GBP/EUR Week Ahead Forecast: Retreating

- Written by: Gary Howes

Image © Adobe Images

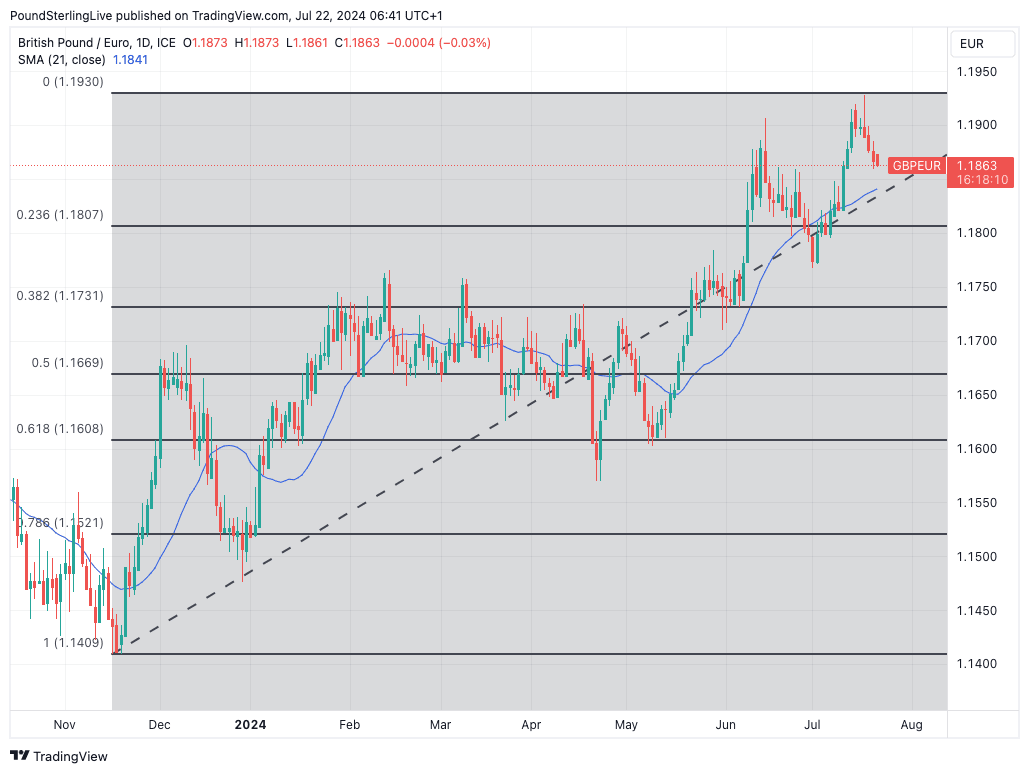

Pound Sterling has turned lower following a strong run and we forecast the pullback to extend to 1.1840 and 1.1807 in the coming days if equity markets continue to struggle. Eurozone and UK PMIs are the week's calendar focus.

The Pound to Euro exchange rate topped out at 1.1928 last Wednesday and has been under pressure ever since amidst a deterioration in global investor sentiment linked to growing fears of a China-U.S. trade war. The Pound remains sensitive to risk and is exposed to weakness when stock markets fall, as was the case last week.

Over the coming five days, the global stock market performance could ultimately decide how Pound Sterling will behave against its major peers. A major global IT failure was also behind some of Friday's selling, and there is the potential for some of those losses to be recovered this week, which can help the Pound. Also keep in mind U.S. politics will be a consideration as the Democrats look to replace President Joe Biden on November's election ticket.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

From a technical perspective, the snapback pauses Pound Sterling's stellar run against the Euro. However, the exchange rate is still 2.85% stronger over the course of 2024 and remains in an uptrend.

A retracement of the rally is therefore underway: the RSI has unwound from overbought readings at 70 and is pointed lower at 57, which hints at a near-term downside.

This week, a retreat to the 21-day moving average at 1.1840 is possible. Beyond here is the 23.6% Fibonacci retracement level at 1.1807, which is possible on a 1-2 week timeframe.

According to the median forecasts of over 30 investment banks, further declines in the exchange rate will bring it closer to both the September 2024 and year-end targets that are still below current levels in spot.

Above: GBP/EUR at daily intervals with 21 DMA and Fibonacci retracement levels. Track GBP/EUR with your custom alerts; find out more here

"Sterling is also on the back foot against the euro somewhat after stretching to near 2-year highs. GBP/EUR's grip on the €1.19 handle has loosened as it flirts precariously with its 200-month moving average, which has been a tough resistance level over the past eight years," says George Vessey, Lead FX Strategist at Convera.

Bigger picture, the Pound to Euro exchange rate remains in a longer-term uptrend, trading above its 50-, 100- and 200-day moving averages, all of which are trending higher. Weakness is expected to be limited to the aforementioned levels ahead of a resumption of the uptrend.

Turning to the economic calendar, UK and Eurozone PMIs are the only significant calendar risk for both the Euro and Pound Sterling in the coming week. They are released on Wednesday and you can see the updated consensus forecasts on our calendar. Should Eurozone data beat expectations, the Euro can recover further.

Likewise, should UK PMIs beat expectations, the Pound could recover some of its recently lost ground. However, any undershoot will take the exchange rate to the downside targets we discussed above as weak data could prompt the Bank of England to cut interest rates on August 01.

"PMIs will be in the spotlight and are expected to improve marginally. If they disappoint, the pound would be placed on the defensive," says Asmara Jamaleh, an economist at Intesa Sanpaolo.