Sharp Drop in UK Unemployment Rate

Image © Adobe Images

The UK unemployment rate unexpectedly fell to 4.9% in February, down from 5.0% in January, but the decline flies in the face of consensus expectations for a rise to 5.1% to be announced.

The ONS said on Tuesday that the figures suggest the employment market was "broadly stable" in recent months, following the sharp shock of spring 2020.

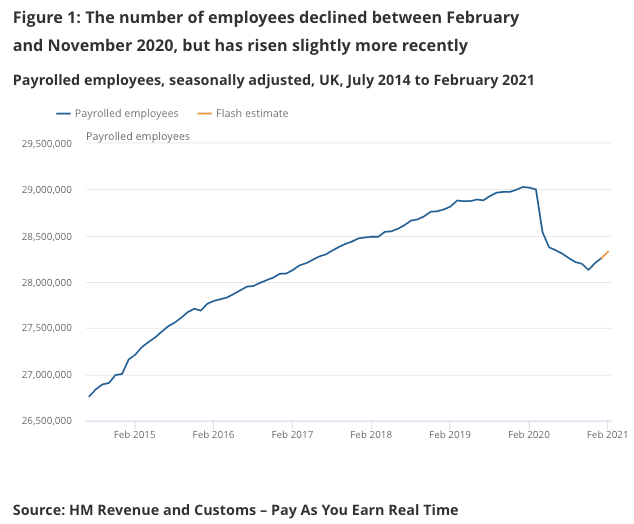

Indeed, there remain 800K fewer employees than was the case before the pandemic struck.

In the three months to February employment fell 73K, but this was far less than the -147K reported in the three months to January and less than the -150K the market was looking for.

"The labour market withstood the lockdown well in Q1 and should be in even better shape by the summer. The extension of the furlough scheme until the end of September has crushed redundancies, which on a three-month average basis fell in February to the lowest level since July. Struggling firms have no incentive to fire workers at least until July," says Samuel Tombs, Chief U.K. Economist at Pantheon Macroeconomics.

Come July employers will be required to start contributing to the cost of the furlough scheme.

Average earnings, with a bonus included, rose 4.5% in February, which is less than the 4.8% reported in January and the 4.8% the market was expecting.

The wage growth figure remains one of the curiosities of the pandemic data suite; but it must be emphasised that growth is in part driven by compositional effects driven by a fall in the number and proportion of lower-paid employee jobs and by increased bonuses.

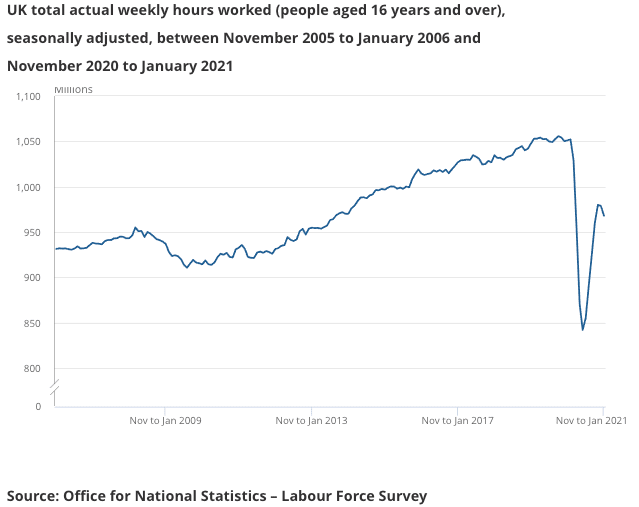

Total hours worked continued to increase from the low levels in the previous quarter, although the increase is stalling says the ONS.

The number of job vacancies in December 2020 to February 2021 was 26.8% lower than a year ago.

However, it is reported that more timely data on job listings shows a marked increase in jobs availability as the economy unlocks again.

Job vacancies surged last week as the economy sprang back to life with the partial reopening of the retail and hospitality industries.

The number of positions on offer last week was back up to 99.5% of its February 2020 level, according to the ONS and Adzuna.

"The positive news is that online job adverts are returning to pre-pandemic levels as the economy begins its tentative steps to normality, and it appears better times are on the horizon," says Paul Craig, portfolio manager at Quilter Investors.

For markets, today's data is too stale to be of significant consequence and hence the Pound barely moved in reaction.

Instead, markets will be more interested in the scale of the UK economic rebound now that the economy is opening up once more.

With this in mind, Friday's flash PMI data for April will most likely be the week's potential market-moving release.

In addition, investors will want to know that the government's current roadmap to unlock the economy remains on track and will not be delayed by any resurgence in covid-19 cases.

"The UK is approaching somewhat of a sweet spot with the successful vaccine rollout allowing the economic reopening, and this is coinciding at a time when the stimulus taps remain turned on, giving people hope that better times are right around the corner. The government will be hoping that this increase in consumer demand results in a spending splurge of the accumulated lockdown savings, providing businesses with a significant boost given what they missed out on last year," says Craig.