Euro to Dollar Forecast for the Week Ahead: Chance of a Bigger Setback

- Written by: Gary Howes

Image © Adobe Images

The Euro faces a setback this week despite rising odds that the ECB will accelerate the pace of its interest rate cuts.

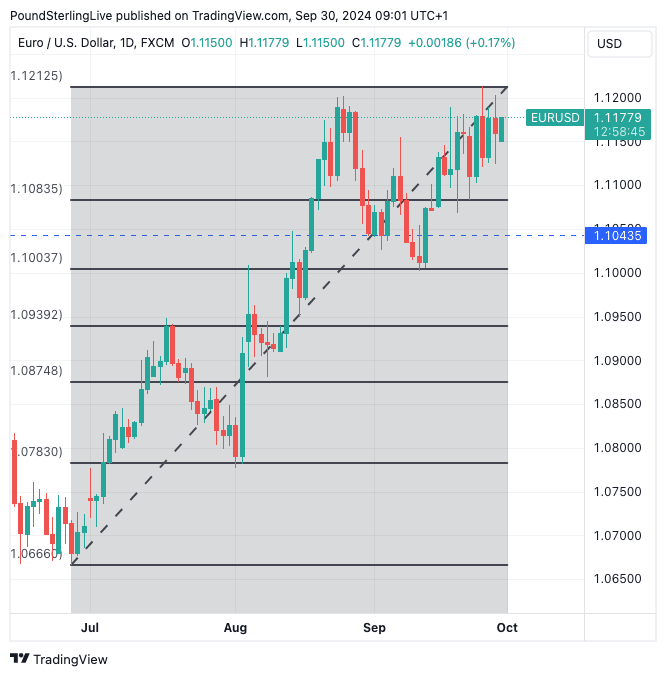

The Euro to Dollar exchange rate hit a new 2024 high at 1.1212 last week and has since retreated, with the charts suggesting it is building up energy ahead of a break higher.

Indeed, the technical setup is constructive and advocating for further gains in the coming week, but we are weary of betting on further upside at this juncture given the calendar risks that litter the path ahead.

"Investors are nervous ahead of several Fed speakers this week as well as the release of U.S. ISM and labour market data," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Above: EUR/USD at daily intervals with Fibonacci retracement levels shown.

For now, the 1.1212 barrier remains the upside objective and we see it as being easily achieved if U.S. data undershoots expectations this week.

However, in the event that the cards don't fall in the euro bulls' favour, a retreat to the 1.1083 level will be likely, where we think buying interest will emerge. As per the above chart, this is the 23.6% Fibonacci retracement of the 2024 rally and it has already proven its worth as a predictive level.

"The EUR continues to trade close to recent highs vs the USD but it is increasingly undermined by aggressive market ECB rate cut expectations that have intensified in the wake of the Fed’s jumbo rate cut last week," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

In the Eurozone, ECB thinking will be influenced by inflation figures for September, with Germany releasing its on Monday ahead of the all-Eurozone release on Tuesday, where the expectation is for headline Eurozone CPI to fall below the ECB's 2.0% target, landing at 1.9%.

Last week's French and Spanish figures undershot expectations by a significant margin, raising the odds to 80% of another ECB rate cut as early as October.

The market is, therefore, already leaning on the dovish side of expectations, which limits the prospect of a major market reaction (i.e. Euro-Dollar downside).

"The EZ inflation reading for September on Tuesday is of utmost importance for the ECB monetary policy decision on October 17. Should core inflation and service inflation remain high levels, at 2,8% YOY and 4.2% YOY respectively. The ECB may focus on bringing it down although certain European economies, especially the German, are in an urgent need for a more supportive monetary policy," says Ulf Andersson, an economist at DNB.

Members of the ECB's Governing Council have maintained the view that caution on cutting rates is warranted, but George Buckley at Nomura says this week will be littered with speeches from ECB policy makers, which will be "critical in determining how realistic the ECB thinks a faster pace of cuts will be."

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Keep an eye on ECB President Christine Lagarde, who is due to speak on Monday; markets will want her to address rising odds of an October rate cut in light of the poor state of German data, the decline in Eurozone PMIs in September and the soft incoming inflation figures.

Lagarde could choose to maintain the view that the ECB will want to see more data before cutting interest rates again, verifying the ECB's apparent desire to only cut rates again in December.

But, the data we do have is sending some clear signals, namely that Germany is in dire need of ECB interest rate cuts and inflation is at risk of falling faster than the ECB expects.

German central bank president Joachim Nagel will potentially also address the issue on Tuesday, as he has a scheduled appearance. Banque de France's de Guindos also speaks on Tuesday.

Fedspeak and Payrolls

Yet, it is the U.S. Dollar that remains the dominant player in the Euro-Dolla rpair.

With this in mind, keep an eye on U.S. PMI survey data on Tuesday and speeches from Fed Open Market Committee (FOMC) members Cook, Collins, Barkin and Bostic. Bowman and Barkin speak on Wednesday.

There are more U.S. PMI figures incoming on Thursday (covering the services sector), which will keep markets entertained ahead of the week's highlight, which is Friday's non-farm payroll release.

Here, a headline of 144k is expected. The rule of thumb is that anything slightly below would signal the need for more cuts at the Fed and keep the mood music supportive of global risk and the Pound.

But any big downside miss could backfire as it would suggest maybe the economy is slipping into recession. If the figures give a significant upside surprise, markets will almost certainly fall as investors race to bet the Federal Reserve will slow down the pace of cuts.

This would likely trigger a recovery in the Dollar, prompting a retest of the technical support level at 1.1083.