"Fast and Furious" Bank of England to Hike Bank Rate to 2.0% says Credit Suisse

- Written by: Gary Howes

Image © Adobe Stock

A strong labour market and rising wages will mean the Bank of England will have to keep pushing interest rates higher says Credit Suisse, even as UK inflation rates begin to fall later in 2022.

Economists at the bank anticipate as many as six more hikes to come from the Bank of England in the current cycle, which makes them more hawkish than many peers who say the prospect for hikes beyond a Bank Rate at 1.0% are limited.

For Sterling, the findings suggest further upside from the interest rate channel will become available.

"Inflationary pressures are expected to be high in the near term, labour markets are tight and wage growth is above pre-pandemic rates," says Sonali Punhani, Chief UK Economist at Credit Suisse.

"We think the BoE could hike rates again by 25bps in March 2022, sooner than our previous forecast of May 2022," he adds.

The Bank of England hiked rates by 25 basis points at the February 03 policy meeting, making for a second successive rate hike amidst heightened inflationary pressures.

UK inflation increased 5.4% year-on-year in December according to the ONS, beating expectations for a reading of 5.2% and surpassing November's 5.1%.

The Bank of England now projects inflation to be above its 2.0% target over the medium-term, assuming Bank Rate reaches 1.5%.

Credit Suisse acknowledges that in the second half of 2022 inflation is expected to fall, which could reduce the pressure on the Bank to hike rates.

"Our view is that despite the fall in inflation in H2 2022, further monetary tightening is warranted," says Punhani.

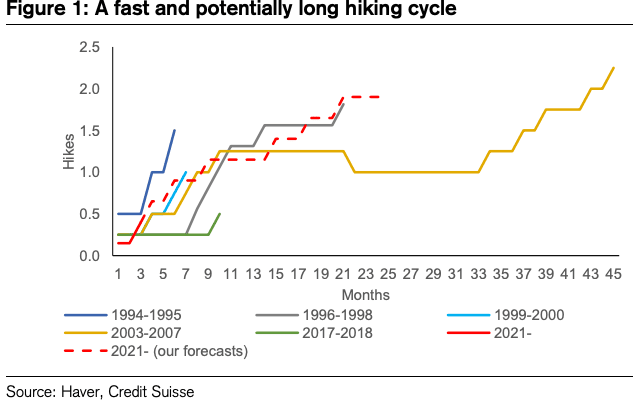

Credit Suisse now forecasts three further rate hikes in 2022 and three hikes in 2023 and see a terminal Bank Rate at 2.0%.

"We think the drop in inflation is likely to slow the hiking cycle, but not stop it," says Punhani.

"This is because we expect the labour market to continue to tighten on the back of strong labour demand and squeezed labour supply," he adds.

The UK's unemployment rate fell to 4.1% in December from 4.2% previously, beating expectations for a reading of 4.2%.

The ONS reported there are 409K more people in work than was the case pre-Covid in February 2020 level.

The labour market will likely remain robust as the number of job vacancies in October to December 2021 rose to a new record of 1,247,000, an increase of 462K from its pre-coronavirus January to March 2020 level, with most industries displaying record numbers of vacancies.

"Strong wage pressures should keep underlying inflationary pressures intact, even as pressures from energy and goods prices subside," says Punhani. "There is a risk wage growth broadens out as inflation ramps up pay demands in the midst of a tight labour market."