Euro-Dollar: Eurozone PMIs a Sea of Red

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate is set for a third consecutive weekly loss, partly thanks to a disappointing economic survey that showed economic momentum faded in June.

S&P Global said its PMI survey of the Eurozone economy showed the "economic recovery suffered a setback at the end of the second quarter of the year."

The headline Composite PMI read at 50.8, which was down on May's 52.2 and below consensus estimates for 52.5. Manufacturing remained well within contractionary territory at 45.6 (exp: 47.9, pre: 47.3). Services continues to carry the economy, registering an expansion at 52.6 (exp: 53.5, pre: 53.2).

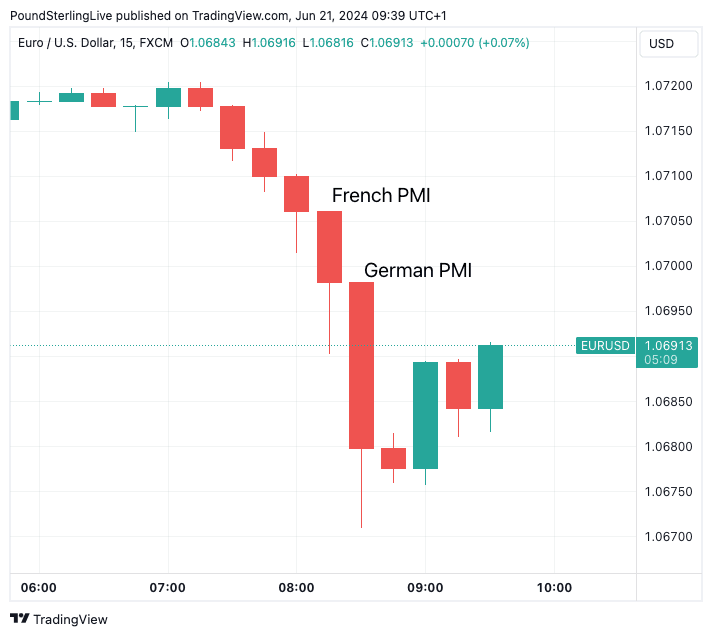

The Euro sold off ahead of the Eurozone PMI as markets considered German and French PMIs, which were released 45 minutes and 30 minutes (respectively) prior to the all-Eurozone release. They showed a sea of disappointment with all components undershooting expectations.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

In the 45-minute window following the German release, the Euro sold off a third of a per cent against the Dollar.

According to S&P Global, firms reported that new orders decreased for the first time in four months, feeding through to softer expansions in business activity and employment.

Above: Euro-Dollar on June 21. Track EUR/USD with your own alerts, find out more here.

The European Central Bank (ECB) cut interest rates in June and could feel emboldened to cut again in coming months as rates of input cost and output price inflation eased to six- and eight-month lows, respectively.

Business confidence dipped to the lowest since February.

"The lower PMI in June suggests that growth in the second quarter may be slower than initially expected. With price pressures easing according to the survey, this confirms the view of a moderate economic environment in line with expectations of very cautious easing from the European Central Bank," says Bert Colijn, Senior Economist for the Eurozone at ING Bank.