GBP/EUR Forecast Lifted at Goldman Sachs

- Written by: Gary Howes

Image © Pound Sterling Live.

Goldman Sachs raises its Pound to Euro exchange rate forecast saying the UK currency's recent strength "has staying power".

In a research briefing released July 11 Goldman Sachs analysts Isabella Rosenbard and Michael Cahill say investors are responding to the Bank of England's new concerted approach to fighting inflation sensing that it has rebuilt credibility amongst investors.

"The data have argued for a strong response to tight labour markets and evidence of a slower policy pass-through, as well as more persistent inflation. So far, the BoE has responded," says Rosenbard and Cahill.

The Bank of England proved a 'reluctant hiker' through 2022, cautioning at various points that it would not need to raise interest rates as high as front-running markets were expecting. This meant the Bank was perceived as always being in a position of playing catch-up with markets and not doing what was required to get on top of inflation.

This policy stance coincided with Pound Sterling underperformance in 2022, but fast-forward to 2023 and "despite all the hand-wringing, Sterling is the best-performing currency in the G10 this year," say the Goldman Sachs authors.

"We think the shift in FX positioning after the 50bp hike demonstrates that markets were reassured by the BoE's swift action, and changes in market pricing over the last few months are consistent with this as well," says Rosenbard and Cahill.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

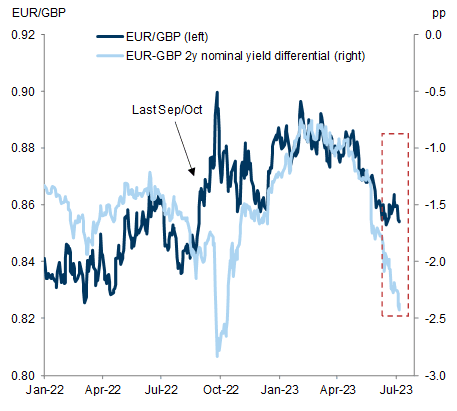

The authors acknowledge "there are still some credibility concerns" owing to the Pound's sharp decline in September 2022 when bond markets collapsed following the ill-fated 'mini budget' of Prime Minister Liz Truss.

"While some 'sentiment scars' remain, we think things are in a different place than they were last year," says Rosenbard and Cahill.

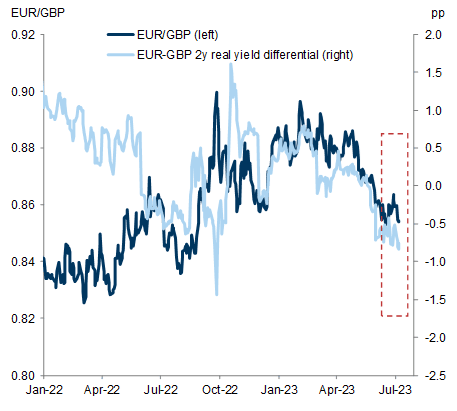

What will be important to Sterling-Euro going forward is the differential in 'real yields' between the Eurozone and UK; Goldman Sachs strategists note that although UK nominal yields have surged higher in relation to those of the Eurozone, real yields are still relatively flat owing to the UK's high inflation rates.

"EUR/GBP has traded in line with real rates, rather than nominal rates where inflation pricing has driven the move" - Goldman Sachs.

Should inflation come down over the coming weeks then real yields can potentially find some upside traction.

Goldman Sachs economists now anticipate the Bank of England to raise interest rates to 6.0% from the current 5.0% and anticipate the Pound to remain supported as a result.

"We think the factors contributing to Sterling strength look durable," says Rosenbard and Cahill.

As a result, Goldman Sachs lowers its Euro-Pound Sterling forecast profile from 0.86, 0.87 and 0.87 over 3, 6 and 12 months to 0.85, 0.84 and 0.84.

This gives a Pound-Euro forecast profile of 1.1627, 1.19 and 1.19.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes