GBP/NZD Week Ahead Forecast: Rebound Tested, Labour Market Stats Awaited

- Written by: Gary Howes

- GBPNZD rebound put on ice

- But too soon to predict outright decline

- Watch NZ labour market stats on Tuesday

- Bank of England due on Thursday

- Fed and Chinese PMIs to influence NZD

Image © Adobe Stock

The rebound in the Pound to New Zealand Dollar exchange rate has been paused and could face a deeper setback if this week's New Zealand labour market statistics beat expectations and the Bank of England sends a dovish signal at Thursday's policy update.

But this week also sees a busy global calendar with Chinese survey figures and the U.S. Federal Reserve potentially proving more important to New Zealand Dollar direction than the local jobs report.

Tuesday at 22:45 GMT sees the release of New Zealand labour market data, with the consensus looking for 0.4% growth in employment quarter-on-quarter in the third quarter, which represents a slowdown from Q2's 1.0% growth.

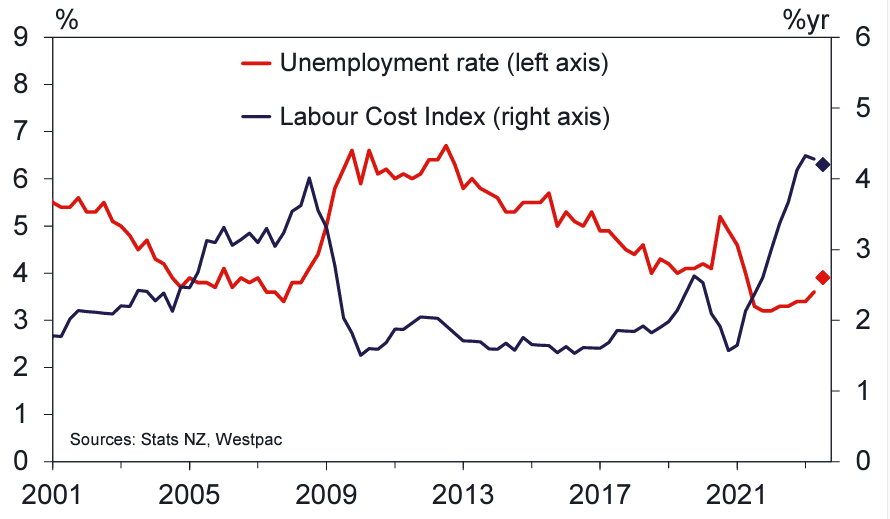

Elsewhere in the report, the labour cost index should give an impression of where wage dynamics are heading, and the market is poised for 1.0% quarter-on-quarter growth, which is close to the previous quarter's figure.

"Given comments made at the October meeting, we are sure that the RBNZ will be paying particular attention to the wage information," says Darren Gibbs, Senior Economist at Westpac.

Above: NZ labour market expectations, image courtesy of Westpac.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The unemployment rate is expected to be higher at 3.9% q/q from 3.6% previously, a development that will, in part, result from the record levels of long-term immigration recorded by New Zealand.

"We expect a higher unemployment rate (as do most), but employment and wages will be strong too, so the data will be nuanced. But there seems to be a sense that the data will herald in a new era of

weakness, with some even saying it may avert a February OCR hike, which makes is think an upside surprise would be the bigger upset," says David Croy, strategist at ANZ.

This would suggest the NZ Dollar is likely to be more sensitive to positive surprises in the data, suggesting risks are to the upside on the day.

