Pound-Dollar Rate Tags 1.40 Handle, but More Gains Likely: Think Markets

Image © Adobe Images

- GBP/USD spot rate at time of writing: 1.3993

- Bank transfer rate (indicative guide): 1.3600-1.3700

- FX specialist providers (indicative guide): 1.3810-1.3895

- More information on FX specialist rates, here

- Set an exchange rate alert, here

The 'reflation trade' keeps the British Pound underpinned says Fawad Razaqzada, Market Analyst at ThinkMarkets.com:

The Pound has stormed back to life over the past couple of days, rising nearly 300 pips from Friday’s low to climb above the 1.40 handle again.

Expectations continue to grow that the pound and UK’s value stocks will benefit from a post-pandemic surge in growth and inflation.

Investors have warned towards UK assets because of the nation’s decisive action on the Covid vaccinations programme and management of the infections with daily rates and deaths continuing to fall.

The government’s vast fiscal spending programmes have also helped to offset the economic damage of the pandemic with many jobs saved due to the furlough scheme and other government measures.

All this means is that as lockdown measures are lifted slowly, pent up demand should help to fuel a strong economic recovery, with investors also no longer having to worry about the Brexit uncertainty which had weighed on sentiment over the past several years.

These expectations are the reasons why investors continue to buy short term dips in both the Pound and UK stock market.

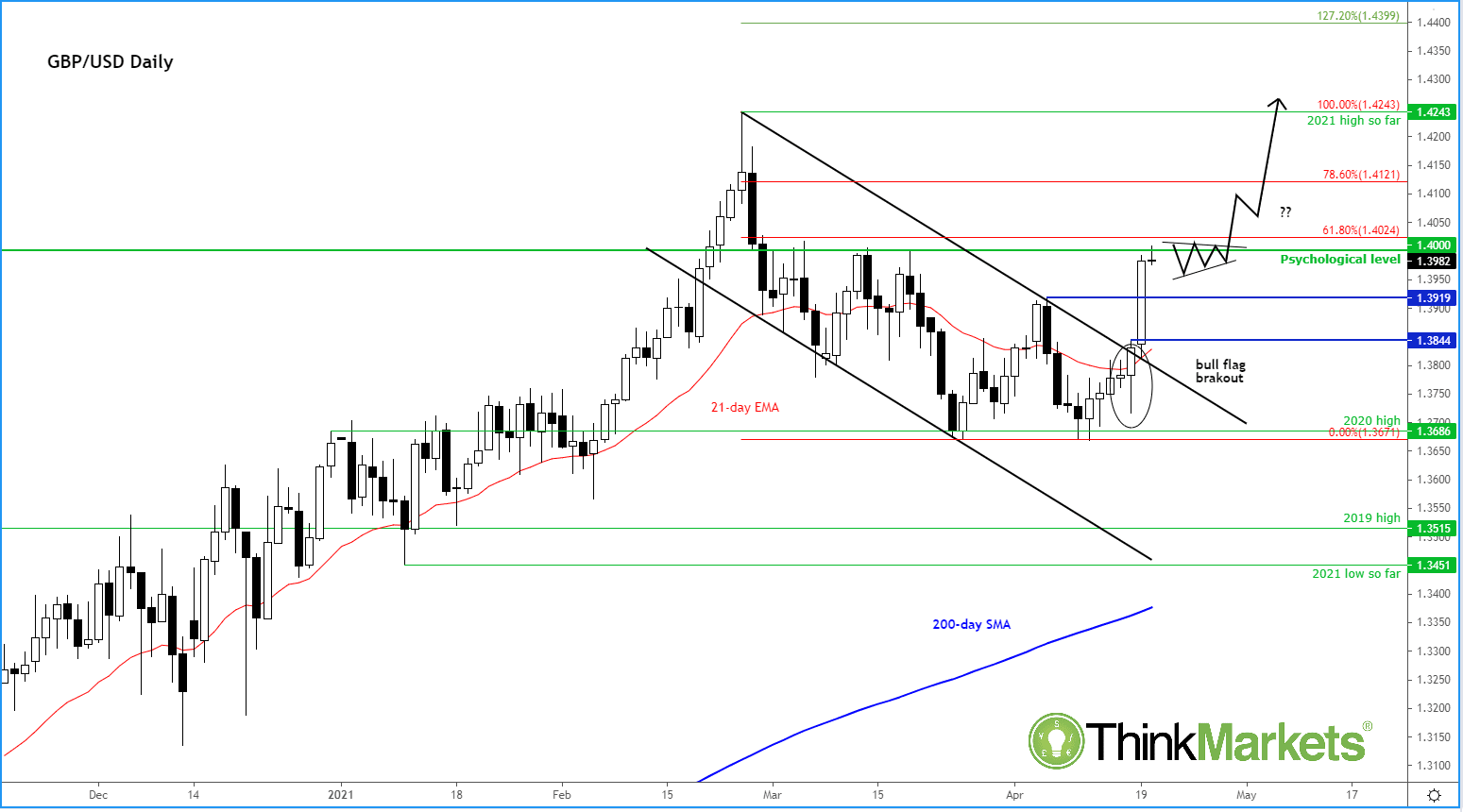

After finding strong support around the 2020 high of 1.3686, GBP/USD broke out of its bull flag pattern to the upside on Friday, leading to a sharp continuation higher on Monday.

Today it has reached the psychologically-important level of 1.40, meaning that a bit of profit-taking should be expected after the big two-day rally.

However, the breakout means that the path of least resistance remains to the upside and after a short period of consolidation I am expecting the pound to continue higher.

I think a retest of this year’s earlier high at 1.4243 is highly likely.

Key support now comes at 1.3920 and then 1.3844. The former was previously resistance while the latter marks the point of the origin of the recent breakout.

Wednesday will see the release of UK CPI, which is expected to have doubled to 0.8% y/y in March from 0.8% in February.

Bank of England Governor Andrew Bailey is also speaking on Wednesday and his commends on monetary policy will be scrutinised now that the U.K. is lifting Covid lockdowns and vaccinations continue at a very good pace.

Thursday will see the release of CBI industrial order expectations followed a day later by the publication of the March retail sales report and the latest PMI data.

Retail sales expected to have risen 1.5% compared to the previous reading of 2.1%. The services sector PMI is seen improving to 58.6 from 56.3, while manufacturing PMI is expected to have edged higher to 59.0 from 58.9 previously.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |