Euro Leads Rebound As U.S. Dollar's Trump Surge Fades

- Written by: Gary Howes

Photo by: Sanziana Perju / ECB.

The Euro leads the global FX rebound amidst indications the initial U.S. Dollar surge to Donald Trump's election win is running out of steam.

The Euro to Dollar exchange rate (EUR/USD) rallied to 1.0577 from the previous day's low at 1.05 after Federal Reserve Chair Jerome Powell cast doubt on a December interest rate cut at the Federal Reserve.

"The economy is not sending any signals that we need to be in a hurry to lower rates," Powell said.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Powell added that, "the recent performance of our economy has been remarkably good, by far the best of any major economy in the world."

He said the labour market is "now by many metrics back to more normal levels that are consistent with our employment mandate," and "inflation is running much closer to our 2% longer-run goal, but it is not there yet".

His comments caused a spike in short-term U.S. bond yields, which would typically fuel the dollar exchange rate gains. However, the USD failed to respond, signalling potential exhaustion.

"The scale of the move in front-end rates was notable in that it had limited impact on lifting the US dollar," says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank Ltd.

"The failure of the US dollar to extend its rally after Powell’s hawkish comments likely made way for a technical rebound," says Raffi Boyadjian, Lead Market Analyst at Trading Point, referencing the EUR/USD rally.

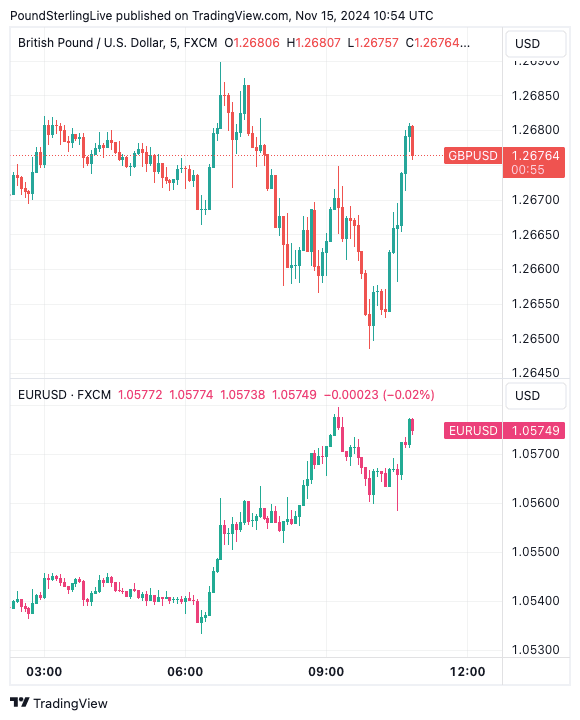

The GBP/USD exchange rate followed suit, rallying from 1.2630 to 1.2675.

GBP/USD (top) and EUR/USD at 5-minute intervals.

"This is perhaps not a surprise and it does point to the potential for the dollar to enter a consolidation phase given the sharp move stronger since Trump’s election victory. We suspect the positive momentum we have seen since and before the election may now start to fade," says Halpenny.

The Dollar will nevertheless complete a seventh consecutive weekly advance on the Pound, falling from 1.34 to 1.2675.

For the Euro, the losses embrace a decline from 1.12 to 1.0570, a near-6.0% decline that has taken place in less than two months.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

"EUR/USD has now dropped 7-big figures in a little over a month and we may be reaching a point when the positive momentum fades and better two-way flow begins to emerge into the market," says Halpenny.

Driving the USD advance is a rapid reduction in the pace of rate cuts expected at the Federal Reserve, which has widened the gap between U.S. bond yields and those of the Eurozone.

Michiel Tukker, Senior European Rates Strategist at ING Bank, says Powell's speech last night was interpreted more hawkishly by markets, which pared back the chances of a rate cut in December to less than 50%.

"The economic resilience would allow the Fed to make more careful decisions. While the latest inflation data was a bigger bump than the Fed had anticipated, it clearly appears to be in no rush to cut rates," adds Tucker.

MUFG's Halpenny says the Euro might find increased demand around current levels.

"From speaking to clients, our sense is that levels around or certainly below 1.0500 would be viewed as attractive buying levels for those who have EUR buying requirements," he explains.