Pound-Yen Surges After Bank of Japan Softens Message on Rate Hikes

- Written by: Sam Coventry

Image © Leonid Andronov, Adobe Stock

The Japanese Yen is in the red after the Bank of Japan (BoJ) appeared to waver on its commitment to raise interest rates further.

The BoJ left its policy interest rate unchanged at 0.25%, and guidance showed an optimistic outlook for the economy and a commitment to deliver further interest rate hikes.

However, "what is striking is the lack of explicit forward guidance in today's statement. In July, it was stated that the BoJ would continue to raise interest rates if inflation evolved as expected. While the statement can still be read that way, it is no longer explicitly stated," says Volkmar Baur, FX Analyst at Commerzbank.

"This confirms our view that the situation in Japan is not quite as clear-cut as the Bank of Japan would sometimes like us to believe," he adds.

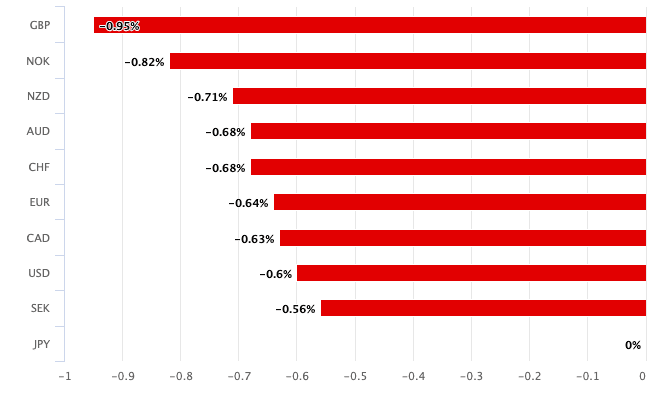

The market reaction suggests investors are in agreement, thinking the Bank of Japan might be softening its commitment to raising interest rates, which could deny the Yen a key source of support. As a result, the Japanese currency is trading lower against all its G10 peers:

Above: JPY is down against all G10 peers on Friday following the BoJ decision.

The Pound to Yen exchange rate is 0.86% higher on the day at 191.14, the Euro to Yen is 0.67% higher at 160.25 and the Dollar to Yen conversion is 0.70% higher at 143.63.

The Yen has been one of the better performers in global FX since July, bolstered by the thesis that the Bank of Japan would be hiking interest rates while everyone else was cutting as the interest rate differential narrowed.

New data out Friday showed that Japan's seasonally adjusted monthly inflation rate rose by 0.5%, and prices have risen by an annualised 3.9% over the past six months.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

However, "if we exclude the price increases for fresh food and energy, the annualized increase over the past six months is only 2.2%. And a look at service prices, which have risen by 0.8% at an annual rate over the same period, offers little promise for the hoped-for domestic inflation," says Baur.

He explains that the data suggests inflation isn't as bullish for the JPY as it could be, which might explain a potential easing in 'hawkish' guidance from the Bank of Japan.

The central bank's September decision also follows the Federal Reserve's bumper 50 basis point cut on Wednesday, which sent the Dollar lower and further rate cuts could yield further USD weakness.

This matters for the BoJ which had grown frustrated by the Yen's relentless decline in the first half of the year. If the USD weakens on its own volition, the BoJ can step back a bit if it thinks its own currency is at levels it feels comfortable with.

"The yen’s gains have also made the BoJ’s life easier from a risk management standpoint, alleviating political pressure to support the currency while lowering the risk of an inflation overshoot from rising import prices," says Konstantinos Venetis, an economist at TS Lombard.

TS Lombard thinks the BoJ can raise interest rates again and pencil in 0.50% for the policy rate by year-end and 1% by mid-2025 based on our central economic forecast.

However, Commerzbank thinks the BoJ will find it difficult to raise interest rates significantly and expect only one more rate hike in December, "which will lead to a weaker JPY in the coming months," says Baur.