Pound Rallies After Inflation Nixes a Rate Cut on Thursday

- Written by: Gary Howes

Image © Pound Sterling Live

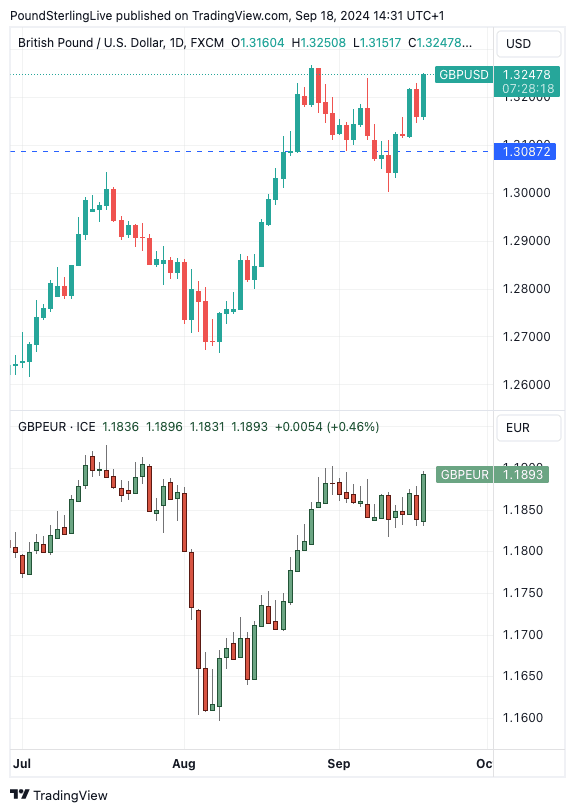

Pound Sterling extended its gains after a solid UK inflation report saw traders resign themselves to the fact the Bank of England would not cut interest rates on Thursday.

The Pound to Euro exchange rate is 0.45% higher on the day at 1.1893; if it can close the day around these levels, we would record the highest close since July. This after the ONS said the headline rate of inflation rose to 0.3% month-on-month in August, up from -0.2% in July. The annual rate was steady at 2.2%. These figures both matched analyst expectations.

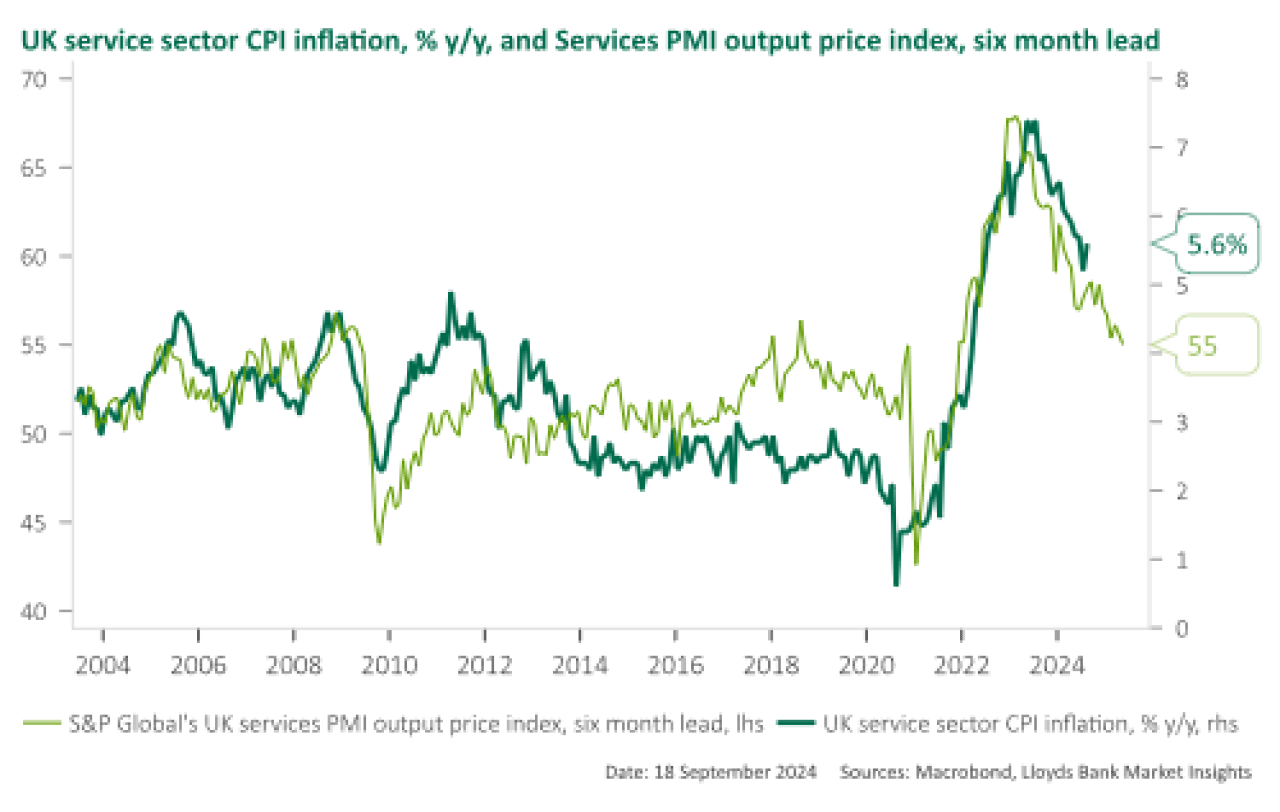

Core inflation rose from 0.1% to 0.4% m/m in August, with the annual rate reaching 3.6% from 3.3%. Both met expectations. Services CPI - a major source of concern for the Bank of England - rose 0.4ppts to 5.6% y/y.

The Pound to Dollar exchange rate is 0.70% higher on the day at 1.3250 and is eyeing the 2024 peak at 1.3266, just hours ahead of a critical Federal Reserve interest rate decision.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"This morning’s numbers all but confirm that the Bank of England should keep rates on hold tomorrow," says Francesco Pesole, an analyst at ING Bank.

Ahead of the inflation release the market saw the odds of a cut on Thursday rise as high as 35%, with traders apparently thinking a 50bp cut at the Federal Reserve on Wednesday would open the door to an accelerated pace of cuts at the Bank.

But with a robust economy and evidence of rising inflation, the argument for the Bank of England to accelerate the pace of rate cuts will be difficult.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

The Pound is 2024's best performing G10 currency owing to expectations for an extended period of high UK interest rates and these inflation data don't change that picture.

"This year’s top G10 FX performer has been swift to dodge potential headwinds that arose in the past six weeks or so, such as a close BoE rate cut, softer UK inflation and stalling activity mid-year. That is perhaps because the GBP is on track to become the highest yielder in the G10 space in the coming weeks or months, as the BoE looks very much set tomorrow for a pause that today’s UK CPI release is unlikely to challenge despite the softer prints of a month ago," says Alexandre Dolci, an analyst at Crédit Agricole.

"Inflation is expected to pick up later this year and domestic price pressures, such as wage growth, still pose an upside risk to the outlook. That should result in a gradual path for interest rate cuts going forward, with rates likely to stay unchanged this month," says Martin Sartorius, Principal Economist at the CBI.

Looking at the specifics of the inflation release, rising transport prices were a concern, with air fares rising 22.2% between July and August.

"While some summer price hikes are normal, this is the second most dramatic take off in plane ticket prices since 2001," says Nicholas Hyett, Investment Manager, Wealth Club.

"High core inflation, coming in a touch above expectations, increases the chances the Bank of England choose to leave interest rates unchanged tomorrow. It's a delicate balance to strike though - especially when headline numbers are driven by big movements in a single, seasonal variable like air fares," he adds.

Sam Hill, Head of Market Insights at Lloyds Bank, says these data will make it difficult for the Bank of England to justify raising interest rates tomorrow but won't stop another cut ahead of year-end.

"Looking past the September MPC decision tomorrow, these data do still point to the likelihood of a Bank Rate cut in November. Despite services CPI rising 0.4ppts to 5.6% y/y, that is still 0.2ppts below the BoE staff forecast from the August MPR," says Hill.