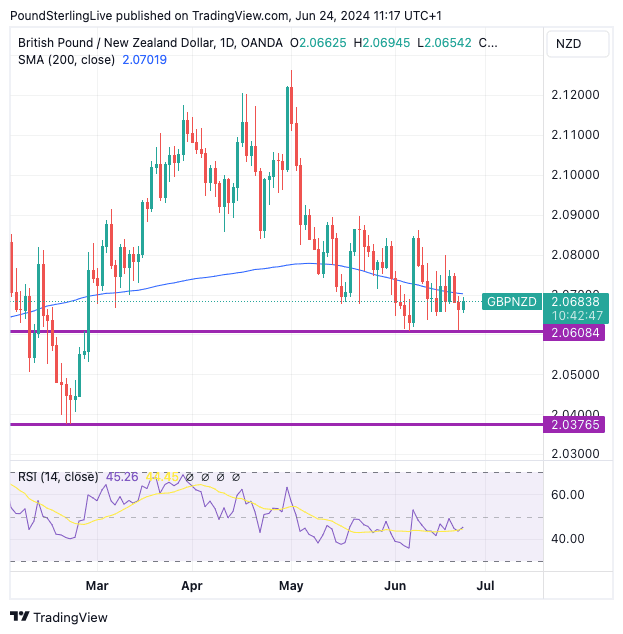

GBP/NZD Week Ahead Forecast: 2.0608 and then 2.0370

- Written by: Gary Howes

Image © Adobe Images

The New Zealand Dollar has been strengthening against the British Pound since the start of May and there is nothing to suggest its run of appreciation is about to end.

Rising global equity markets and the expectation that the Reserve Bank of New Zealand (RBNZ) will cut interest rates after many of its peer central banks are driving the Kiwi dollar higher.

This creates an interest rate advantage for Kiwi-based assets, attracting foreign exchange inflows that ultimately support the currency. It is looking particularly attractive against the Pound given the elevated chances that the Bank of England will cut interest rates as soon as August.

However, we think there could be scope for some near-term consolidation in the next one to three days, and we expect levels of 2.07-2.0750 to be delivered as a result. We note the daily RSI is pointing higher again, which is often a sign that some near-term gains can be forthcoming.

Above: GBP/NZD at daily intervals with the RSI in lower panel. Track GBP/NZD with your own alerts, find out more here.

However, our base case remains that GBP/NZD strength will be limited, and we prefer that any rallies be sold. This means those with NZD purchase requirements should be agile.

GBP/NZD trades below its 200-day moving average, which provides us with confirmation that this exchange rate is in a downtrend.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

It's important to note that any strength in GBP/NZD is likely to be short-lived, aligning with the broader downtrend. This understanding helps traders and investors set realistic expectations.

We forecast the downtrend to result to resume on a multi-day and multi-week timeframe and have high confidence that 2.0608 will be tested again.

An eventual break below this 'line in the sand' would then invite a steady move towards the February lows at 2.0376.

Should the exchange rate break back above the 200-day moving average - currently at 2.0709 - then we would start reconsidering the overall stance. But we would emphasise that we need a few successive daily closes above this level and, ideally, a weekly close above here.

There are no major domestic factors to worry either GBP or NZD, in the coming week, and we reckon global drivers will matter.

With this in mind, Friday's PCE inflation reading from the United States forms the weekly highlight for markets. Should the figure undershoot expectations then the Dollar can fall and those currencies that do well when investors are confident can outperform.

The NZ Dollar is a prime candidate. "Further easing in the Fed’s favourite core inflation measure would help both the AUD and NZD," says Forrester.

Core PCE is expected to read at 0.1% month-on-month and 2.6% year-on-year. Should it beat expectations, expect the Kiwi to end the week on a high, with the Pound-NZ Dollar potentially ending the week at lows not seen since February.

A strong reading would have the opposite effect and could help GBP/NZD end the week closer to 2.08 than 2.06.