New Zealand Dollar: RBNZ to Cut Big Next Week

- Written by: Gary Howes

Image © Adobe Images

Having been to slow to recognise the "imploding economy" the Reserve Bank of New Zealand (RBNZ) will step up the pace of rate cuts says a New Zealand lender.

The Bank of New Zealand (BNZ) predicts that the Reserve Bank of New Zealand (RBNZ) will cut interest rates by 50 basis points at its October meeting.

"We think the disinflationary information that we have received will dominate and that this will, ultimately, encourage the RBNZ to accelerate the easing process," says Stephen Toplis, Head of Research at BNZ.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

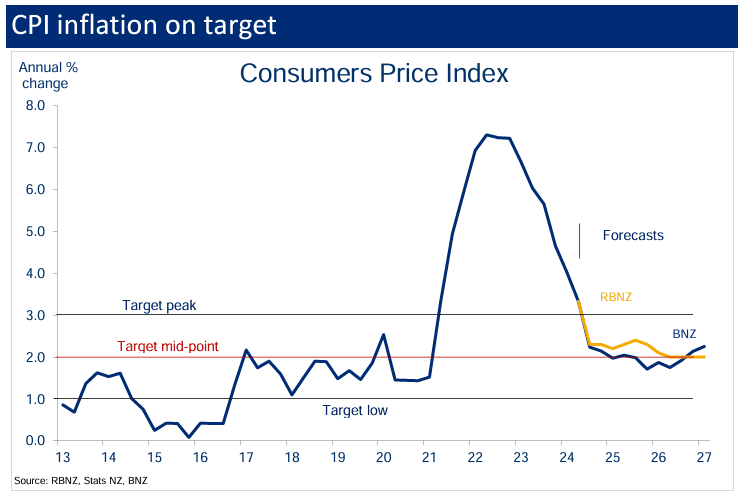

BNZ observes that inflation has been contained, and there is a growing possibility of it falling below the RBNZ's target band of 2%.

Analysts now expect inflation to be 2.0% by March 2025 and 1.7% by December 2025, saying they hold a more 'dovish' inflation profile than the RBNZ owing to recent declines in fuel prices.

Markets are currently split on whether or not the RBNZ goes with a 25bp cut or a 50bp cut.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Generally, a decrease in a country's interest rates by a larger-than-anticipated margin can lead to a weakening of its currency.

Therefore, if the RBNZ does cut interest rates by 50 basis points, it is plausible that this could lead to a depreciation of the NZD.

"We have long argued the Reserve Bank has been slow to cut rates in the face of an imploding economy, weakening labour market and a return of inflation to target," says Toplis.

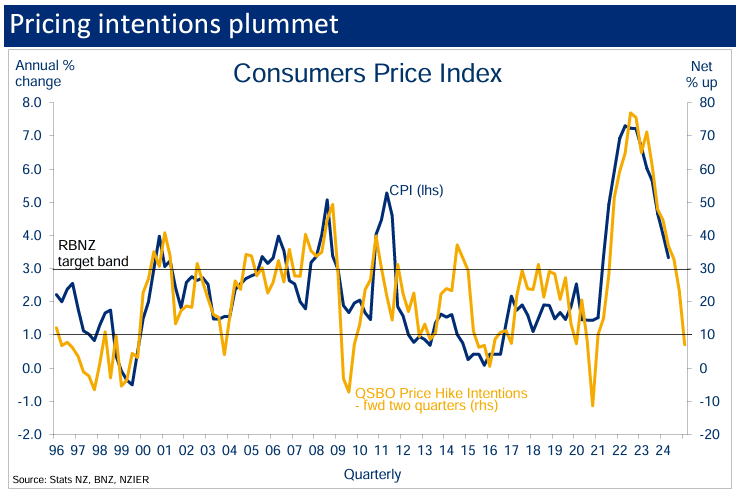

Raising the odds of an acceleration in the rate cutting pace is the Quarterly Survey of Business Opinion (QSBO), which this week revealed a significant drop in businesses intending to raise prices.

This supports the view that inflation is on track to fall below 1%.

The QSBO also indicates reduced difficulty for businesses in finding skilled and unskilled labour.

This suggests a moderation in wage inflation, another factor driving down overall inflation.

BNZ also argues that the RBNZ needs to stimulate economic growth to prevent inflation from falling too low and believes a rate cut is necessary to encourage this growth.

While the BNZ believes a 50 basis point cut is warranted, they recognise several factors might make the RBNZ hesitant:

- The ANZ Business Opinion Survey presented a more optimistic view of the economy than the QSBO.

- Q2 GDP exceeded expectations.

- Non-tradables inflation remains elevated.

- Housing market confidence is increasing.

The RBNZ may be cautious about appearing inconsistent in its approach and concerned about exceeding market expectations for rate cuts.

BNZ suggests that the RBNZ's ultimate decision might be influenced by market pricing for future rate cuts.

If the market leans towards a 25 or 50 basis point cut, it could sway the RBNZ's decision.

BNZ believes that even if the RBNZ opts for a 25 basis point cut next week, a 50 basis point cut is still likely in November, with a possibility of another 50 basis point cut in February 2025.

Analysts predict the OCR to be at least 125 basis points lower than its current level by the end of April 2025, reaching 4.0% or lower.