The Dollar Tends to Weaken After the First Fed Hike

- Written by: Gary Howes

- GBP/USD up 0.30% at 1.3082

- Fed to hike rates 25 basis points

- Analysis shows USD tends to fall following first hike

Image © Adobe Images

Pound Sterling advanced against the U.S. Dollar ahead of what amounts to a significant milestone for global markets: the Federal Reserve will raise interest rates for the first time since 2018 and in doing so will fire the starting gun on a policy normalisation cycle.

The market has been prepared for a 25 point hike for some time now and therefore a hike in itself is unlikely to shake the tree, instead markets will be looking for guidance as to how fast and aggressive the Fed will be when it comes to raising interest rates over coming months.

"Our base case scenario is that the USD fades slightly lower as the Fed comes in roughly as expected with no hawkish surprises," says Stephen Gallo, Head of European FX Strategy at BMO Capital Markets.

The decision to raise rates by 25 basis points and associated guidance will come at 18:00 GMT,

Already this week the yield on U.S. ten year bonds pushed back to its highest level since July 2019, and U.S. interest rate futures now have 175bp of tightening priced in this year compared to 120bp two weeks’ ago.

"Ten-year U.S. yields are now at their highest since the middle of 2019 following the very sharp sell-off seen over the past week. Markets are discounting rate hikes at all of this year’s remaining Fed meetings, suggesting that they are more than primed for today’s probable announcement," says Rhys Herbert, an economist with Lloyds Bank.

Ahead of the decision the Pound to Dollar exchange rate was a third of a percent higher at 1.3080.

"For this Wednesday, if we don’t see the dots reflect at least 5 hikes for this year, I suspect that the USD gets hit," says Bipan Rai, North America Head of FX Strategy at CIBC Capital Markets.

The 'dots' he refers to is the set of projections each voting member of the Federal Open Market Committee (FOMC) plots for where they see the base rate band being in the future.

Above: "FOMC participants’ assessments of appropriate monetary policy: Mid point of target range or target level for the federal funds rate" - Source: Federal Reserve.

- GBP/USD reference rates at publication:

Spot: 1.3090 - High street bank rates (indicative band): 1.2630-1.2723

- Payment specialist rates (indicative band): 1.2972-1.3090

- Find out about specialist rates and service, here

- Set up an exchange rate alert, here

If the dots move higher the market will accordingly price in more rate hikes, and this could boost the Dollar.

But the outlook is already richly priced and some foreign exchange strategists are unsure the Fed can really get much more 'hawkish', potentially leaving Dollar exchange rates exposed to a downside reaction.

"The market will be eyeing the dots. And those WILL need to shift from what was conveyed in December (3 hikes by the end of 2022, 3 for 2023 and 2 for 2024). The market is pricing in over 6 for this year, followed by 1-2 for next year," says Rai.

Brent Donnelly, CEO of Spectra Markets, says he looks to sell the Dollar on the first rate hike.

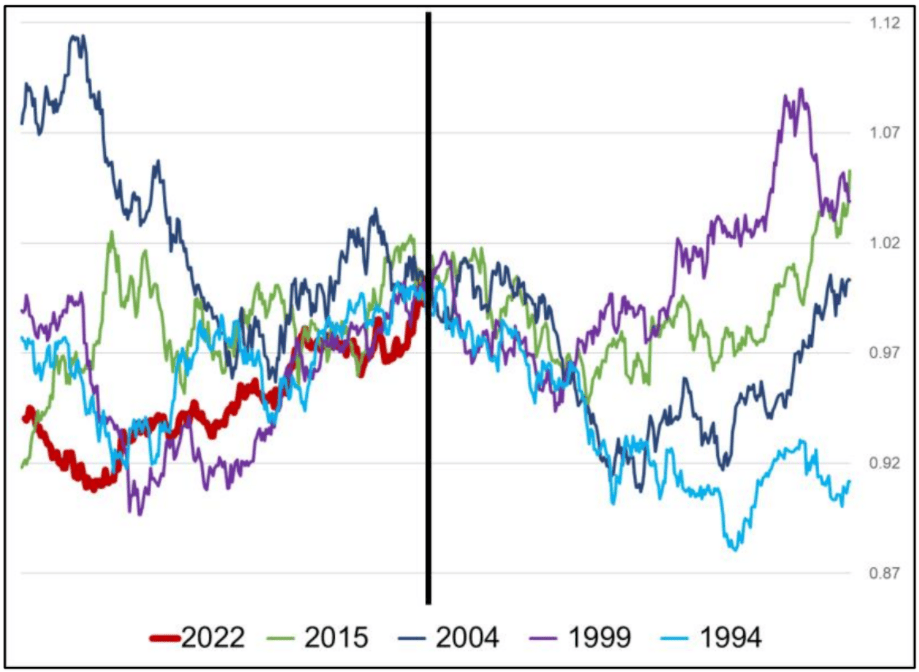

Donnelly, a market veteran who previously traded FX for HSBC, says "history says sell USD on the first Fed rate hike. It’s a sample size of four, so clearly not a statistical truth or anything, but logical. It is classic 'buy the rumor / sell the fact'."

Above: The Dollar index 250 days before and 250 days after the first Fed hike. - Spectra Markets.

And another chart Donnelly uses suggests heading into the first rate hike of 2022 shows the Dollar displaying very similar patterns to previous first-hike events:

Above: The same chart as above, but this time averaged. It shows a similar pattern is underway in 2022.

Ahead of the FOMC event the Pound to Dollar exchange rate is seen trading at 1.3052, near its lowest levels since November 2020 and extending a medium-term downtrend that has been entrenched since May 2021.

The market has pushed the Pound lower against the Dollar largely in anticipation of a rapid series of rate hikes from the Federal Reserve that will come faster than those delivered by the Bank of England.

However, this theme has been in place for some time and is well understood by the market.

Sterling bulls will therefore hope that the momentous occasion of the first Fed hike of the next cycle is where a material change in Pound-Dollar's fortunes lies.

But Derek Halpenny, Head of Research at MUFG, has also identified the historic trend for the Dollar to fall following the first rate hike, and he warns this time could be different.

He says the strong momentum for the U.S. dollar into this first rate increase reflects the Russia’s invasion of Ukraine.

"It implies an element of difference in terms of comparisons with the previous rate hike cycles and therefore it suggests the scope for the US dollar to probably remain supported for longer than in the three previous cycles illustrated below," says Halpenny.