RBNZ Can Cut by 50bp Next Week in Wake of QSBO Survey

- Written by: Sam Coventry

Although there has been a turn for the better, economists say more rate cuts are needed from the RBNZ. Image © Adobe Images.

A new survey shows that although New Zealand business sentiment is improving a window has opened to allow the Reserve Bank of New Zealand (RBNZ) to cut interest rates by 50 basis points next week.

The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows a marked improvement in business confidence in the third quarter as a net 5% of firms expect a deterioration in general economic conditions over the coming months on a seasonally adjusted basis.

This is a significant drop from the net 40% of firms that felt the same way in the second quarter.

"Business confidence has markedly improved. The RBNZ's August rate cut, and expectation of more, underpins the lift in sentiment. Firms are feeling more optimistic about the outlook. However, current activity levels remain weak and signal a need for further policy easing," says Mary Jo Vergara, Senior Economist at Kiwibank.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The same survey for the second quarter showed that a net 40% of firms expected a deterioration in the general economic outlook over the coming months, and economists said this pointed to the economy having entered recessionary conditions.

Economists also said at the time that the survey would encourage the RBNZ to cut interest rates sooner rather than later, which they duly did in August.

Although the Q3 survey offers some encouragement, New Zealand-based economists say more support is required from the RBNZ.

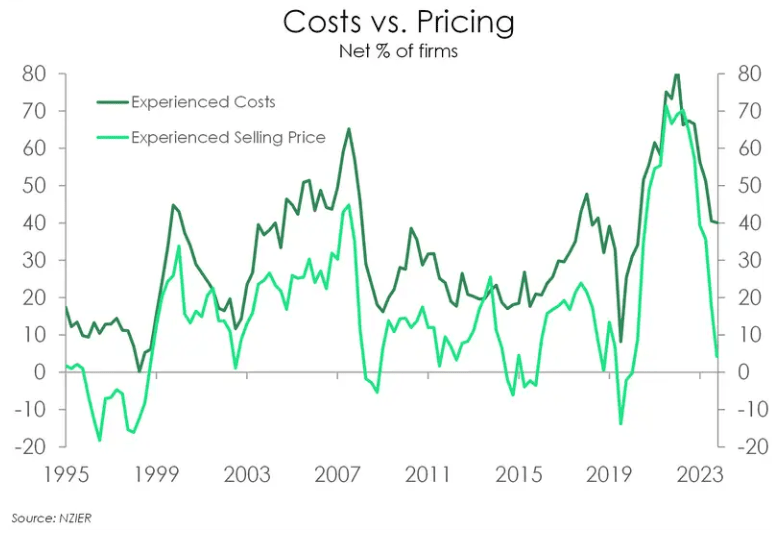

Above: The survey shows an ongoing disinflation process in NZ. Image courtesy of Kiwibank.

"The Q3 survey showed modest signs of improvement from the dire Q2 readings, but still suggest that the economy is struggling," says Mark Smith, Senior Economist at Auckland Savings Bank.

"Activity gauges from the QSBO ticked up, but were still nothing to write home about, being consistent with recessionary conditions," he adds.

Retailers were the most optimistic in the QSBO survey and pessimism was shown to have eased in the construction sector.

🎯 GBP/NZD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The RBNZ will take particular note of the survey's findings that employment intentions remain firmly in retrenchment mode, which suggests labour market easing and fading wage pressures ahead.

For the RBNZ, this could signal further declines in domestic core inflation, emboldening it to cut interest rates further.

"The weak QSBO figures highlight some upside risk to the unemployment rate outlook, as is consistent with a sharp climb above 6% by year end," says Smith.

Also of note is that pricing metrics from the QSBO have dropped significantly, suggesting businesses are less inclined to hike prices, removing a potential source of unexpected inflationary pressures from the outlook.

"Next week’s OCR decision still looks to be a choice between a 25bp or a 50bp cut. Our base case is a 25bp cut, but we would not rule out a 50bp cut next week if the RBNZ deemed it to be more necessary to more quickly normalise OCR settings and to mitigate the labour market fallout," says Smith.

"The outlook has improved. But the here and now demands more rate relief from the RBNZ – and quick in order to stave off further unnecessary weakness in the Kiwi economy and labour market. The lift in business confidence is underpinned by the expectation of more rate cuts. The RBNZ must deliver," says Kiwibank's Vergara.