Pound Sterling Volatile as Bank of England Offers a 'Hawkish' Hike but 'Dovish' Guidance

- Written by: Gary Howes

- Bank Rate up to 0.50%

- Quantitative tightening commences

- GBP rallies

- But Bailey cools excitement in press conference

- Suggests Bank will step off accelerator later in year

- Disappointing GBP bulls

Above: Governor Andrew Bailey, press conference Feb 03. © Pound Sterling Live, Still Courtesy of The Bank of England.

The British Pound jumped to new post-pandemic highs after the Bank of England opted to raise interest rates again, but the currency's gains were soon reversed after Bank Governor Andrew Bailey struck a decidedly more 'dovish' tone with regards to future rate hikes.

The Bank of England raised interest rates by 25 basis points, although some members were keen to hike by a more substantive 50 basis points.

The Monetary Policy Committee (MPC) voted by a majority of 5-4 to increase Bank Rate by 0.25 percentage points but said those members in the minority preferred to increase Bank Rate by 0.5 percentage points, to 0.75%.

That the Bank almost voted for 50 basis point hike signals further hikes are coming, and they might come soon.

Indeed, the Bank could yet meet the market's expectations to deliver 100 basis points of rises by year-end.

The 'hawkish' hike saw Pound Sterling rise across the board:

The Pound to Euro exchange rate rose half a percent to 1.0260, the Pound to Dollar exchange rate rose a further 0.30% to reach 1.3617. (If you are looking to transact at current levels - at market beating rates - please find out more here).

"The pound gained sharply versus the euro and the U.S. dollar on the statements unexpectedly hawkish stance," says Erik Norland, Senior Economist at CME Group.

Above: GBP/EUR at 15 minute intervals, with the UK ten-year gilt yield (orange line).

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

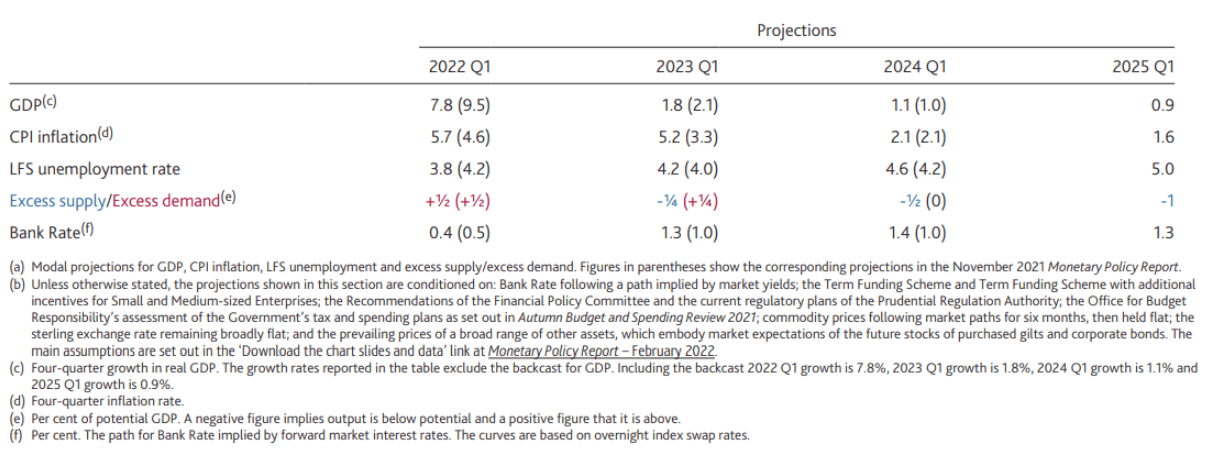

But the hawkishness did not end with the vote composition: the Bank's all-important inflation forecasts contained in the Monetary Policy Report revealed the Bank now anticipates inflation to be above its 2.0% target over the medium-term.

The first-quarter 2024 inflation prediction reads at 2.1%, and this is assuming a Bank Rate at 1.5%.

This is an exceptionally hawkish projection and could underpin UK yields and exchange rates going forward.

The Bank also said it would proceed with quantitative tightening (QT) - the process whereby it shrinks its balance sheet by no longer reinvesting expiring bonds held in its portfolio.

These bonds were bought under the quantitative easing programme that ended in December, QT is therefore a reversal of this programme and will act alongside interest rates to tighten UK monetary policy.

A further hawkish surprise was the Bank's stated intention to sell corporate bonds - which is a more proactive form of QT. Granted, the corporate bond holding is relatively minor (£20BN) compared to sovereign debt holdings (£875), but it still signals a desire to move at pace.

But it could signal the Bank intends to raise rates to 1.0% and then begin actively selling sovereign bonds, putting to bed any doubts that it might opt to defer such a decision.

Concerning the economic outlook, the Bank said UK economic growth would jump again in February and March as the hit from the Omicron episode looks to be relatively limited, but further out growth would slow markedly.

The Bank said underlying earnings growth is estimated to have remained above pre-pandemic rates, and is expected to strengthen over the coming year.

As the above chart shows, growth forecasts were largely downgraded, creating an air of caution regarding the outlook and in the process taking some heat out of the Pound and bond markets.

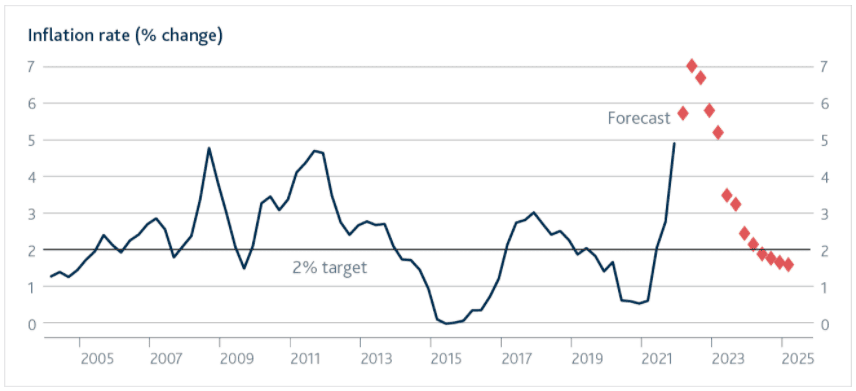

Inflation is nevertheless forecast to increase further in coming months and test 6% in February and March, before peaking at around 7.25% in April.

This projected peak is therefore 2 percentage points higher than expected in the November Report.

The Bank said any further tightening in monetary policy will depend on the medium-term prospects for inflation and if the economy develops broadly in line with the February Report's central projections, some further modest tightening in monetary policy is likely to be appropriate in the coming months.

Although much of the Monetary Policy Report was hawkish, there was also something for the doves.

"Today’s communications from the MPC should prompt investors to reconsider quite how far the MPC is prepared to hike Bank Rate over the next year," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics, Reuters' and Bloomberg's top-ranked forecaster for the UK economy in 2021.

Tombs explains the MPC thinks that CPI inflation would average 2.3% in the third year of its forecast, if Bank Rate remained at 0.50%, signalling a clear need for higher interest rates.

But it thinks CPI inflation would average 1.7%, if Bank Rate rose to 1.2% by the end of this year and 1.4% by the end of 2023, as investors expected in the 15 working days to January 26.

"Its three-year ahead inflation forecast, assuming market rates, is its lowest since November 2011. These numbers imply that the MPC thinks Bank Rate needs to increase by only 35bp by the end of this year for CPI inflation to hit the 2% target in the medium term," says Tombs.

If the market unwinds its aggressive bets for future rate hikes then the Pound's rally could ultimately stall.

