GBP/USD Rate Supported as Fed 'Hawkishness' Reaches its Zenith

- Written by: Gary Howes

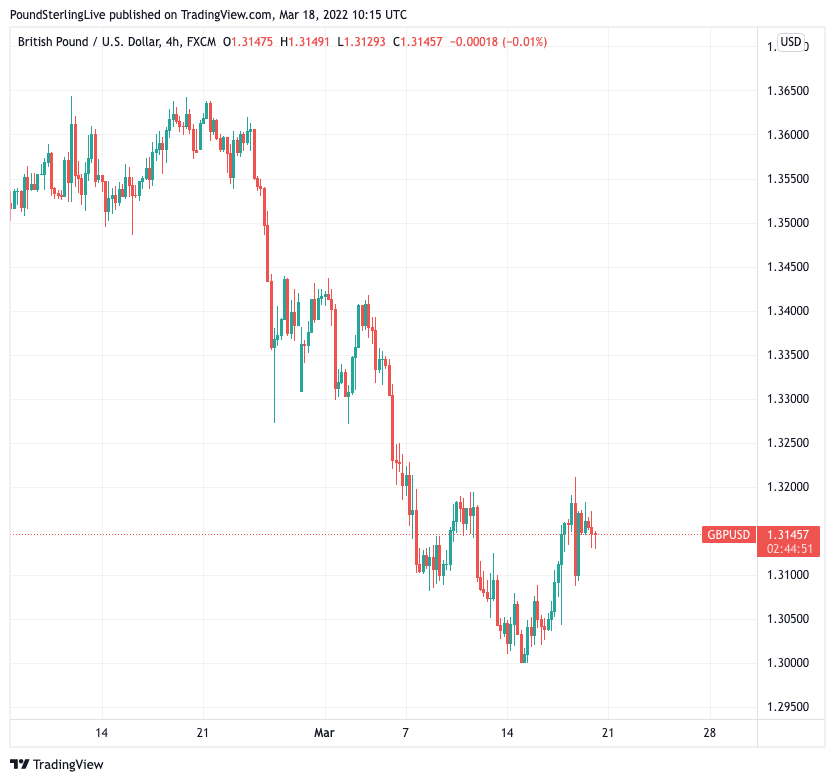

- GBP/USD holding 1.31 marker

- As USD struggles in wake of Fed hike

- But don't bet against the USD yet says RBC Capital

Image © Adobe Images

The Dollar will struggle to extend a multi-month rally as the market looks to have achieved 'peak hawkishness' in its expectations for future Federal Reserve interest rate hikes say some analysts, however others query a notion the U.S. currency always declines after the first hike of the cycle.

Both the Federal Reserve and Bank of England hiked rates this week, and both the Dollar and Pound are proving laggards in the G10 space.

But, the Pound has held onto an advance against the Dollar, suggesting expectations for future Fed rate hikes are what matter more for the Pound-Dollar pair at this point.

The Fed is on course to raise interest rates on six more occasions in 2022 - more than the Bank of England will - in what amounts to a frantic attempt to normalise policy in the face of surging inflation.

However this policy path has been adequately telegraphed, meaning foreign exchange markets were 'pricing it in' long before the Fed actually lifted off with a 25 basis point hike on Wednesday.

This build up in expectations manifested in a push higher by the Dollar which remains one of the best performing currencies of the past year.

But, "the market is pretty much at 'peak hawkishness' for the Fed. Can the Fed hike 7 times this year? Probably, but the market’s already priced that in," says Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

Above: GBP/USD at four hour intervals.

- GBP/USD reference rates at publication:

Spot: 1.3145 - High street bank rates (indicative band): 1.2685-1.2777

- Payment specialist rates (indicative band): 1.3027-1.3060

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

One leg of the Dollar's multi-month run of appreciation against Sterling and other major currencies was the expectation of higher interest rates at the Fed, which in turn raise bond yields and increase inflows into U.S. monetary assets.

For this trend to continue markets would like to see further rate hikes priced into the future.

"Can it go more than that? Maybe not considering how sentiment has been sliding already. This is likely why STIR and equity markets rallied, and why the USD went into a tailspin after Powell’s presser. We’re past the tipping point for pricing," says Rai.

Projections issued by the Fed indicate seven hikes this year and almost four next year with the projected median rate ending at 2.8%.

The Pound to Dollar exchange rate recovered above $1.31 in the wake of the Fed's March policy decision that saw it hike interest rates and signal as many as six more hikes are likely to fall in 2022.

The pair had been as low as 1.29 on Monday.

The faded Dollar strength confirms suspicions held by some analysts the market has effectively saturated the Fed hike expectations play, thereby offering diminishing returns for Dollar bulls.

"The USD remains the high-yielding, safe-haven king of G10. That said, the price action in the wake of the March FOMC meeting has highlighted that there are limits to which its growing rate advantage can support the USD across the board," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

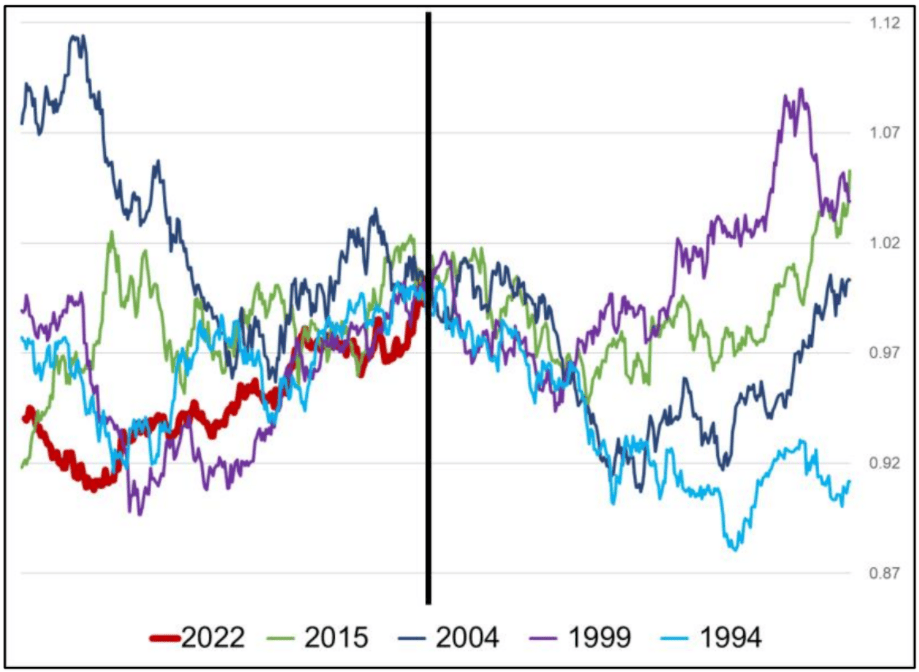

Some analysts are meanwhile pointing to an historical tendency of the Dollar to depreciate following the first rate hike in a Fed hiking cycle.

"A well-worn market axiom, that says sell USD on the first Fed rate hike, is circulating with added momentum after USD’s failure to rally in the wake of this week’s indisputably hawkish FOMC," says Adam Cole, Head of FX Strategy at RBC Capital Markets.

Above: The Dollar index 250 days before and 250 days after the first Fed hike. - Spectra Markets.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

"History says sell USD on the first Fed rate hike. It’s a sample size of four, so clearly not a statistical truth or anything, but logical. It is classic buy the rumor / sell the fact," says Brent Donnelly, CEO of Spectra Markets.

But, Cole cautions against rehashing the idea the Dollar will behave as it has done in the past.

"While this would have held on average across multiple Fed hiking cycles, experience around the turn in the rate cycle has been so diverse that the average is meaningless," says Cole.

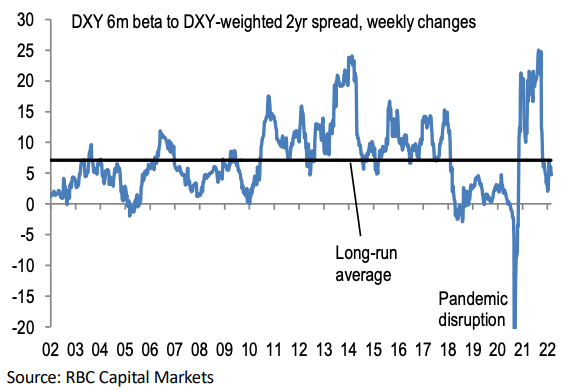

Research by RBC Capital finds in the last 20 years there have been periods where the Dollar has been insensitive to rate spreads, but there has never been a period where

its beta has been sustainably negative.

"This is not to argue we have to be USD bullish as the tightening cycle starts, but rather to pour cold water onto simple rules of thumb, based on long-run averages of limited historical observations," says Cole.

Above: "USD’s beta to rate spreads rarely turns negative" - RBC Capital Markets.

Another key ingredient to the Dollar's rally higher is the ongoing market anxiety linked to Ukraine.

The safe haven Dollar is a natural benefactor as investors display nerves and as long as the war continues weakness in the world's reserve currency will be met by support.

Rallies in the Pound-Dollar exchange rate would likely prove limited under such conditions; indeed it is worth recalling Sterling is one of the undisputed G10 losers of the war in Ukraine.

“There is a camp arguing that the dollar typically sells off in the first six months of a Fed tightening cycle - presumably on the 'buy-the-rumour, sell-the-fact' mentality of a well-telegraphed tightening cycle. What is different this time, in our opinion, is the aggressive front-loaded tightening about to be undertaken by the Fed and events in Ukraine which have damaged European growth prospects and will weigh on currencies in the region,” says Chris Turner, global head of markets and regional head of research for UK & CEE at ING.

“In short, we suspect the dollar will stay bid on dips against European FX and the JPY, while the commodity-exporting currencies can continue to outperform,” Turner and colleagues wrote in a Friday research briefing.

The war has meanwhile underpinned high commodity prices, promising to extend a period of intense global inflationary pressures that threaten to slow global economic growth rates.

The Dollar is an anti-cyclical currency meaning it rallies when the global economy is struggling and therefore the fundamental backdrop remains one in which the Dollar can benefit.

"The reality is that all tightening cycles are different and how USD responds depends on a whole range of factors such as policy in the rest of the world, why the Fed is raising rates and how well hikes have been built into expectations before they happen," says Cole.

"This does not mean we have to be USD bullish after the first hike, but there should be no default position of USD weakness once the hiking cycle is underway," says Cole.