Lagarde Blows Pound / Euro Exchange Rate Away

- Written by: Gary Howes

- ECB drops a surprise

- And triggers a EUR bounce

- But too soon to call end to GBP/EUR rally

Image: © European Union, reproduced under CC licensing.

Pound Sterling has fallen sharply against the Euro and put at risk a long running trend of gains after the European Central Bank (ECB) delivered a dramatic shift in stance at its February policy meeting.

The ECB signalled concerns that inflation was now expected to run hotter than was previously the case and that a fundamental shift in thinking with regards to policy could take place at coming meetings.

ECB President Christine Lagarde said the Governing Council had expressed an "unanimous concern about inflation," which reached 5.1% in January.

She said "risks to the inflation outlook are tilted to the upside, particularly in the near term."

Markets jumped on this as a sign a rate rise is coming sooner rather than later, with money markets now suggesting a rate hike in June is possible.

"EURGBP buying stole the limelight during the very hawkish ECB press conference," says Erik Bregar at thefxbeat.com.

The Euro to Pound exchange rate surged from a low at 0.8285 to record a high at 0.8395, meaning the Pound to Euro exchange rate reversed a two-year high at 1.2067 to record a low at 1.1910.

Above: There was a stark decline in the value of GBP relative to EUR in the wake of the ECB event.

- Reference rates at publication:

GBP to EUR: 1.1864 - High street bank rates (indicative): 1.1550 - 1.1632

- Payment specialist rates (indicative: 1.1757 - 1.1805

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

But economists remain sceptical the ECB can sustain such a hawkish pivot, arguing Eurozone inflation is unlikely to prove as persistent as that in the UK and U.S.

UBS economists expects the Bank of England to tighten by more, and sooner than the ECB, "which should mean that the pound should continue to outperform the single currency over the coming months," says Dean Turner, Chief Eurozone and UK Economist at UBS Global Wealth Management’s Chief Investment Office.

The ECB's guidance is a "classic example" of central banks following the market during a tightening cycle says Brent Donnelly, CEO of Spectra Markets.

Central banks can make a habit of following each other: note the Bank of England was widely anticipated to hike rates in November but bottled the decision only to surprise again and raise in December.

But keen followers will remember that by the time the Bank hiked on December 16 the Federal Reserve had sent clear signals it too was about to enter a rate hiking cycle.

And this signalling has since only grown stronger, potentially nudging the ECB along.

"A month ago they were saying no hikes in 2022. Now, anything is possible. CB communication is meaningless in hiking cycles, they just do whatever is priced in," says Donnelly.

So what is priced in?

"10 basis point ECB hike priced in for June," says Frederik Ducrozet, Global Macro Strategist at Pictet Wealth Management.

This pricing marks an extraordinary shift in expectations for the ECB which only last year was guiding the markets to a 2023 rate hike, at the earliest.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The significant pulling forward of hike expectations raised the yield paid on Eurozone bonds which in turn lit a fire under Euro exchange rates.

Given the gap between previous expectations and current expectations was the greatest for the ECB's policy path, it stands that the Euro had the most to gain when the gap shrunk.

For the Euro what matters from here is whether calls for a June hike can be sustained: if yes, then the rally can continue.

If no, then the Euro's rebound might have a limited shelf life.

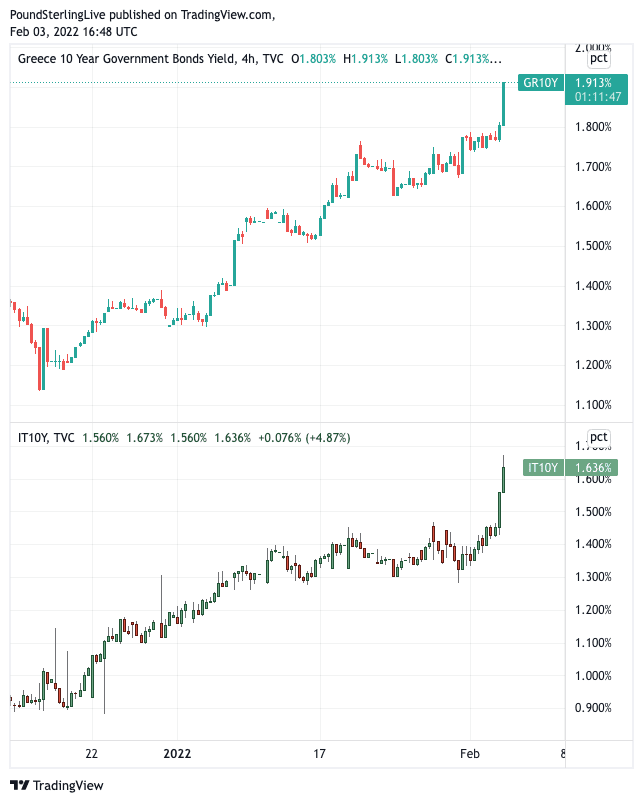

Note that the yield paid on peripheral Eurozone bonds are surging, meaning the cost of financing in Spain, Italy and Greece are shooting up relative to the yield paid on German bunds.

Above: The yield paid on ten year bonds in Greece (top) and Italy (bottom), is surging.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

This is a scenario the ECB will be loathe to entertain and the potential for Lagarde to row back on recent hawkish guidance is therefore very real.

The blowout in the Euro could in fact be relatively short-lived if the ECB does push back; note Thursday's policy statement is at odds with guidance issued by the ECB's Chief Economist Philip Lane just last week.

Lane said for inflation to sustainably breach 2.0% in the medium-term wages would need to be growing at or above 3.0%.

With wages rising 2.5% in the third quarter of 2021 this outcome is still some way off, yet there is a sense of haste at the ECB.

"The surprise rise in inflation to 5.1% yoy in January reflects mostly an energy price shock. Unlike the US, the Eurozone is showing neither signs of excess demand nor of excessive wage gains (yet)," says Holger Schmieding, Chief Economist at Berenberg Bank.

Berenberg has brought forward a call for the first 25 basis point ECB rate hike from June to March 2023.

This is still some months away from the market's current expectation for June 2022, meaning if Berenberg is correct the Euro must return lower.

"The hurdle for the ECB to raise rates this year remains high, though. The proverbial doves at the ECB can still argue that inflation looks set to decline from March 2022 onwards unless energy prices, Chinese lockdowns or other factors deliver a new shock," says Schmieding.