Pound Sterling: GDP Growth Beats Expectations, But Outlook against Euro and Dollar Remains Fragile

- Written by: Gary Howes

Image © Adobe Images

The British Pound remains on a fragile footing against the Euro and Dollar but nevertheless received a small boost ahead of the weekend following the release of UK GDP data that showed the economy grew 0.3% in January.

This exceeded analyst expectations for growth of 0.1% and marks a sharp rebound from December's -0.5%.

The economy, therefore, starts what is expected to be a hard year by handsomely beating expectations and diminishing the prospect of recession in the first quarter.

The Pound to Euro exchange rate was higher on the day at 1.1270 as it looked to stabilise following the losses experienced earlier in the week, the Pound to Dollar exchange rate was 0.20% higher at 1.1943.

(Both GBP/EUR and GBP/USD will be highly reactive to the release of U.S. labour market data at 13:30 GMT).

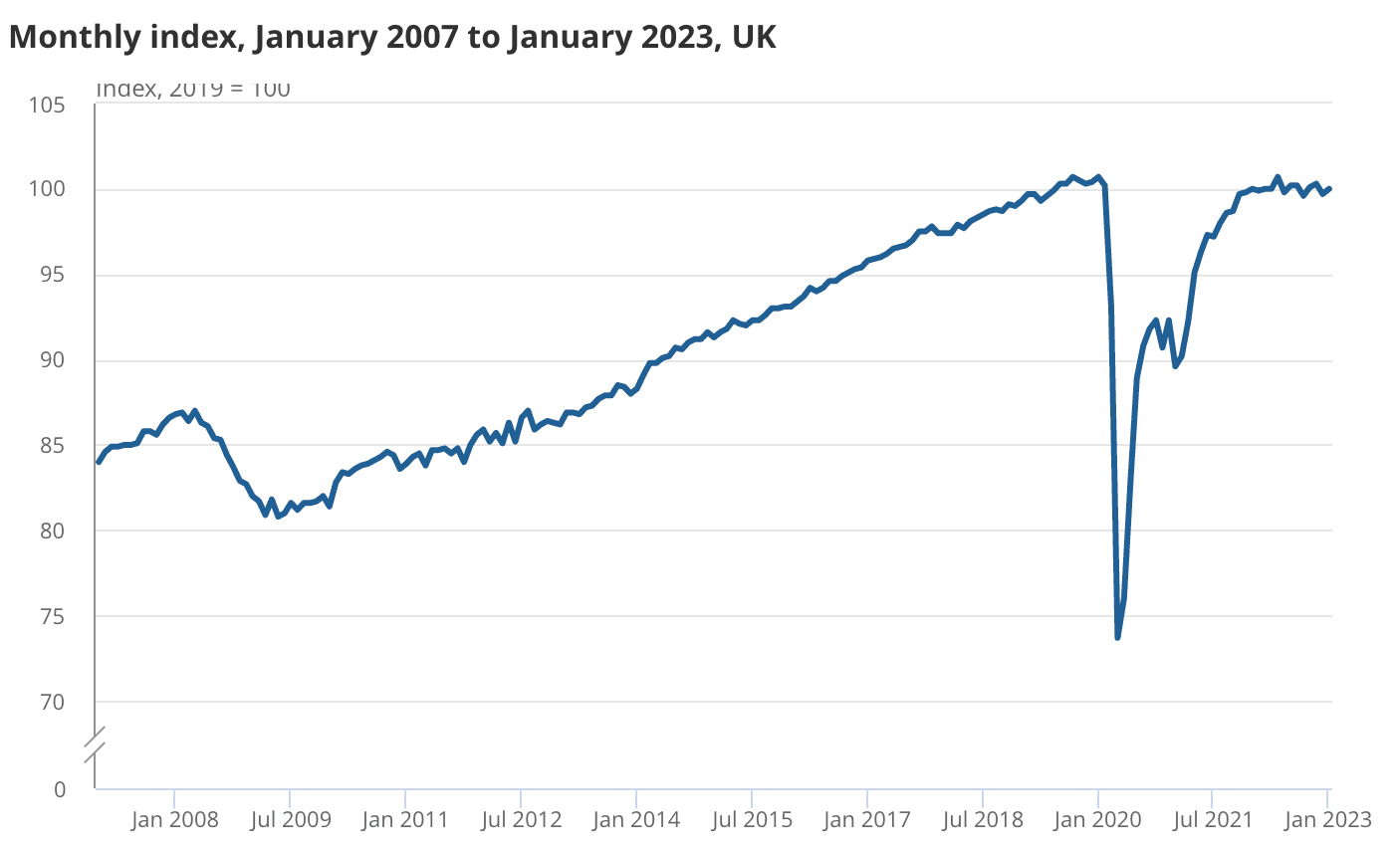

Image: ONS.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The ONS said the uplift to January meant GDP was now flat in the three months to January 2023.

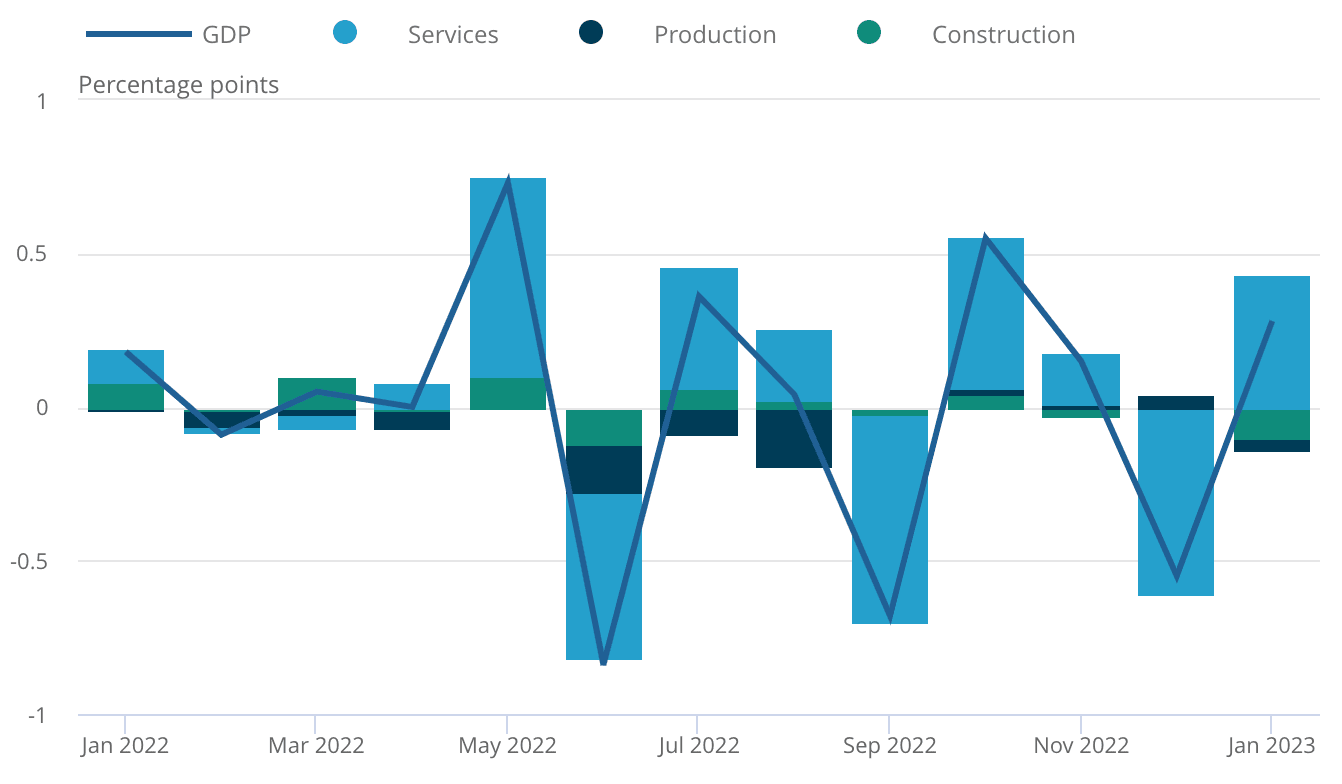

January's economic growth was driven by increased activity in the services sector which grew by 0.5% in January 2023, after falling by 0.8% in December 2022.

The largest contributions to growth in January 2023 came from education, transport and storage, human health activities, and arts, entertainment and recreation activities, all of which have rebounded after falls in December 2022.

"The rebound in services activity is a technical rebound as the contraction in December 2022 in part reflected one-offs, from striking workers that impacted healthcare and transportation activities, to reduced school attendance that weighed on education output, and (strangely) a fall in entertainment activities due to the postponement of Premier League fixtures for the FIFA World Cup," says Daniel Vernazza, Chief International Economist at UniCredit Bank.

Above: The drags and uplifts to UK GDP. Image: ONS.

Taking the shine off the data - and therefore potentially limiting any upside impact to the Pound - were indications other sectors of the economy continued to struggle.

Production output fell by 0.3% in January 2023, following growth of 0.3% in December 2022.

The construction sector fell by 1.7% in January 2023 after being flat in December 2022.

For the Pound, the outcome of the data is unlikely to materially alter the outlook for UK monetary policy: the Bank of England looks set to bring a close to its interest rate hiking cycle on March 23.

This is as central banks in the Eurozone and U.S. look to continue hiking in 50 basis point increments.

This could penalise the Pound over the coming weeks and months.

"It may take a great deal more expectation-beating data to shift the bleak expectations for the UK economy. However, a quiet, more optimistic, consensus does appear to be forming. The economic outlook is much improved, energy prices are falling sharply, China is reopening, and interest rate expectations have eased significantly," says Jonathan Moyes, Head of Investment Research at Wealth Club.

UniCredit's Vernazza says the economy is currently undergoing a sharp slowdown and is in recession.

"The outlook remains weak and we continue to expect a 0.3% quarter-on-quarter contraction in 1Q23 and a technical recession in the first half of the year, as the effects of tighter monetary policy work through the economy," says Vernazza.

However, recent PMI data showed economic expansion continued into February and monetary conditions have eased significantly since last year, drawing questions as to how much of a drag the Bank of England is actually creating.

This sets up the prospect of further upside surprises that could continue to frustrate economists who have long been calling a UK recession.

"Today’s GDP data further supports our long-held view that the downturn in UK activity this year will not be as bad as many of the fearmongers have so far made out. While part of the bounce can be attributed to the low base, following the 0.5% contraction in December, and the easing impact from rail and postal strikes, we still see the rebound in activity, particularly in the services sector, as highly encouraging," says Matthew Ryan, Head of Market Strategy at global financial services firm Ebury.

"We think that the resilience of the UK economy will provide decent support for the pound in the coming months," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes