Pound Sterling Rally to be Challenged by Looming Job and Wage Report

- Written by: Gary Howes

Image © Adobe Images

The British Pound remains 2023's top-performing currency but the first major test of July comes into view in the form of Tuesday's UK labour market release.

The figures are likely to confirm the UK's labour market remains 'tight' as job creation continues amidst low unemployment rates, in turn ensuring wage growth remains well above the Bank of England's 2.0% inflation target.

Indeed, the data comes as markets are prepared for the Bank of England to raise interest rates a further 150 basis points in its fight against inflation, an expectation that has ensured the Pound remains well supported.

"The MPC will be under pressure to keep hiking until it sees clear evidence that wage growth is beginning to cool. If the MPC doesn't push back against these pressures forcefully enough, the risk they persist will increase," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

The consensus expectation is for employment to have increased 158K in the three months to May, keeping the unemployment rate at 3.8%. The average earnings index (with bonuses) is expected to have risen 6.8% in May, up from 6.5% previously. Average earnings with bonuses included are expected to have risen 7.1% in May, down on 7.2% previously.

Should any of the figures beat expectations, UK bond yields will likely extend their relentless march higher, reflecting the market's expectation for further Bank of England rate hikes, which can support the Pound.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, the immediate impact on the Pound is hard to ascertain as it has proven relatively sanguine to UK data beats of late.

This could reflect market fears that ever-higher interest rates will ultimately result in a deep UK recession, which will prompt the Bank to cut rates faster and deeper than elsewhere further down the line.

Yet for now, the rule of thumb should be that stronger-than-expected data can prove supportive of Pound Sterling which is caught in a technical trend higher against a host of major currencies.

"Two higher than expected inflation reports and stronger wage growth that compelled the BoE to hike by a larger 50bps in June has resulted in the 2yr Gilt yield surging a huge 150bps in the last two months. It helps explain why the GBP was the top-performing G10 currency in the first half of the year," says Derek Halpenny, an analyst at MUFG Bank Ltd.

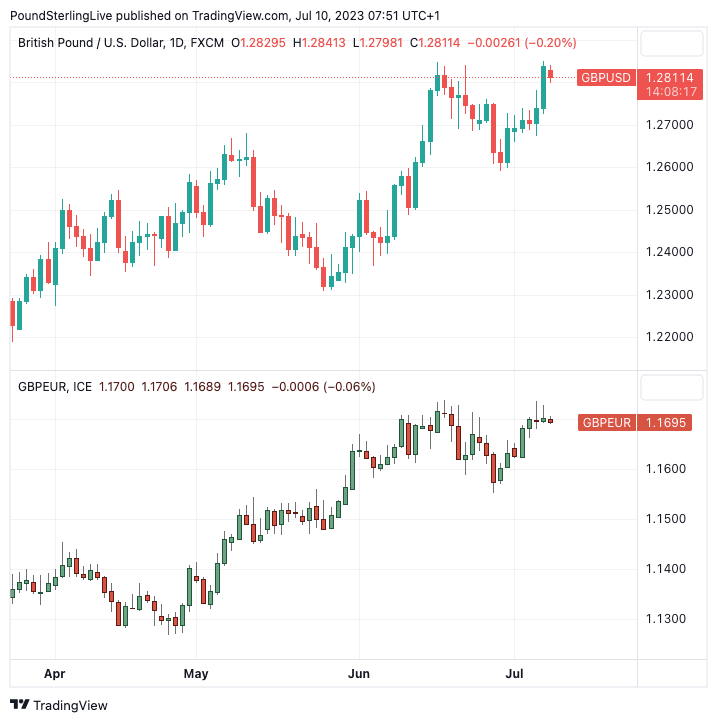

Above: GBPUSD (top) and GBPEUR. Sterling remains in an uptrend against its major peers.

The Pound to Euro exchange rate last week tested highs near 1.1735 before retracing back to just below 1.17 by the time of writing at the start of the new week.

The Pound to Dollar exchange rate rose to a high of 1.2850 on the back of an undershoot in U.S. jobs data, but a break to fresh 2023 highs could be in prospect on a firm UK jobs reading.

Ahead of the jobs report a survey of the labour market suggests slack is indeed starting to open up, which hints at future jobs reports coming in softer.

According to the KPMG and the Recruitment and Employment Confederation (REC) UK Report on Jobs survey, the number of vacancies in June climbed at the slowest pace in 28 months, with a significant drop in permanent placements.

Staff availability rose for the fourth month in a row, with the supply of both temporary and full-time workers surging at the fastest pace recorded since December 2020.

Recruiters said companies became reluctant to take on new staff in June owing to the darkening UK economic outlook, particularly as the rising cost of living and competition for skilled workers have pushed up wages.

Upwards pay pressure slumped to its lowest level in 26 months, with rates of starting salary and temp wage inflation falling to more than a two-year low.

Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, looks for Tuesday's official labour market report to show that growth in both employment and wages has lost momentum.

"While the slowdown won’t be severe enough to stop the MPC in its tracks, it should lay the foundations for the Committee to end its rate hiking cycle in November, by which time more evidence that labour market slack is accumulating will have emerged," he explains.

If this prediction is correct, and the market reduces rate hike expectations, Pound Sterling could retreat.

"We doubt the GBP will maintain this top performing ranking going forward. For now the focus has been on yield but the focus is likely to switch to growth now that the yield curve looks rich relative to our expectations," says MUFG's Halpenny.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes