Pound Sterling On Softer Footing Against Euro & Dollar As June Rate Cut Odds Hit 80%

- Written by: Gary Howes

Image © Adobe Images

The British Pound's status as 2024's top-performing currency has been put on notice as the odds of a June interest rate cut have risen, but losses are likely to be limited says Nomura.

Following the Bank of England's latest guidance, markets now see an 80% chance June is the start date, with a cut by August now fully priced.

"We maintain our call that the first rate cut will come in June, with two further 25bps cuts lowering Bank Rate to 4.5% at the end of this year," says Andrew Goodwin, Chief UK Economist at Oxford Economics. "The inflation trajectory now looks well set and the need to maintain a very tight policy stance to guard against second-round effects looks less convincing."

The Pound to Euro exchange rate dropped 0.44%, its biggest daily drop since December, after two members of the Bank's Monetary Policy Committee (MPC) dropped their votes for additional hikes and joined the majority in opting to hold interest rates.

The Bank also said there was space to cut rates without risking stimulating inflation, a sign that rate cuts can begin before the 2.0% target is reached sustainably. "We agree the probability of a June move increased... so we stick with our call for a first cut in June, followed by September and December," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The Pound to Dollar exchange rate fell 1.44% in the 24 hours following the decision, the scale of the move being testament to suspicions the Federal Reserve will opt to cut rates after the Bank of England, which would offer USD further interest rate carry support.

"The BoE has set the groundwork that it's ready to cut its policy rate, if necessary, and with how the market is positioned, we believe the downside risk to GBP in the near-term is growing," says George Buckley, an economist at Nomura.

"We think the balance of risks is tilted to the Bank moving more quickly than we think (i.e. June rather than August)," he adds.

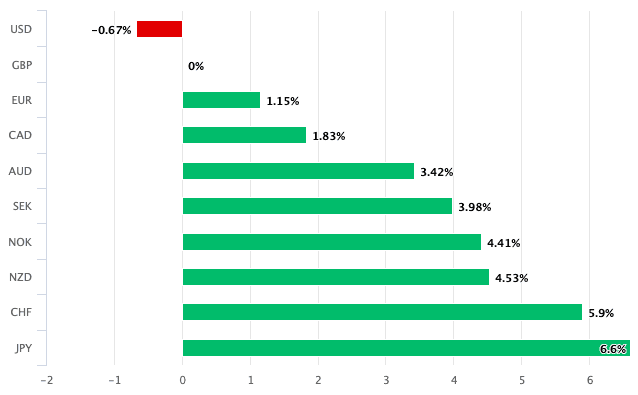

Above: GBP performance in 2024.

The Pound was 2024's best-performing G10 currency heading into last Thursday's decision thanks to expectations that the Bank would be one of the last of the major central banks to cut interest rates owing to expectations that core inflation in the UK would be slower to return back to the 2.0% target than elsewhere.

But, there are signs that inflationary pressures are well on course to hit target, with April likely to see inflation hit the 2.0% target. Wage price pressures - a key determinant of domestic inflation - have also retreated notably, and economists say they can fall further.

"GBP has performed quite well YTD because of first-tier UK data showing resilience and the market’s view that the BoE’s rate cut will likely be later than that of the Fed and ECB. However, (Thursday's) statement may see the market re-think the timing of the BoE’s first cut, which will likely weigh on GBP in the near-term," says Buckley.

Track GBP/AUD with your own custom rate alerts. Set Up Here

However, Nomura strategists say weakness in Pound Sterling would likely be limited, and it is unlikely to enter a downtrend.

"For GBP to enter a softening trend, we would need more evidence that the UK economy is weakening, but we haven’t had strong proof of that," says Buckley.

Downside potential against the Euro is particularly limited as the Bank and European Central Bank are likely to cut simultaneously and embark on a synchronised cutting cycle.

This would only entrench the recent low-volatility range seen in GBP/EUR.

There are no calendar risks for the Euro and Pound this week, but next week's Eurozone inflation figures bear watching. Should inflation undershoot, we are confident that the GBP/EUR can return towards the upper end of the 2024 range.