NVIDIA Bubble Pop Will Take the Rest of the S&P 500 Down With It

- Written by: Gary Howes

-

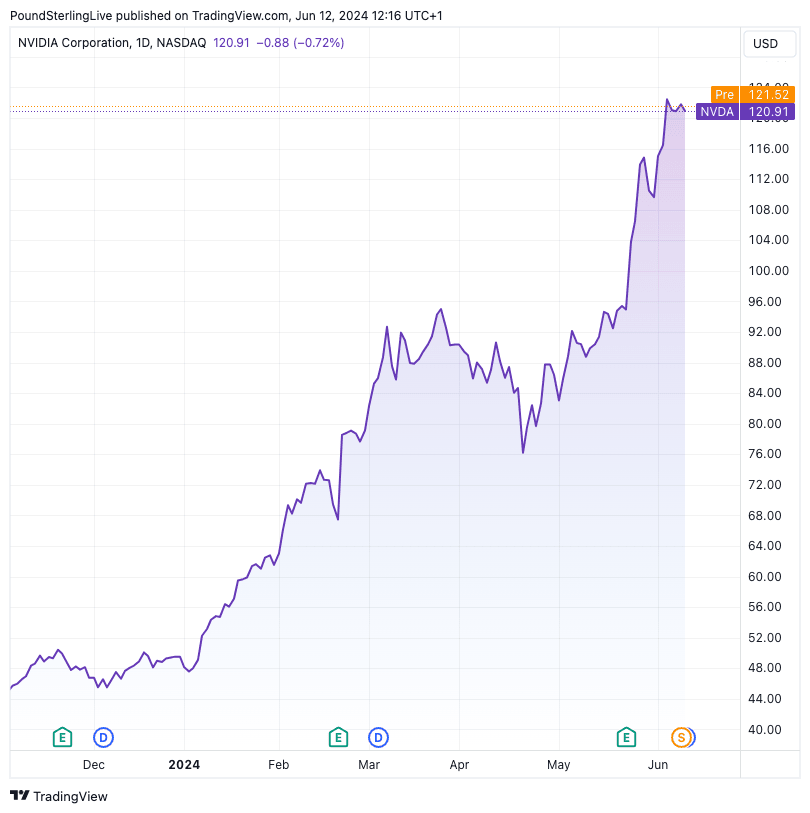

A decline in the value of the NVIDIA share price may torpedo the rest of the market, according to Apollo's Torsten Slok.

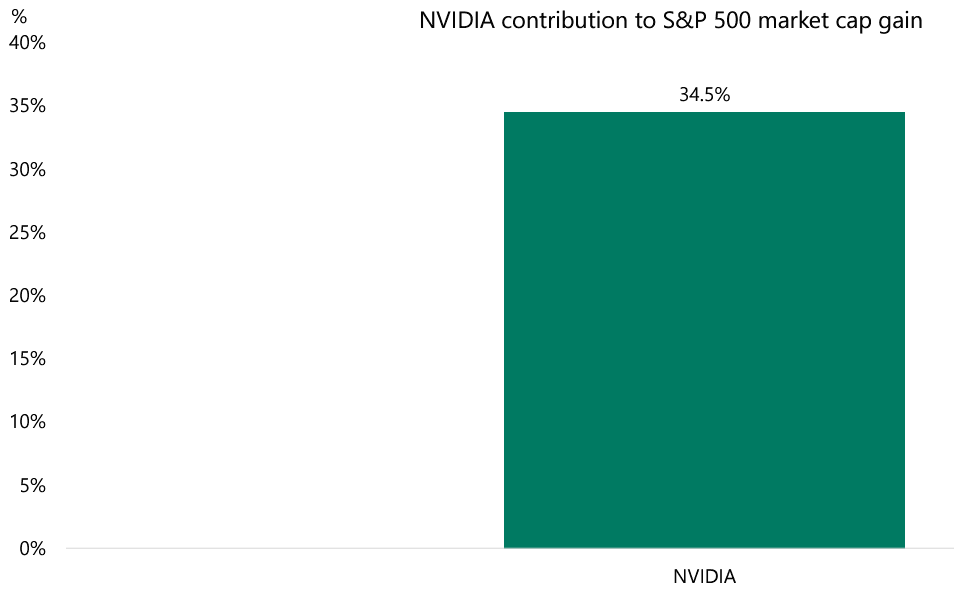

The chief economist says thirty-five per cent of the increase in the S&P 500’s market cap since the beginning of the year has come from one stock, NVIDIA.

Slock says the reliance on the broader stock market on Nvidia is reflected in the extreme concentration of returns in the S&P 500.

This makes investors more vulnerable to single headlines impacting the one stock driving index returns.

Image courtesy of Apollo.

"Such a high concentration implies that if NVIDIA continues to rise, then things are fine. But if it starts to decline, then the S&P 500 will be hit hard," says Slok.

Slok wrote recently that the NVIDIA craze is a fad that resembles a bubble, and chasing it is risky.

"There is always a new fad somewhere... for investors, it is challenging to figure out when bubbles start, when they peak, and when they end," wrote Slok, adding:

"Put differently, a bubble is a narrative. And the latest shiny narrative is AI. However, a lot of questions remain unanswered, such as how useful will AI be, how long will it last, will it significantly change our lives, are the AI companies worth buying when they have already increased 50% in 2023 and have P/E ratios around 50?"

Based on Slok's writing, the S&P 500 is being propped up by a 'bubble stock'. "The bottom line is that bubble chasing is not a good investment strategy," he warns.