UK Jobs Report: Pound Sterling Rises Against Euro, Hits New 2023 Best Against Dollar

- Written by: Gary Howes

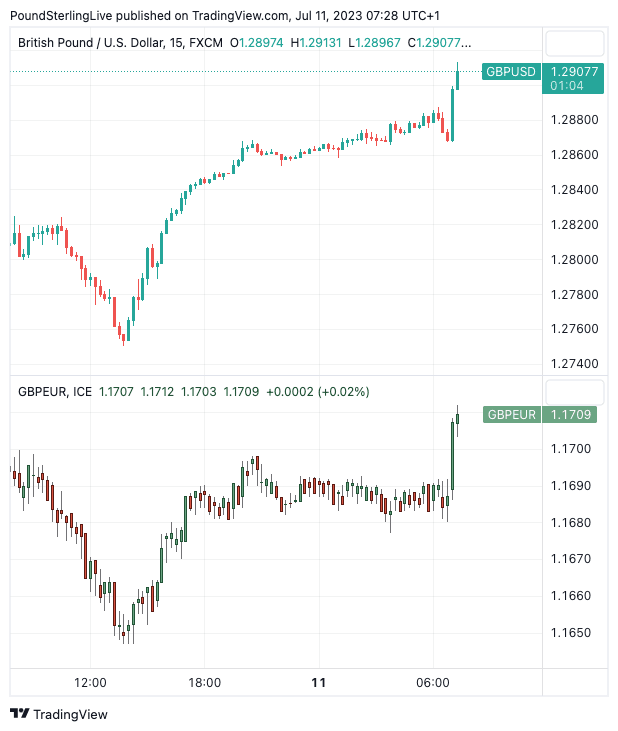

Pound to Euro rate rises to 1.17 in the immediate aftermath of the UK labour market release while the Pound to Dollar exchange rate goes to a new 2023 best at 1.2899.

Image: Dave Collier, sourced: Flickr, licensing: CC 2.0.

The British Pound rallied to hit a new 2023 high against the Dollar and went back above €1.17 against the Euro after the release of data that suggests wages in the UK are close to peaking.

The ONS reported wage figures that were above expectation, but a rise in the unemployment rate and an increase in the claimant count suggest the labour market is finally starting to 'ease' suggesting the Bank of England won't have to pursue an economy-busting interest rate hiking cycle over the coming months.

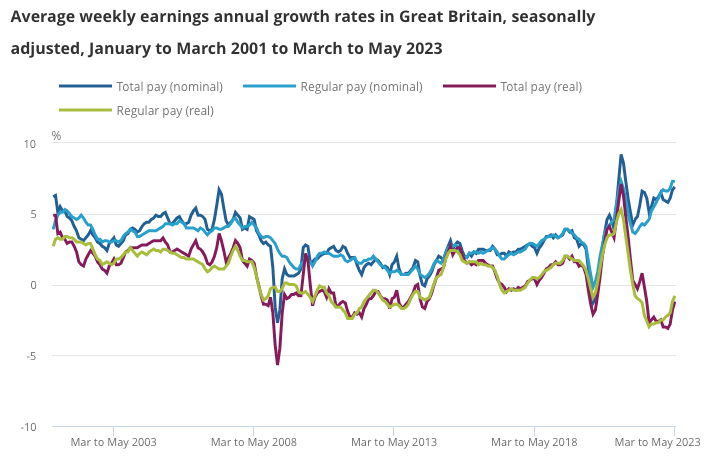

The Bank of England is particularly interested in labour and wage data as they are a key driver of domestic inflationary pressures and remain consistent with the need to hike further: the average earnings index, excluding bonuses, rose 7.3% in May, above the consensus expectation of 7.1%, and in line with April's 7.3%.

The average earnings index with bonuses included rose 6.9% in May, a touch higher than expectations at 6.8% and higher than April's 6.7%. Both data would suggest the UK continues to see wage settlements come in at very high levels that would be consistent with elevated domestic inflationary pressures.

Image: ONS.

But there are signs that wage pressures, a lagging indicator, will come down as employment growth slows and 'slack' starts to build. The ONS said the UK's unemployment rate rose to 4.0% in May, a surprising jump on April's 3.8% and the market expectation of 3.8%.

The more timely claimant count showed those seeking out-of-work benefits rose 25.7K in June, ahead of the -8.6K expected and the -22.5K reported in May.

