New Zealand Dollar: Record Immigration To Keep RBNZ Rates Higher for Longer

- Written by: Sam Coventry

Image © Adobe Stock

The Reserve Bank of New Zealand (RBNZ) won't have the luxury of cutting interest rates for some time yet with economists pointing out that record immigration levels will require added vigilance from the central bank.

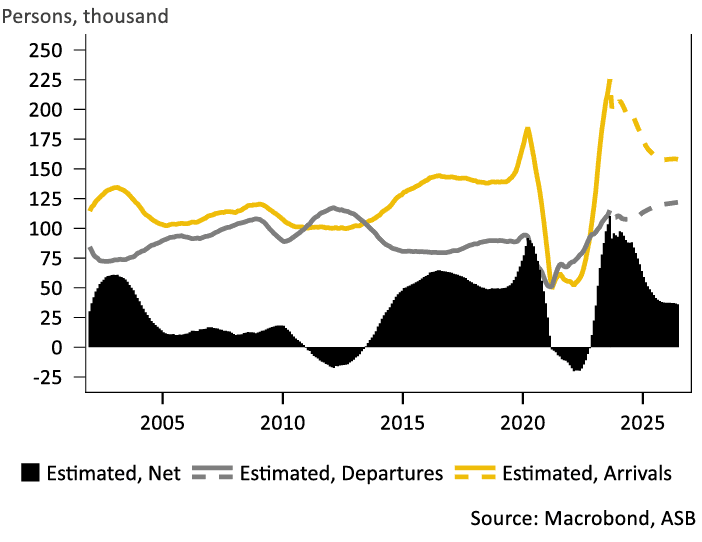

New Zealand reported 9,980 permanent and long-term (PLT) arrivals in August, helping to push the annual total net inflow to 110,244 persons, the largest net inflow on record.

"Annual net PLT immigration hit a record high, with the risk of a higher for longer net immigration boost that will have implications for the economic and interest rate outlook," says Mark Smith, Senior Economist at Auckland Savings Bank (ASB).

The annual net inflow is driven by a net gain of 152,800 non-New Zealand citizens against a net loss of 42,600 citizens.

Above: Net annual migration figures, image courtesy of ASB.

What does this mean for the New Zealand Dollar? Ultimately, the currency angle rests with how these arrivals influence 1) the labour market, 2) housing and rents and 3) future RBNZ policy.

"To date the inflow seems to be helping to alleviate tightness in the labour market – helping to explain reports of record applications for the jobs on offer – while also underpinning a lift in house sales, prices and especially rents," says Darren Gibbs, Senior Economist at Westpac.

"How these competing influences on the economy and inflation continue to play out will have a bearing on the required level of interest rates over the year ahead," he adds.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

A net supply of workers should result in labour market slack, all else being equal, which can cool wage pressures and inflation.

ASB's research shows the labour "supply-rich composition" of immigrants is boosting productive capacity, suggesting that the current migration mix is helping to temper inflationary pressure.

Jeremy Stretch, a strategist at CIBC, says continued migration flows point towards an 'easier' labour market backdrop which would imply downward pressure on wages which in turn poses downward pressure on domestic inflation.

The textbook says such conditions would allow the RBNZ to consider holding interest rates unchanged or even look forward to rate cuts. The NZ Dollar would likely come under pressure should the market suspect the RBNZ will likely embark on a more aggressive rate-cutting path than peer central banks.

But, the population growth suggests house prices and rents will come under pressure unless the supply of housing keeps pace. This is unlikely given the speed of arrivals.

"Given such very strong net immigration, the NZ economy and the housing market should be booming, and while domestic spending and the housing market has been supported there remain headwinds to contend with," says Smith.

"Migrant inflows point towards ongoing upside pressure on rents and house prices, validating RBNZ resilience," says Stretch.

Economists say the RBNZ needs to be wary of the risks posed by extremely strong net immigration persisting. Vigilance on this front leads ASB to reckon the RBNZ will maintain interest rates at elevated levels and they don't expect interest rate cuts until 2025.

Such a 'higher for longer' profile for NZ interest rates could, on balance, prove supportive for the Kiwi Dollar, particularly against currencies belonging to central banks that are ahead in the rate-cutting cycle.

ASB says the current migration boom will place much less upward pressure on medium-term inflation than is historically the case.

"However, we expect the RBNZ to take out insurance and to retain restrictive OCR settings, and while the OCR may still move higher from here, it will not be moving lower for a while yet," says Smith.

A 'higher for longer' profile for New Zealand interest rates supports the New Zealand Dollar on balance.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes