GBP/NZD Forecast: Building Confidence

- Written by: Gary Howes

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate is forecasted to extend a recent rally towards 2.0832 in the coming days. Friday's U.S. jobs report is the week's focus for NZD, while Thursday's UK election is the focus for GBP.

Pound Sterling starts the new week on the offensive against the New Zealand Dollar as it rises alongside other European assets thanks to the outcome of the weekend's French legislative election.

The far-right party of Marine Le Pen didn't do quite as well as the final poll of polls were expecting (34% vs. 36.2%). All signs point to no single party holding a majority in the legislature once the second round of votes is completed this coming Sunday, removing some significant tail-risk outcomes that would have been detrimental to Europe.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The relief rally seen in markets is centred on Europe, which is helping the Pound against the dollar family.

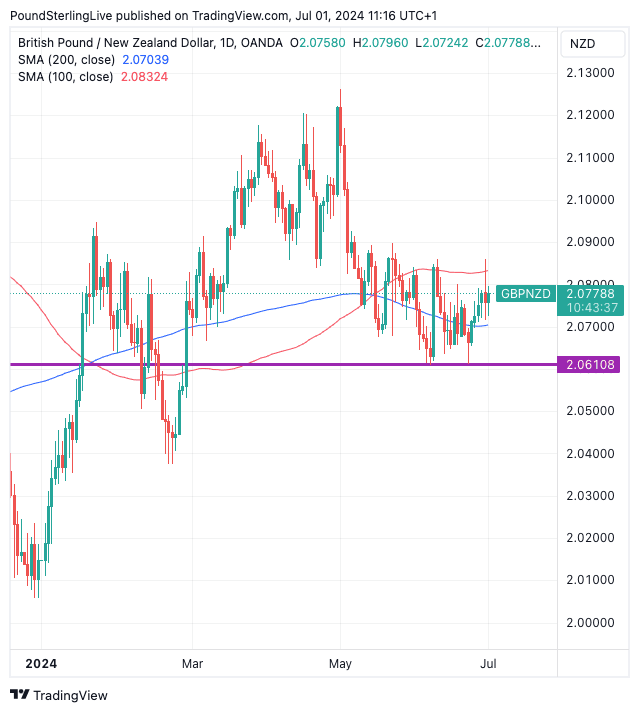

The near-term technical picture for GBP/NZD has improved near-term, with the pair breaking above the 21-day moving average last week and the daily RSI turning to point higher. The most significant technical development, however, was a move back above the 200-day moving average (DMA) at 2.0703.

Above: GBP/NZD at daily intervals. The boundaries of a near-term likely range are seen within the moving averages depicted. Track GBP/NZD with your own alerts, find out more here.

This could signal the bout of strength we have been extending could extend. Last Monday's Week Ahead Forecast for GBP/NZD said to expect a near-term rebound to 2.0750, and this price action has proven that call was correct.

Our near-term target is the 100-day moving average, which sits at 2.0832, some 50 pips away from the current level in spot.

The 100 DMA proved dependable in resisting periods of GBP/NZD strength in May and June, and we anticipate this will remain the case. Watch the 50 DMA, which comes in a little earlier at 2.0808.

The support level is now the 200 DMA located at 2.0703.

The New Zealand calendar is empty this week and global conditions will determine NZD direction. If Euro-centric sentiment improves further, we would anticipate further GBP/NZD upside.

But the U.S. calendar will ultimately determine NZD direction.

Federal Reserve Chair Jerome Powell will speak at the ECB's central bank conference in Sintra, Portugal, on Tuesday. Markets will be interested to hear his updated views on the possibility of a 2024 Fed rate cut.

This theme continues through midweek when the Fed releases the minutes for its June 11-12 policy meeting. This should offer up some more colour to markets on the all-important question of interest rates. Wednesday also sees the ISM PMI survey for the services sector, another potential market-moving release.

The week's data highlight will be Friday's non-farm jobs report. A headline figure of 180K is expected, down from 272K. Average hourly earnings are expected to print at 0.3% month-on-month in June.

As a reminder, the New Zealand Dollar can rise if the market raises expectations for a September Fed rate cut following these data and appearances. Any disappointments will soften the Kiwi. The market is currently pricing in a 56% chance of a September rate cut.

The UK election on Thursday is a low-risk event for the Pound at this stage as the odds of a Labour victory are high and we have not seen any shift in the polling to suggest this won't be the outcome.

The first key event to watch is the exit poll due at 10PM on Thursday night. This has been a very accurate indicator in recent history.

The surprise would be a stronger showing by the Conservatives that results in a 'hung parliament' where no single party can command a majority on its own.

This would result in a softer Pound as markets contemplate a period of uncertainty. However, we would expect volatility to be shortlived as there is nothing radical in the spending and tax plans of Labour, the Conservatives or Liberal Democrats.