Euro's Rally Against Pound Intact: Analyst

- Written by: Sam Coventry

Image © Adobe Images

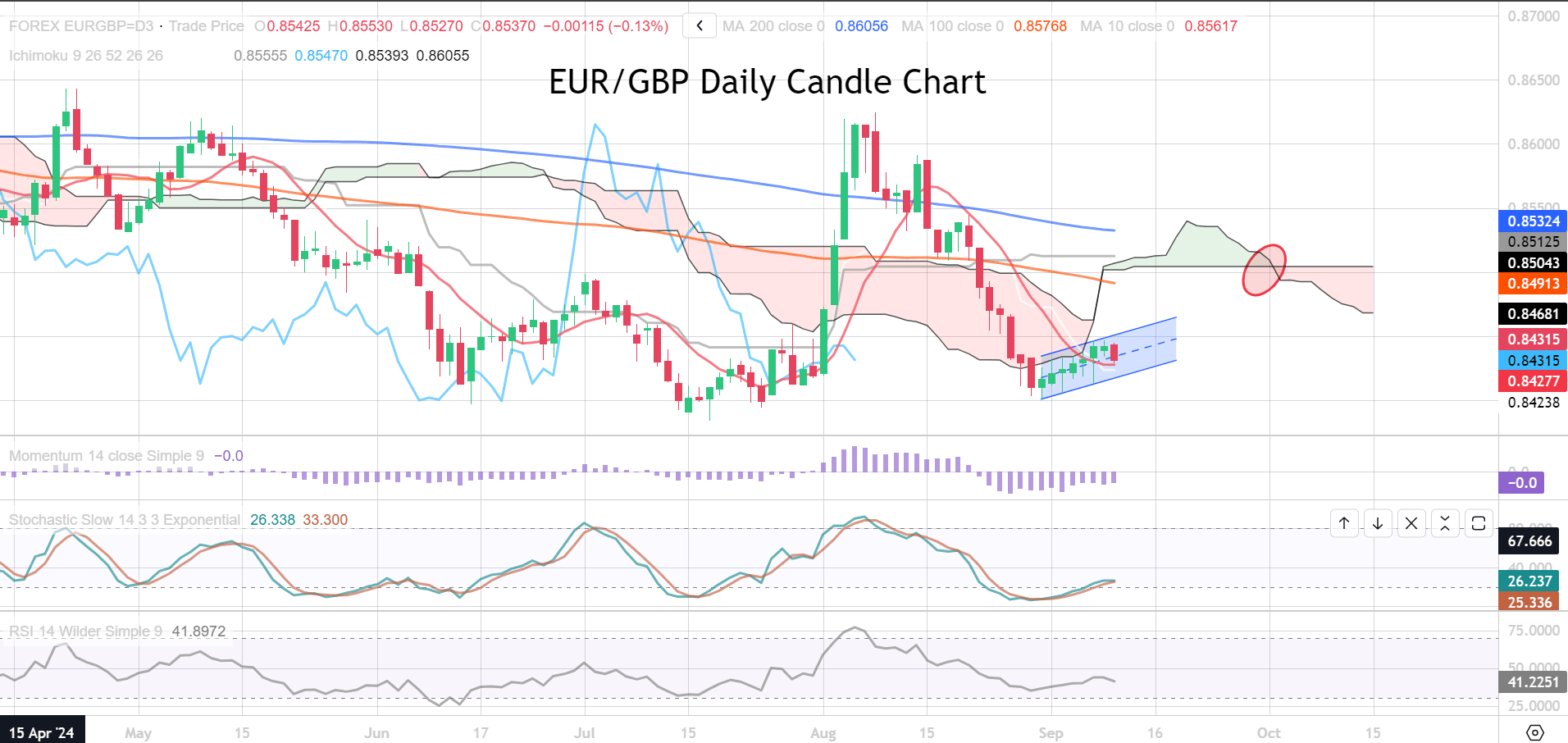

The Euro's recovery against the Pound has suffered a setback, but technical analysts we follow say it is too soon to throw in the towel.

The Euro to Pound exchange rate (EUR/GBP) has been recovering through September, but a decline following Tuesday's UK labour market report saw the pair suffer a setback.

The UK added 265K jobs in the three months to July, exceeding estimates for 123K, in what amounts to the biggest increase since May 2022. Economists say the strength of the data means the Bank of England won't be in a position to raise interest rates more than once before year-end.

Image courtesy of Reuters.

EUR/GBP fell to a low of 0.8425 as Sterling rallied in the wake of the data release, but those wanting a stronger Euro should note that technical analysts say the rally remains intact.

Peter Stoneham, a Reuters market analyst, says although studies are mixed and that upside momentum has waned, as long as the market remains above the 0.8413, Sept. 6 low, the recent rally is intact.

His studies reveal an October 01 cloud twist at 0.8504-0.8509 could also favour the EUR and tactically, "we remain long from 0.8445 with a stop close to market at 0.8410," he adds.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Kenneth Broux, an analyst at Société Générale, says although the Euro is better supported, there is little evidence that the Euro is about to enter a strong rebound against the Pound and that downside risks remain.

"The EUR/GBP decline has stalled after forming interim trough near 0.8400 recently. Daily MACD has been posting positive divergence denoting receding downward momentum, but signals of a meaningful rebound are not yet visible," he says.

For upside impetus to build, the Soc Gen analyst thinks the 50-DMA near 0.8465 must be overcome to confirm a larger bounce.

"Inability could mean risk of deeper pullback. Break below 0.8400 can result in next leg of down move towards 0.8380 and perhaps even towards next projections at 0.8350/0.8340," he adds.