Pound Sterling: Retail Sales, PMIs Help Pare Recent Losses against Euro and Dollar

- Written by: Gary Howes

Image © Adobe Images

The British Pound will head into the weekend with some wind in its sails, thanks to an above-consensus retail sales print from the ONS and a PMI survey showing that the economy continued to expand in June.

The Pound to Euro exchange rate edged higher to 1.1820 after it was reported UK retail sales rose 2.9% month-on-month in May, exceeding estimates for 1.5% and the previous month's -1.8%. Retail sales were up 1.3% year-on-year in May, which was better than the -0.9% figure the market anticipated.

The Pound to Dollar exchange rate is now up on the day at 1.2668.

Gains were shored up by the June PMI report that confirmed the economy continued to expand in June, even if the Composite reading of 51.7 disappointed against expectations for 53.1.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pound Sterling fell in response to the Bank of England's Thursday update, which revealed that the wheels were in motion towards an August interest rate cut. Strong retail sales figures, nevertheless, confirm ongoing economic improvement, and this can limit the Pound's downside as there will be limited scope for the Bank to engage in a deep and aggressive interest rate cutting cycle.

The ONS said retail sales were up in all sectors, but non-food store sales volumes (the total of department, clothing, household, and other non-food stores) rose by 3.5% in May 2024. This was the largest monthly rise since April 2021, and follows a fall of 3.0% in April 2024.

There was strong monthly growth for clothing and footwear retailers, furniture stores, and sports equipment, games and toys stores.

These retailers reported improved footfall, better weather, and the impact of promotions.

"Retail sales have bounced back. With inflation down to the Bank’s 2% target, consumer confidence at the highest level since November 2021 and a 2.9% increase in retail sales volumes, consumer activity is picking up," says Tom Youldon, Partner at McKinsey & Company.

The ONS retail sales report comes on the same day that GfK released its consumer confidence survey, revealing another uptick in consumer confidence in June.

UK Consumer Confidence up three points in June to -14 reports GfK, purveyors of the UK's longest-running consumer confidence report. This was the third monthly increase since March and was driven by optimism about the UK economy.

"Strengthening real wage growth driven by falling inflation boosted consumer confidence again in June. That should keep the economy humming along this year," says Rob Wood, Chief UK Economist at Pantheon Macroeconomics.

GfK says consumers have a more "sympathetic" view of the economy for the last year and the 12 months to come.

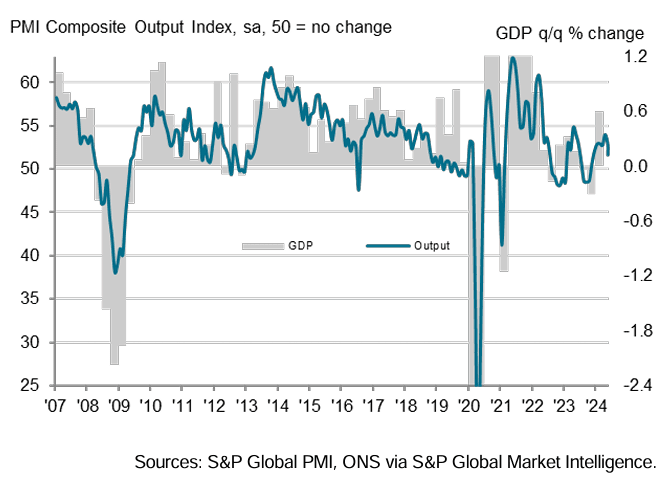

Above: UK PMIs are consistent with growth, but hints of a slowdown emerged in June.

PMIs: Slowing Growth Rates, But Manufacturing Impresses

The S&P Global PMI report confirmed ongoing economic expansion, even if the headline Services PMI disappointed at 51.2 (expected: 53, previous: 52.9).

The UK's Manufacturing PMI offered a spot of brightness, reading at 51.4, which beat expectations for 51.3 and the previous month's 51.2. This is consistent with another month of expansion for the UK's manufacturers, which contrasts favourably with Germany, Europe's manufacturing powerhouse. Here, the Manufacturing PMI slid to 43.4 from 45.4.

In fact, any disappointments in the UK PMIs were overshadowed by a raft of disappointments across the English Channel, with France and Germany seeing all PMI reports disappointing.

This can underpin the Pound-Euro exchange rate near-term.

The PMI survey revealed inflationary pressures were back on the rise during June, as companies widely reported a steep increase in transport costs linked to global shipping bottlenecks.

Input price inflation accelerated from its 40-month low in May,

This could give reason for the Bank of England to remain cautious when it commences its interest rate cutting cycle, with the first cut most likely in August.