Pound to Dollar Exchange Rate's Rally "Fully Justified"

- Written by: Gary Howes

Image © Adobe Images

Analysts are tipping Pound Sterling to extend its run of outperformance after the Bank of England signalled it would maintain a restrained approach to interest rate cuts.

The Pound to Dollar exchange rate registered a new high at 1.3340 on Friday, its highest level since 2022, bolstered by a strong UK retail sales report for August and ongoing tailwinds from Thursday's Bank of England decision.

"GBP continued to benefit from diverging rate policies with GBPUSD hitting its highest levels since March 2022," says Thanim Islam, Head of FX Analysis at Equals Money.

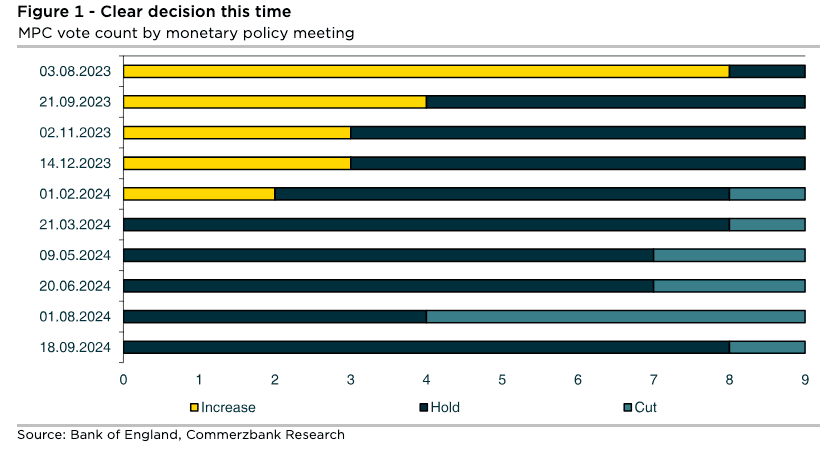

The Bank voted unanimously to maintain Bank Rate at 5.0% and said "in the absence of material developments, a gradual approach to removing policy restraint remains appropriate," said the minutes to the meeting.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"Sterling's rally on yesterday's Bank of England communication looks fully justified," says Chris Turner, a foreign exchange analyst at ING Bank. "The BoE does genuinely seem to be questioning whether inflation will come down as much as elsewhere in the world and continues to present three scenarios."

Sealing the Bank's caution was Wednesday's release of inflation data for August, that showed headline, core and services inflation all increased since July. In fact, the Bank's own forecasts show inflation will continue to steadily rise through the remainder of 2024.

"Governor Andrew Bailey has a broad majority in favour of his monetary policy, and we expect three more rate cuts, one per quarter, which should bring the key rate down to 4.25% by the middle of next year," says Volkmar Baur, FX Strategist at Commerzbank.

"This means that in the upcoming meetings, the Bank of England will continue to take a pause in the cutting cycle from time to time. This cautious approach, which is also appropriate given the stubbornness of inflation, should support sterling and allow GBP-USD to rise slightly," says Baur.

Cutting interest rates again will require the backup of a new set of financial forecasts that show inflation should fall over a medium-term timeframe. This we will receive at the November policy meeting, and market pricing shows investors are poised for the next 25 basis point cut at this event.

ING's Turner says the Bank "certainly does not seem to be in the Fed camp of signalling the 'all-clear' on inflation... Sterling can continue to do well. Thus it's hard to rule out GBP/USD making a push to the 1.35 area."

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

George Vessey, Lead FX Strategist at Convera, says GBP/USD will continue to head higher in the coming months, "helped by narrowing nominal and real interest-rate differentials working in its favour."

With UK events out of the way, Pound Sterling is free to consider global matters in the coming weeks. Here, Pound-Dollar is highly sensitive to international investor sentiment, tracking the rises and falls of stock markets.

If markets can continue to grind out gains, now that the tailwinds of Federal Reserve rate cuts are blowing, further upside is possible.

But any setbacks to global sentiment can frustrate the Pound and deal it regular, albeit shallow, setbacks.

"U.S. stocks surged higher yesterday with the S&P500 rising 1.7% to reach a new record high whilst the Nasdaq jumped 2.4%, as market participants continue to digest the latest Federal Reserve decision. The Fed delivered a jumbo 50bps rate cut, the first decrease in borrowing costs in four years, and signalled further reductions ahead for this year and next," says George Vessey, Lead FX Strategist at Convera.