Euro-Dollar Downgraded

- Written by: Gary Howes

Image © European Central Bank

The Euro to Dollar exchange rate is forecasted to "stay heavy" in the next few weeks, with one technical analyst downgrading his view for the pair.

"The risks on the downside are increasing for the EUR/USD to fall towards 1.05. We downgrade the rating to Bearish," says Mensur Pocinci, Head of Technical Analysis at Julius Baer.

The call comes amidst a significant selloff in Euro exchange rates linked to rising political uncertainty in the Eurozone.

Uncertainty is centred on France, where a snap poll for the country's legislature was called on Sunday night. Rumours of Emmanuel Macron potentially resigning and news of a tie-up between the RN and The Republican party have only increased angst.

"EUR/USD remains heavy under 1.0750," says Joseph Capurso, an analyst at Commonwealth Bank. "Increased political uncertainty in France following President Macron’s decision to call a snap election is likely to weigh on EUR/USD in the next few weeks."

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

French bond yields have surged relative to those of Germany in the first part of this week, signalling investors are demanding greater returns for holding French government debt. The prospect of the right-wing coalition winning the legislative vote raises the prospect of a potentially unstable government in France at a time of ballooning government debt.

"French government bonds have sold off modestly more than the bonds of other large European governments," says Capurso.

In late May S&P downgraded the French credit rating from AA to AA-. Moodys now warns France's elections could be a negative for France's Aa2 rating. It said the current 'stable' outlook on the rating could be changed to ‘negative’ if its debt metrics deteriorated.

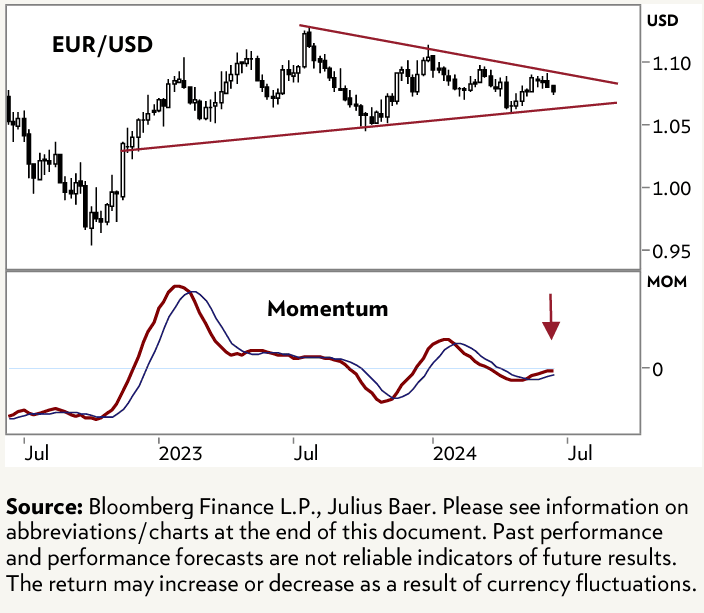

Regarding the technical outlook for Euro-Dollar, Julius Baer's Pocinci says the EUR/USD has been in a tight consolidation over the past year, trading between 1.04 and 1.12:

"With the failure to rise above 1.09, the medium-term momentum indicator looks to have peaked again, suggesting a third peak this year. Thus, the risks are increasing for a retest of 1.05," says Pocini.

He explains that it is more likely than not that the EUR/USD will drift slightly lower and remain in a low volatility environment. His forecast is for an eventual move to 1.05.