Bank of England Rate Setter Warns on Further Pound Sterling Weakness

- Written by: Gary Howes

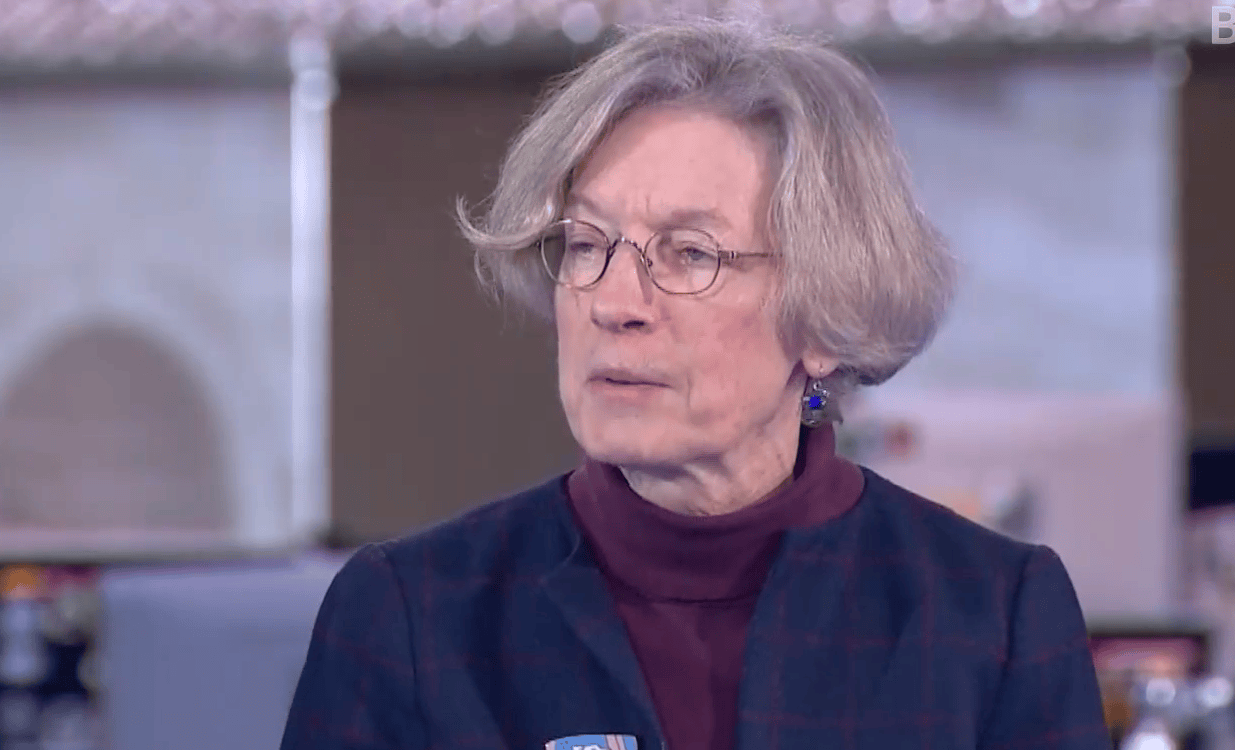

Above: Still of Catherine Mann. Source: Bloomberg TV.

A member of the Bank of England's interest rate setting committee says there is scope for further depreciation in the British Pound if markets are yet to fully appreciate the full extent of interest rate hikes to come from the European Central Bank and the U.S. Federal Reserve.

Catherine Mann - an external member of the Bank's Monetary Policy Committee - told Bloomberg that Pound Sterling could come under pressure if the 'hawkish' tones coming from the Fed and ECB are not yet digested.

"The important question for me with regard to the Pound is how much of that existing hawkish tone is already priced into the Pound," she said.

The Federal Reserve and European Central Bank are expected by investors to continue raising interest rates amidst elevated inflation levels in the Eurozone and U.S.

The Bank of England is meanwhile expected by economists to end its hike cycle in March, despite the UK facing a similar level of inflation as the Eurozone and U.S.

Mann said if the divergence in expectations is "already priced in, then what we see is what we get. But if it's not completely priced in, then there could be depreciation pressure."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Money markets show investors expect a further ~80 basis points of rate hikes to come from the Bank of England, suggesting they believe the Bank will be forced into hiking beyond March.

But if the Bank is intent on making March its final hike then markets will adjust expectations accordingly, potentially heaping pressure on the Pound.

"Benign monetary policy will weigh on the pound," says a weekly currency briefing from Barclays.

Barclays says the Pound will struggle as investors encounter a "still dovish Bank of England" and "significant and persistent inflation in the UK".

Mann said other central banks had meanwhile "been talking hawkish for a while but I think perhaps there's more to go."

She said the value of the Pound was an important factor for the Monetary Policy Committee to consider as it was "significant for inflation", reiterating the point she had made on the matter of the currency in a speech delivered in 2022.

Mann's modelling found that in order to stabilise domestic UK inflation and alleviate inflationary pressures coming through the exchange rate, Bank of England policymakers would need to roughly go along with the tightening from the Federal Reserve.

Mann is considered a 'hawkish' member of the MPC and she argues the Bank should have been more aggressive earlier on its rate hiking cycle in order to avoid having to raise rates for an extended period, a situation which could actually result in a higher terminal interest rate being reached.

She said in her Tuesday interview she was still concerned about the persistence of core inflation and the strong pricing power of firms who were able to pass on their costs to customers, a view echoed in a speech given on February 23.

"I've had recent speeches where I've indicated that I thought more needed to be done in order to ensure that expectations in particular are for a declining rate of inflation and the embeddedness to be mitigated," she said.

Mann also noted the mortgage market was recovering, something that flies in the face of expectations amongst some of her colleagues that previous interest rates are enough to prompt a slowdown in the economy.

"We've seen a reduction in mortgage rates from the high point last fall. We see more competition in terms of products coming from various lenders," she said. "And so that suggests to me that there's more revival in process as opposed to a continued downward momentum," she said.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes