Market Selloff Snaps GBP/EUR Rate's Winning Streak

- Written by: Gary Howes

Biden's latest moves to restrict the flow of technology to China has hit market sentiment, and with it, the Pound. Image: Official White House Photo by Adam Schultz.

A global stock market dip is weighing on the British Pound, reminding us that the stars can't always align for 2024's stellar performer.

Pound Sterling's winning streak against the Euro and Dollar has faltered amidst a selloff in global equity markets as concerns grow that a trade war between the U.S. and China is hotting up. Stock market losses ahead of the weekend deepened amidst a major global IT failure, weighing on the Pound against some of its major peers.

A problem with Crowdstrike, a piece of antivirus software used in many Microsoft systems, appears to be causing computers to crash. Television channels, airports, banks, health services and businesses around the world have been knocked offline.

"This is not a connectivity issue or a global internet outage. It seems to be directly linked to the CrowdStrike Falcon Sensor, which is expected to block cyber attacks. Stocks are still under pressure, but have clawed back some earlier losses," says Kathleen Brooks, an analyst at XTB.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Falling stock markets signal softer investor sentiment, which has, in turn, halted the Pound's recent run higher. The correlation between sentiment and the Pound reminds us that the UK currency is pro-cyclical and will tend to struggle when sentiment deteriorates.

"Returning risk aversion has put an end of the GBP’s winning streak this week," says Valentin Marinov, Head of FX Strategy at Crédit Agricole.

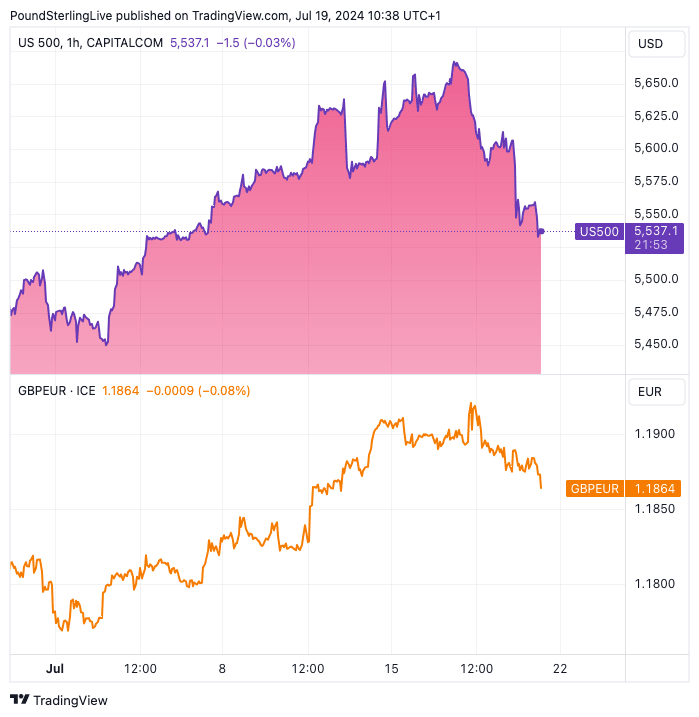

Above: A turn lower in the S&P 500 - a proxy for global sentiment - is weighing on the Pound. Track GBP/USD with your custom alerts; find out more here

The Pound to Euro exchange rate has fallen below the 1.19 marker, having peaked at 1.1928 on Wednesday.

The recent rally took the Pound to overbought conditions, signalled by the RSI, which touched 70 last Friday. Overbought conditions were noticeable across the Sterling strip, suggesting some pullback was warranted after a solid run.

We are seeing this play out at present, with a fall in the headline U.S. S&P 500 index - a proxy for global risk sentiment - coinciding with a pullback in GBP/EUR and GBP/USD. "Equity markets were mostly in the red," says Raffi Boyadjian, Lead Investment Analyst at XM.com. She explains that the developments are behind heightened fears of a fresh trade standoff between China and the U.S.

"It’s easy to interpret this panic as the market’s reaction to Trump’s increased prospects of winning the November presidential election. After all, Trump’s campaign is proposing to slap tariffs of at least 60% on all imports from China. But it is the current administration’s plan to tighten the rules for all chipmakers that use U.S. technology to sell to China that seems to have sparked this week’s rout," says Boyadjian.

The Biden administration, facing pushback to its chip crackdown on China, has told allies that it’s considering using the most severe trade restrictions available if companies such as Tokyo Electron Ltd. and ASML Holding NV continue giving the country access to advanced semiconductor technology.

For now, equity strategists look at the market pullback as potentially short-lived, with the settings that took the market to fresh all-time highs earlier in the week still in play.

"We think a transformation akin to past technological revolutions is gearing up. We keep leaning into risk and the AI theme," says Jean Boivin, Head of BlackRock Investment Institute. "Rather than waiting for clarity, we’re leaning into risk. We stay overweight U.S. equities and the artificial intelligence (AI) theme yet monitor valuations."

UK A Buy

BlackRock, the world's biggest asset manager, also had some good news for UK assets after it told clients it is now a buyer of UK stocks.

"We go overweight UK equities," says Boivin. "We see the Labour Party’s landslide UK election victory increasing the likelihood of a two-term government."

UK assets are undervalued relative to global peers, and should global investors lean into them, the Pound could find additional support.

To be sure, fundamentals are in the Pound's corner: high interest rates relative to elsewhere, political stability and a growing economy are supportive.

But, the current market dip should serve as a reminder that the stars cannot always be in alignment.