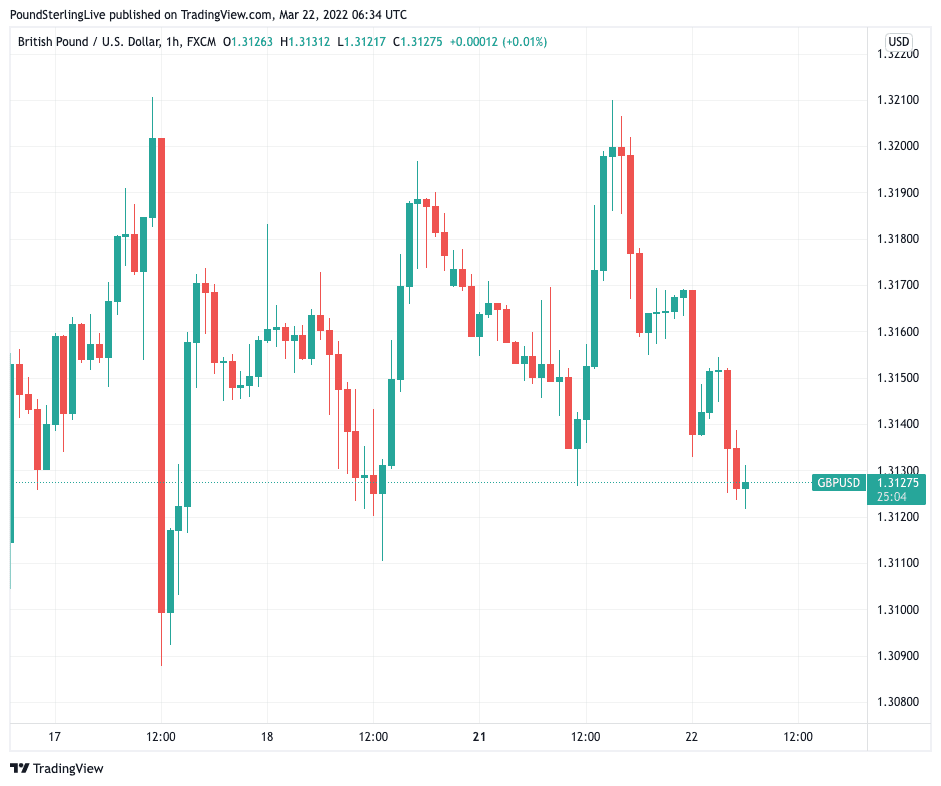

Above: GBP/USD at one hour intervals since the Fed 17 decision to hike rates.

- GBP/USD reference rates at publication:

Spot: 1.3129 - High street bank rates (indicative band): 1.2670-1.2760

- Payment specialist rates (indicative band): 1.3011-1.3050

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

The Dollar fell in the wake of the hike, confirming to some that the Dollar might have reached its limits as 'peak hawkishness' had been achieved.

But the suggestion that a 50 basis point hike is likely, combined with Powell's apparent breathlessness in wanting to get ahead of inflation, suggests calling the end of the Dollar rally might have been premature.

The Pound to Dollar exchange rate had been in the process of recovering recent losses heading into Powell's remarks but is down a third of a percent at 1.3128 at the time of writing.

The Dollar advanced as markets raised pricing: in the wake of the Fed's rate hike the market anticipated 180 points of hikes to be delivered in 2022, this now stands at 190.

"We expect the Fed funds rate to finish 2022 at 1.50%-1.75%, a bit above the consensus forecast, which sees the fed funds rate ending this year at 1.25%-1.50%. For 2023 we expect a further cumulative 75 bps of rate hikes," says Nick Bennenbroek, International Economist at Wells Fargo Securities.

Powell said there was "nothing" to prevent the bank moving forward with a half point rate increase in May.

Stocks fell and the Dollar rose in the wake of the comments, confirming the market is yet to fully account for a the sheer weight of incoming monetary policy tightening.