"If, as we continue to expect, GDP growth is sluggish this year and CPI inflation shows clear signs of falling sharply from April onwards, then the MPC seems likely to proceed much more slowly with rate hikes from the summer onwards," says Tombs.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Speaking to the press following the decision Governor Andrew Bailey said the outlook remains uncertain and warned it would be a mistake to assume interest rates are on an "inevitable long march up".

He appeared keen to quell the market's hawkish expectations further by saying rates were not rising because the economy "is roaring away".

"Listening to the press conference, we were left with the impression that the MPC isn't feeling as hawkish as the headlines might suggest," says Dean Turner, Chief Eurozone and UK Economist at UBS Global Wealth Management’s Chief Investment Office.

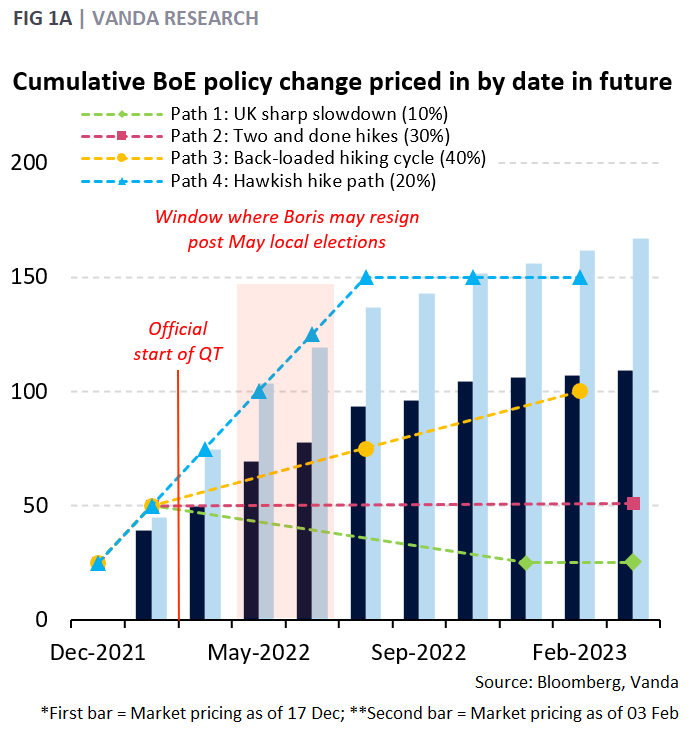

Image courtesy of Vanda Research

Of concern is the impact rising energy prices and inflation will have on consumer spending on coming months, fearing they will act as a headwind to growth.

"It reads more like they are hiking because they feel they have to ... but it’s front-loaded and may or may not be the start of a true cycle. Certainly sounds more data dependent than autopilot to me. If I was long GBP, I would be taking profit here," says Brent Donnelly, CEO of Spectra Markets.

Strategist Viraj Patel at Vanda Research says there are now six back-to-back rate hikes priced in.

"Surely only downside risks to this," he says. "Pain trade of higher short-term rates continues. Not sure how UK consumer handles higher rates + squeeze on incomes. Cue 2023 recession talk".

The Pound's rally that followed the initial decision has therefore understandably been cut short by the subsequent communications from the Bank's governor.

"In our view, it is reasonable to assume that UK rates will continue to rise, with the next hike possibly coming as early as March. But we think that the peak will be around 1% this year," says Turner.

The Pound meanwhile fell sharply against the Euro after the European Central Bank (ECB) delivered a drastic shift in stance at its policy meeting, held alongside that of the Bank of England.

The ECB signalled concern with inflation and that a fundamental shift in thinking with regards to policy could potentially take place at coming meetings.

Markets jumped on this as a sign a rate rise is coming sooner rather than later, with money markets now suggesting a rate hike in June is possible.

But economists remain sceptical of this timing, arguing Eurozone inflation is unlikely to prove as persistent as that in the UK and U.S.

UBS expects the Bank of England to tighten by more, and sooner than the ECB, "which should mean that the pound should continue to outperform the single currency over the coming months.