We've Turned Bullish UK Stocks Says BlackRock

- Written by: Gary Howes

-

Image © Pound Sterling Live

The world's largest asset manager turns bullish on UK stocks while continuing to "lean into" AI, saying a transformation akin to past technological revolutions is gearing up.

BlackRock, a company with US$10 trillion in assets under management - says it is "leaning into risk" assets that include UK stocks.

"We go overweight UK equities," says Jean Boivin, Head of BlackRock Investment Institute. "We see the Labour Party’s landslide UK election victory increasing the likelihood of a two-term government."

This leads BlackRock to see the potential for long-term policy implementation, which should bring relative political stability.

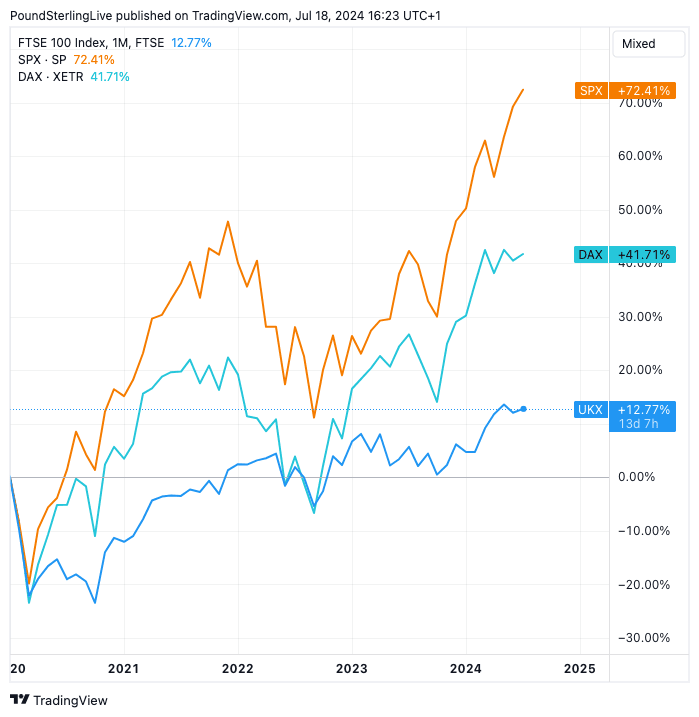

Above: Since 2020, the FTSE 100 (dark blue) has underperformed the S&P 500 (orange) and Germany's DAX.

"We think perceived stability can help improve sentiment – especially among foreign investors who own more than half of UK shares," says Boivin.

UK equity markets have underperformed their global peers over recent years, prompting some companies to shift their primary listing to New York.

A rotation into UK equities amidst improved sentiment towards the UK can ease concerns for the future outlook of the London market.

"Political stability and a growth pickup could improve investor sentiment, lifting the UK's low valuation relative to other DM stock markets," says Boivin.

The asset management house is also looking to increase exposure to the AI asset bull run, judging that the move has legs to run.

"We think a transformation akin to past technological revolutions is gearing up. We keep leaning into risk and the AI theme," says Boivin. "Rather than waiting for clarity, we’re leaning into risk. We stay overweight U.S. equities and the artificial intelligence (AI) theme yet monitor valuations."

BlackRock says the transformation "of a historic scale could be unfolding." It thinks investment opportunities transcend the unusual macro backdrop of sticky inflation, higher interest rates, slower growth and elevated debt.

"U.S. equities had a banner first half of 2024 versus other developed markets (DMs) even as markets priced out Federal Reserve rate cuts. The strength of U.S. stock gains has been matched by corporate earnings beating expectations, led by a handful of AI names," says Boivin.

As a result, BlackRock sees "concentration as a feature, not a flaw, of today’s market environment."

Some analysts think there is a risk that the ongoing equity market bull run is concentrated in a few big names. The fear is that it creates a sizeable risk to portfolios in the event one big name (think Nvidia) undergoes a setback.

"Such a high concentration implies that if NVIDIA continues to rise, then things are fine. But if it starts to decline, then the S&P 500 will be hit hard," says Torsten Slok, chief economist at Apollo.

Approximately 35% of the increase in the S&P 500’s market cap since the beginning of the year has come from one stock, NVIDIA.

However, BlackRock thinks the next six to 12 months is a time to lean into risk but says it is prepared to reassess as new opportunities arise.