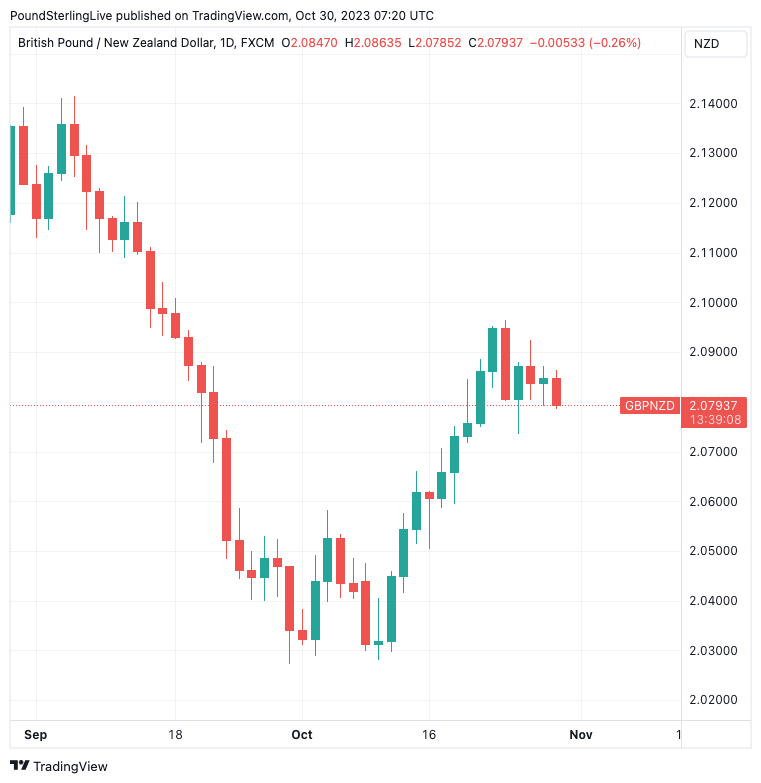

The GBPNZD exchange rate has been recovering through the course of October but has been stymied by resistance located near the 2.0950 area:

Above: GBPNZD at daily intervals. Set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The technical setup looks to be one of consolidation as opposed to one of outright deterioration that signals the start of another downtrend.

The reaction to the Kiwi labour report will be instrumental in this regard: a disappointing figure will bolster GBPNZD support and convince us that this is a market that is consolidating ahead of another move higher.

But should data print on the solid side, and boost expectations for another RBNZ rate hike, then we would begin eyeing a retest of last Wednesday's low at 2.0734 ahead of a fall back to 2.06.

Also due on Tuesday is a speech from RBNZ Governor Adrian Orr at 23:00, where markets will be looking for guidance on the potential for another interest rate hike on either November 29 or February 28.

Orr could reference the labour market figures that were released earlier in the day.

"Slowing employment growth and rapid labour force growth on the back of high migration will lead to NZ's unemployment rate heading higher in Q3 and support the RBNZ’s case for an extended pause in rate hikes. With the NZ rates market priced at about 40% for another rate hike, such a data outcome would weigh on the NZD," says a weekly strategy note from Crédit Agricole.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The other key idiosyncratic event for GBPNZD this week is the Bank of England, where interest rates are expected to be left unchanged.

However, we are wary of another 'dovish' event, given the Bank's tendencies to err on the side of caution, which could undermine the Pound. For a more detailed preview, please see here.

Global drivers will also be of importance for the New Zealand Dollar: "the main event for the AUD and NZD in the coming week will likely be the FOMC meeting," says Crédit Agricole in a weekly currency note.

Crédit Agricole's U.S. economist expects the Fed to stay on hold this week and to remain on data watch.

"With the market priced a bit less than 40% for another 25bp rate hike by the Fed, the Antipodean currencies will be highly sensitive to remarks by Fed Chair Jerome Powell about the potential for further rate hikes in the face of tighter financial conditions already doing some of the Fed’s work for it," says the note.

The New Zealand Dollar will be impacted by movements in U.S. Treasury yields and equity markets post the FOMC meeting.

If the market's takeaway is that the Fed is unlikely to raise rates again, then U.S. Treasury yields should fall and equity markets and the NZ Dollar can appreciate in value.

Tuesday sees the release of Chinese PMI figures from S&P Global, which will give a sense of how the economy's rebound is progressing.

The manufacturing PMI is expected at 50.4, a figure that would confirm the economy is in expansion mode.

Wednesday sees the release of China's official Caixin manufacturing PMI for October, where growth should be confirmed with an expected reading of 50.8 being announced.

Any disappointment or positive surprise in these economic surveys could well swing sentiment and impact China-linked currencies such as the Australian Dollar.

We continue to see China playing a sizeable role in moving the antipodean currencies and it could well be that it is China and global sentiment that outweighs any domestic impact coming from the RBA.

"China PMI data will also be important for the AUD and NZD in the coming week. The currencies received a brief boost this week from plans announced by China’s central government it was going to allow a rare mid-year expansion of its fiscal deficit to support the economy," says Crédit Agricole.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes