Pound to Euro Week Ahead Forecast: Inflation and Bank of England Risks to Weigh

- Written by: Gary Howes

File image of Andrew Bailey, credit: Bank of England.

We forecast Pound Sterling to trade on the soft side against the Euro this week but don't see Wednesday's UK inflation report or Thursday's Bank of England decision having a lasting negative impact. Wednesday's Federal Reserve rate cut could prove supportive from a global perspective.

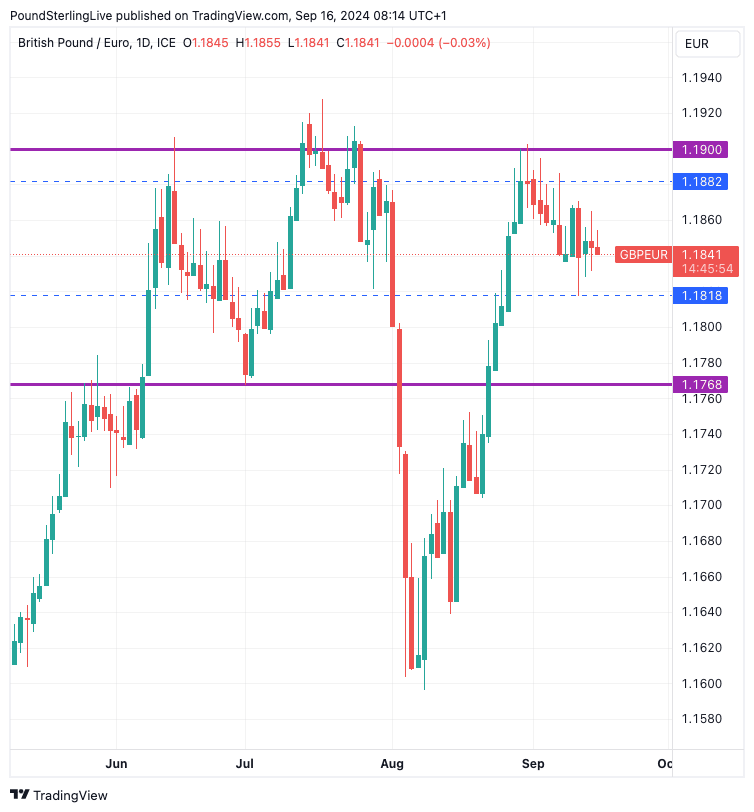

The Pound to Euro exchange rate (GBP/EUR) has been under pressure in September as it cools off from the hectic August recovery that saw it power to a high at 1.19.

It starts the new week at 1.1850, and we would not be surprised to see cautionary weakness in the coming 48 hours as investors show their nervousness ahead of Wednesday's inflation report, where a soft reading would trigger selling pressure.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

If UK inflation undershoots on Wednesday, then GBP/EUR could fall to 1.1818, which is last week's low. It is also the lower part of the exchange rate's favoured range for much of the June-September period.

Should inflation undershoot by a significant margin, then the selling pressure would be more severe, and a potential test of a more significant support area at 1.1768 becomes possible.

However, such a significant fall is not our base-case expectation, and we think weakness will be limited to approximately 1.1818. We suspect those looking to sell the Pound more aggressively will be disappointed by signs of stubborn inflation pressures, which will encourage ongoing caution from the Bank of England.

Looking at the numbers, core CPI inflation is expected by the consensus to have risen from 0.0% to 0.4% month-on-month, taking the annual rate from 3.3% to 3.5%. Headline CPI is forecast to have jumped from -0.4% m/m to 0.3%, while the annual rate is expected to have remained at 2.2.%.

Survey data continues to show a resilient economy and there are no signs of massive disinflation taking hold. The Bank of England and institutional economists think inflation will inch up over the remainder of 2024, and this week's data should confirm this.

The Bank of England will acknowledge these inflation dynamics on Thursday by keeping interest rates unchanged at 5.0% and communicating that it will continue to watch the data when deciding on future interest rate cuts.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Because there is no Monetary Policy Report or press conference this week, markets will instead keep a close eye on the minutes from the meeting and the vote composition of the Monetary Policy Committee.

"The focus could be on the voting pattern among committee members. We are bracing for either an 8-1 or 7-2 vote, with ultra-dove Swati Dhingra to potentially be joined by Dave Ramsden in opting for an immediate rate reduction," says Matthew Ryan, Head of Market Strategy at Ebury.

"A closer vote, whereby we see more of a balance between the hawks and the doves, could trigger a sell-off in sterling, as markets ramp up bets in favour of cuts at a pace more frequent than one per quarter," explains Ryan.

The base case assumption amongst economists is that the vote will land at either 8-1 or 7-2, which, if correct, will mean limited action for the Pound and would underpin our mildly bearish stance on GBP/EUR.

Last week's FX market action showed that the Pound remains highly sensitive to global risk sentiment, which could ultimately prove more important than domestic events. If we look back to the massive early August fall in GBP/EUR, we will recall that the selloff was mainly a result of the sharp slump in global stocks, highlighting the Pound's sensitivity to investor sentiment.

Wednesday is a big day in the global context, as we will see the Federal Reserve finally cut interest rates and signal there are more to come.

Our base case assumption is that markets welcome the Fed's rate cut and guidance, which can bolster market sentiment and raise stock markets, supporting Pound Sterling against the Euro and Dollar.

This is one major reason why our Week Ahead Forecast model is looking for only limited weakness in Pound-Euro in the coming five days.