GBP/EUR 5-Day Forecast: Vulnerable To Breakdown at 1.15

- Written by: Gary Howes

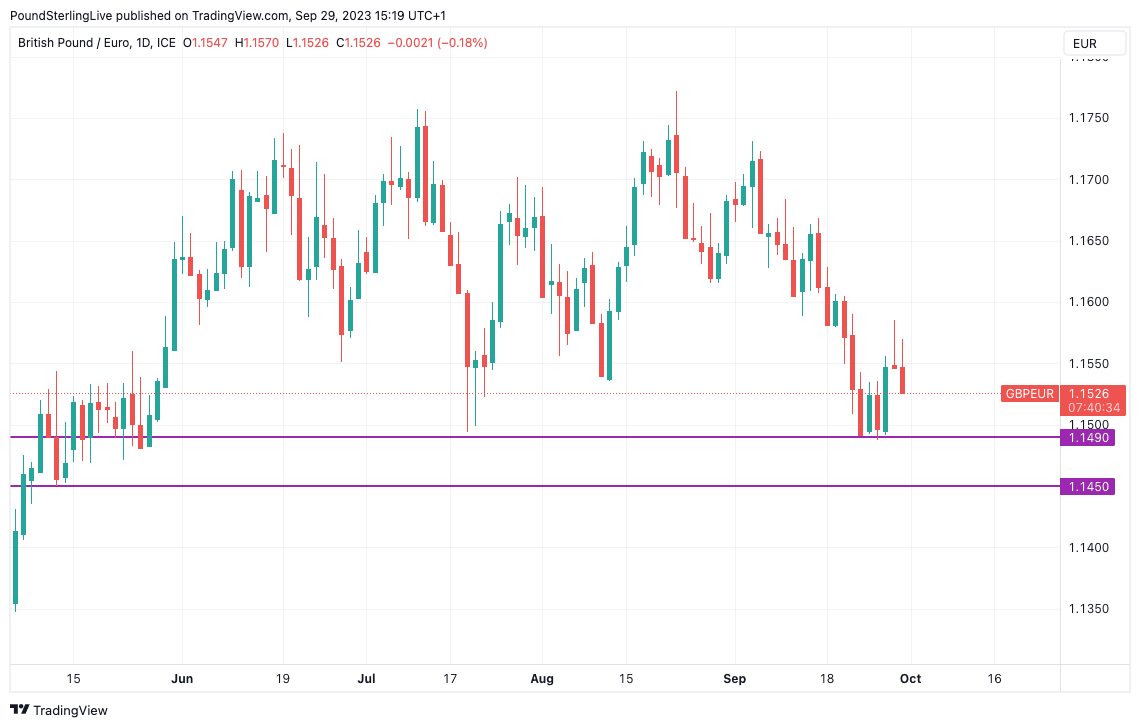

- GBPEUR eyes retest of 1.15 support

- For now, this level is expected to hold

- As Eurozone and UK fundamentals aligned

- But big investment banks are betting on GBP weakness

Image © Adobe Images

Pound Sterling is set to remain vulnerable against the Euro over the coming days and a test of the solid support zone at 1.15 could well come into play in a week devoid of data and events on the calendar for either the Eurozone or UK.

The Pound to Euro exchange rate last week managed to keep its head above the 1.15 waterline for four consecutive days, proving it to be solid support, and ultimately bouncing clear to hit a high of 1.1547.

But gains weren't able to stick in the 1.1550 area and the softness of Thursday and Friday reaffirms Sterling will likely remain under pressure:

Above: The daily chart confirms all eyes are on the downside and whether a key level of support can hold.

There is a chance that the Pound-Euro is going to stick to its broad sideways-orientated summer range as we move into the new month and quarter, but we would have been more confident about this had the recent rebound extended into the middle of the range.

From a fundamental perspective, the state of the Eurozone and UK economies - and the fact that both central banks look to have ended their hiking cycles - suggests neither the Euro nor Pound should hold an advantage over the other.

As such, the fundamental case for the sideways range to hold looks solid and suggests that 1.15 support can hold.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Yet, analysts at a number of investment banks are backing an eventual breakdown in Pound-Euro following the Bank of England's decision to pause hiking rates on September 21.

Morgan Stanley's FX strategy team is 'long' on the Euro against the Pound and is ultimately looking for the pair to break above its summer range as the Euro outperforms its British peer into year-end.

"One of the most boring things to watch, though, has been EUR/GBP," says analyst Matthew Hornbach at Morgan Stanley. "What could shake EUR/GBP out of its slumber? We think that the 'spring' of volatility could be decompressed by a drop in UK rates, bolstering both the pair and volatility."

"This suggests an opportunity for EUR/GBP to begin rising – and rising quickly – and this convexity would benefit both long spot positions and vol positions," he adds.

Analysts at JP Morgan maintain the Pound can fall against the Euro and Dollar in the coming weeks, even if consolidation in GBP exchange rates looks to be the theme as we step into October.

"The Bank of England left rates unchanged which is a clear negative for Sterling given the sell-side consensus for a hike," says analyst James Nelligan at JP Morgan in a recent briefing to clients.

Goldman Sachs last week slashed its forecasts for the Pound, with the FX research team saying they have "officially shifted back to Sterling bears".

The call is a notable one given Goldman has been on the right side of the Pound's rally over the course of the past year but their view has shifted in the wake of the Bank of England's decision to pause its interest rate hiking cycle on September 21.

The new forecast levels are notable as they are consistent with values reached in previous UK-centric crises - such as the Liz Truss minibudget, but Goldman Sachs researchers indicate the crux of their downgrade is the Bank of England's 'dovish' tendencies.

"After being the top performing G10 currency year-to-date at the start of summer, Sterling unwound most of its gains by the end of it. The weaker cyclical outlook in Europe and, moreover, the BoE's dovish reaction function have outweighed the benefits from lower energy prices (relative to last year) and broadly constructive risk sentiment," says a note from Goldman Sachs.

Goldman Sachs raised its forecast for the Euro to Pound exchange rate at 0.91, 0.92, 0.90 over a 3, 6, and 12-month timeframe, up from 0.86, 0.85, 0.84 previously.

This gives a Pound to Euro profile of 1.0990, 1.0870 and 1.11 from 1.1630, 1.1765 and 1.19.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes