Pound / Euro Rebounds, Can Go Higher from here says Analyst

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling will renew its strength over coming months and advance against the Euro, although the end of 2022 and the duration of 2023 will see Europe's single-currency claw back value.

This is according to analysis from Nordea Markets, the global financial services and investment banking arm of the largest Nordic lender, Nordea Bank.

In a new research note to clients analysts present updated forecasts showing they expect the Pound-Euro exchange rate could go as high as 1.25.

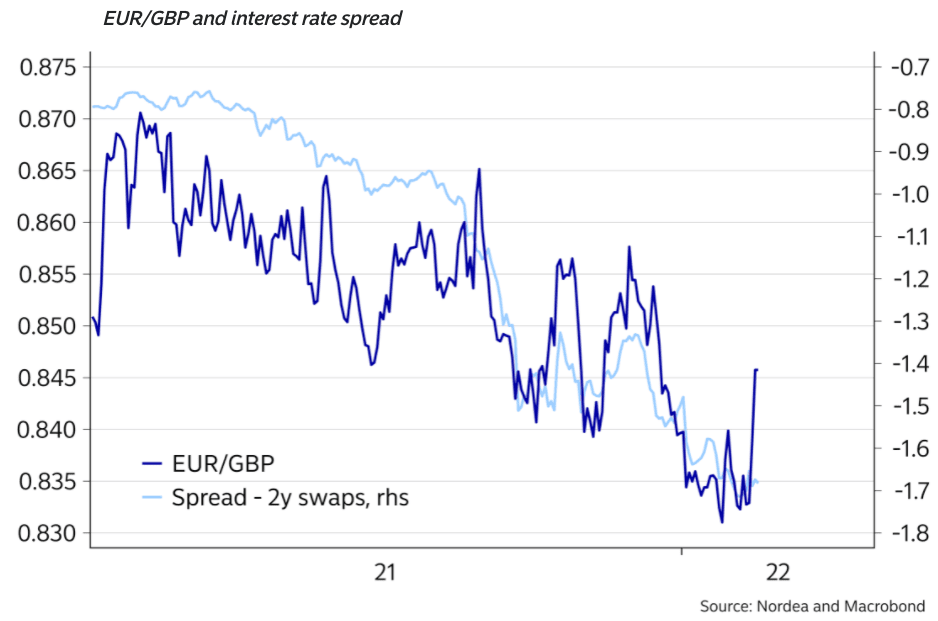

Having assessed the momentous central bank policy decisions from the European Central Bank (ECB) and Bank of England announced on February 03, Nordea still expects the UK to see "much tighter" financial conditions when compared to the Eurozone.

Accordingly, this could aid upside in the Pound to Euro exchange rate over coming months.

Sterling was one of the strongest performing major currencies in the run up to the Bank of England's February 03 policy decision as investors positioned for another 25 basis point hike.

On delivery of the hike the exchange rate surged to its highest level in two years at 1.2069, only for gains to be undermined by developments in Frankfurt.

The ECB dropped a hint that it could now consider raising interest rates in 2022, a position it had fiercely rejected in previous meetings.

But in a subsequent appearance before EU lawmakers ECB President Christine Lagarde sought to calm market expectations for Eurozone rate hikes - indeed markets were seeing as many as 50 basis points of hikes coming from the ECB in 2022 - a move that seemed to have succeeded as the Euro and rates have since eased from recent highs.

Where the Pound-Euro exchange rate goes from here will depend to where the market sees relative monetary policy expectations gravitate from here:

- Reference rates at publication:

GBP to EUR: 1.1870 - High street bank rates (indicative): 1.1550 - 1.1632

- Payment specialist rates (indicative: 1.1757 - 1.1805

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

Nordea still thinks the UK will see more hikes, delivered sooner, than the Eurozone, which should maintain a trend in bond yields that favour the Pound (as noted above).

"The message from the BoE’s Andrew Bailey was clear. There are more rate hikes to come and the BoE is not behind the curve," says Jan von Gerich, Chief Analyst at Nordea Markets.

von Gerich says the UK labour market "is extremely tight and wage pressures are mounting".

Furthermore, inflation numbers will continue to move higher in the months to come which will force the Bank of England to continue tightening monetary policy.

Money market pricing suggests there are over 100 basis points of rate hikes to come between now and next March, while some economists even see the final 'terminal' UK interest rate ending at 2.0%.

This would be significantly higher than the comparable terminal rate in the Eurozone.

Furthermore, once Bank Rate reaches 1.0% the Bank of England is expected to begin selling off the bonds it has acquired under its quantitative easing programme, further tightening financial conditions.

"Hence, much tighter financial conditions ahead in the UK," says von Gerich.

"We call for renewed sterling strength in the months to come, while euro strength will turn the tide for EUR/GBP towards the end of the year and next year," he adds.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Money markets are meanwhile calling for just 50 basis points of hikes to be delivered by the ECB in 2022, although this still represents a significant uplift in expectations.

This time one year ago there were no hikes priced into the year-ahead period.

Nevertheless, Nordea join other analysts in saying the delivery of 50 basis points by December is a stretch, and market expectations will be disappointed.

"We still think that the market pricing of more than 50bp of higher overnight rates, ie around two 25bp rate hikes, until the end of the year looks excessive," say von Gerich.

"We are therefore not ready to call a decisive move higher of the euro from here," he adds.

Nordea forecasts the Euro-Pound exchange rate at 0.82 by mid-2022 (1.2195 Pound-Euro) and 0.80 by year-end (1.25). But by the end of 2023 the Euro-Pound is seen back down at 0.83 as the Euro begins to appreciate (Pound-Euro at 1.2050).