Pound Sterling Forecasts against Euro and Dollar Raised at ABN AMRO

- Written by: Gary Howes

Above: Pound to Dollar (top) and Pound to Euro performance in 2023.

European lender and investment bank ABN AMRO has upgraded its forecast for the British Pound against the Euro and Dollar expecting the Bank of England to be less "dovish" over the coming months than the ECB and Fed.

Economists at the Dutch-based international lender and investment bank say UK inflation is likely to remain 'sticky' going forward, meaning the Bank of England will be one of the last to cut interest rates.

The call comes amidst a period of outperformance for the Pound that saw it break to a new five-month high against the Euro in May and a new 11-month high against the Dollar.

Part of that outperformance has been driven by a run of economic data releases that have beaten expectations, prompting the Bank of England to raise interest rates to 4.5% in May.

ABN AMRO reckons the Bank of England won't raise interest rates again, but for foreign exchange markets, it is the prospect of interest rate cuts later out that is now proving of great significance.

"We think that the central bank has reached a peak in the policy rate at 4.5%. But the less weak near-term growth outlook combined with a more shallow expected rise in the unemployment rate means that wage growth and core inflation is likely to prove stickier," says Georgette Boele, Senior FX Strategist at ABN AMRO.

"We have therefore pushed out our expectation for the start of rate cuts to Q2 2024 from Q4 2023," she adds.

For Boele and her team, a key consideration for the Pound's outlook is where Bank Rate will be at the end of 2024, as this will indicate the longer-term level in interest rates, an important driver of currency valuation.

In this regard, ABN AMRO has "significantly raised" its end-2024 expectation for Bank Rate, to 3.75% from 3% previously.

"We are the least dovish on the Bank of England compared to the ECB and the Fed," says Boele.

"Compared to the market and analysts, we are slightly less hawkish this year and slightly less dovish next year. As a result, we have updated our forecasts to reflect this. We expect higher prices in sterling versus dollar and euro next year," says Boele.

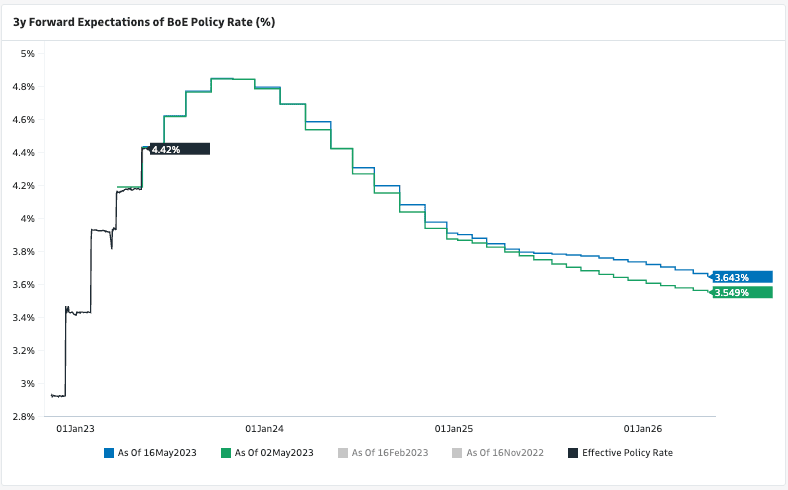

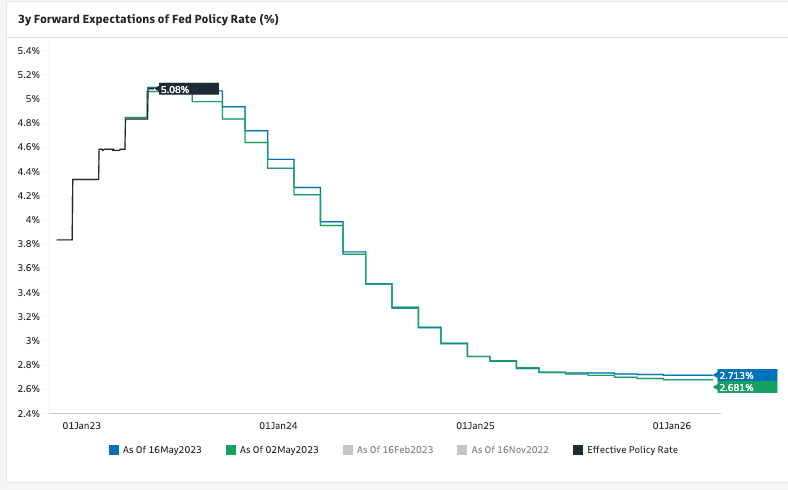

Above: Market expectations for Bank of England cuts (top) is shallower than those for the Fed. This can help explain GBPUSD upside in 2023. Images courtesy of Goldman Sachs.

ABN AMRO's new Pound to Dollar exchange rate forecast is for 1.24 by the end of September, 1.24 by end-2023, 1.25 by the end of the first quarter 2024, 1.26 for the end of the second quarter and 1.30 by year-end 2024.

The Euro to Pound exchange rate forecast profile is 0.88, 0.89, 0.88, 0.87, and 0.85 for these timeframes.

Turning this into a Pound to Euro conversion the forecast points are 1.1360, 1.1240, 1.1360, 1.15 and 1.18.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The forecasts suggest the Pound might have peaked for 2023 and a period of consolidation and softer exchange rates might await currency market participants over the coming weeks and months.

"Having been bullish on the pound since the start of the year, we no longer think the pound presents attractive risk-reward in the short term," says Shreyas Gopal, Strategist at Deutsche Bank.

Deutsche Bank last week wrote to clients saying they expect Sterling's period of outperformance is reaching a conclusion.

Gopal says "UK data surprises are far more positive than anywhere else in G10"... but, "a lot of the domestic good news for the UK is now in the price" of the Pound.

"The currency's beta to these prints has started to diminish in recent weeks as the market has now covered its long-held short position heading into the BoE meeting," he adds.

This is a particularly relevant observation given the Pound's weakness on Tuesday following a softer-than-expected UK labour market report, which in turn follows news that the UK economy unexpectedly shrank in March.

Nevertheless, foreign exchange analysts at the major banks have been busy of late upgrading their forecasts for the Pound owing to the currency's outperformance in 2023.

Analysts at Goldman Sachs last week upgraded their tactical stance on the British Pound to "outright constructive" amidst a surprising UK economic resilience and fading central bank divergence risks.

"We have been arguing for some time that Sterling's fundamentals have improved, and markets were not fully appreciating that," says Kamakshya Trivedi, Head of Global FX at Goldman Sachs.

In February, Goldman Sachs recommended taking profits on Sterling shorts, arguing at the time that the UK currency should no longer underperform on the 'crosses' (non-USD exchange rates).

The move was an effective upgrade of the Pound from underweight to neutral.

But, now it is time to get bullish.

"We are now taking an outright constructive stance," says Trivedi.

Goldman Sachs revising their EUR/GBP forecasts to 0.86, 0.87 and 0.87 in 3, 6 and 12 months (vs 0.89, 0.88 and 0.88 previously).

This gives a Pound to Euro forecast profile of 1.1630 and 1.15.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes