Pound Finds A Floor, Bank of England's Mann Warns Market on Rate Cut Enthusiasm

- Written by: Gary Howes

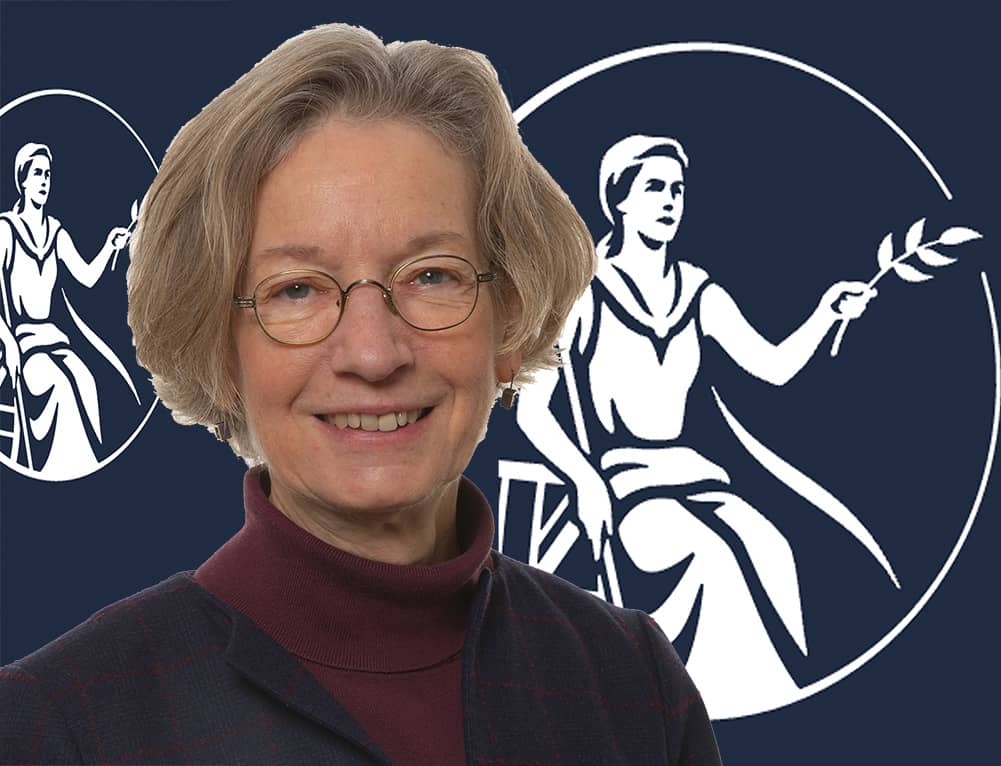

Above: Catherine L. Mann, image: Pound Sterling Live and Bank of England.

Pound Sterling has found an interim floor against the Euro and Dollar, aided by some relatively 'hawkish' commentary from Bank of England MPC member Catherine Mann.

The Pound to Euro exchange rate held its 24-hour recovery at 1.1663, and the Pound to Dollar rate rose 0.20% to 1.2660, aided partly by Mann's warning that markets are pricing in "too many rate cuts" from the Bank.

The Monetary Policy Committee (MPC) member says it is difficult to argue that the Bank will lead the Federal Reserve and European Central Bank rate cutting cycle.

The intervention comes after markets raised bets that the Bank would cut interest rates in June following last Thursday's interest rate decision, having favoured an August start date ahead of the decision.

Some economists even say the Bank could even cut interest rates in May, meaning it would precede the Federal Reserve and European Central Bank, creating a policy divergence that would weigh on the Pound against the Dollar and Euro.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

But Mann appears concerned the market is getting ahead of itself, judging that such expectations could stimulate inflationary pressures.

She says that "in some ways", the Bank does not have to cut because the market already is.

(When market expectations for cuts grow, interest rate swaps on money markets fall. These swaps price a host of financial lending products, such as loans and mortgages. Therefore, falling Bank Rate expectations actually lower real-world lending conditions.)

Given easing monetary conditions, Mann warns markets are "perhaps a bit too complacent" about how long the Bank will hold rates.

She explains that wage dynamics in the UK are stronger than in the U.S. and Euro area and it is therefore hard to argue that the Bank would be ahead of the ECB and the Fed when it comes to cutting rates.

This would imply Mann is of the view that August would be the optimal moment to cut rates, owing to current market pricing, which has the ECB cutting in June and the Fed in June/July.

Mann had voted for another 25 basis point rate hike in February but switched her vote to a hold in March.

Markets interpreted this as a clear indication the Bank was closer to cutting interest rates, prompting UK bond yields and the Pound to fall.

Mann's intervention could help put a floor underneath these moves.

Nevertheless, Mann notes further rate hikes won't be necessary as discretionary services inflation has started to soften "in the last couple of months".

Firms are increasingly cutting hours in the labour market, and National insurance rate cuts will add more workers to the labour market, which will affect wage dynamics soon, she says.