But employment still rose 102K in the three months to May, which represents an undershoot of the market's expected 125K and the 250K reported in April. Rising employment AND a rising unemployment rate signal increased economic participation by formerly inactive individuals with the ONS confirming the economic inactivity rate decreasing by 0.4 percentage points on the quarter, to 20.8% in March to May 2023.

The increased supply of workers can boost business output while also dampening wage pressures as the number of available applicants per vacancy increases.

So while inflationary pressures are still evident in the wage data, the market is almost certainly turning, which should ease pressure on the Bank of England to raise interest rates as high as the market is currently expecting (in excess of 6.0%) which would ultimately lower the odds of the UK economy being driven into a recession.

The Pound's initial reaction was to rise, in a potential sign that perhaps lower Bank of England rate hike expectations are supportive in so far as this lessens the chance of a sharp economic slump down the line.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The high-yielding pound is now 6.6% stronger year-to-date against the softening US dollar, with all eyes on whether $1.30 can be reclaimed. GBP/EUR is toying with the €1.17 handle, with upside restricted by the uplift seen in EUR/USD over the past 24 hours too," says George Vessey, FX and Macro Strategist at Convera.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, says the UK labour market is no longer tight and that we should expect wage growth to slow sharply in 2024.

"Signs that the labour market is loosening quickly bolster the case for the MPC to stop its rate hiking cycle soon," he says.

Above: GBPUSD (top) and GBPEUR at 15-minute intervals showing the initial reaction to the jobs report.

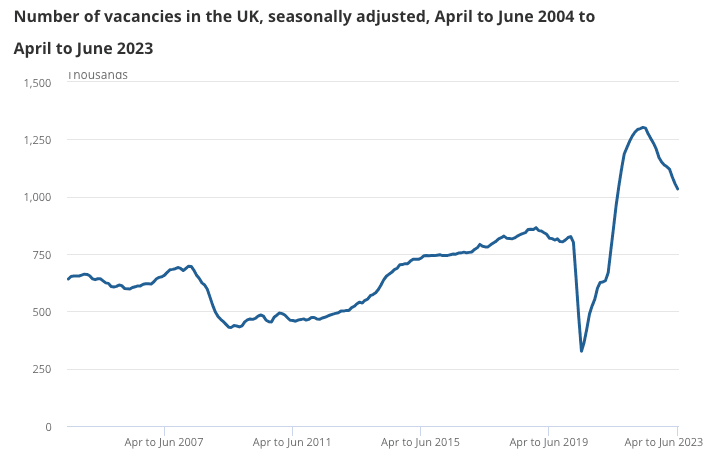

An easing in the UK labour market was confirmed by a more timely survey released yesterday from KPMG and the Recruitment and Employment Confederation (REC), which revealed the number of vacancies in June climbed at the slowest pace in 28 months, with a significant drop in permanent placements.

According to the REC's Report on Jobs, staff availability rose for the fourth month in a row, with the supply of both temporary and full-time workers surging at the fastest pace recorded since December 2020.

Recruiters said companies became reluctant to take on new staff in June owing to the darkening UK economic outlook, particularly as the rising cost of living and competition for skilled workers have pushed up wages.

Upwards pay pressure slumped to its lowest level in 26 months, with rates of starting salary and temporary wage inflation falling to more than a two-year low.

Vacancies meanwhile continue their decline for the 12th consecutive month as the estimated number of vacancies fell by 85K on the quarter to 1,034,000, although this is still well above pre-pandemic levels.

Image source: ONS.

Tombs explains the vacancies-to-unemployment ratio—commonly referenced by the MPC as the best indicator of labour market tightness—declined to 0.77 in May, from 0.83 in April, and a peak of 1.05 in August 2022. It will reach 2019’s average level by November, if the rate of decline since its peak is maintained.

"Single-month data are volatile, but the data chime with surveys which suggest that businesses now are finding easier to recruit than on average in the second half of the 2010s," says Tombs.

Pantheon Macroeconomics looks for two more rate hikes of 25 basis points, on account of rising wages, which is far less than the market is looking for (+100bp).

Should this call be correct and the market is forced to recalibrate expectations, then the Pound can fall.

However, it must be noted too that the Pound has proven relatively unresponsive to rocketing rate hike expectations, suggesting there is a chance it could also rally on falling rate hike expectations.

After all, this would lower the prospect of a deep recession further out.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes