Retail Sales Saw a Revival in May

- Written by: Sam Coventry

Image © Adobe Stock

New data from the CBI shows UK retail sales rose at their fastest pace since December 2022 in May.

The data comes just days after official figures for April disappointed against expectations, with a wet April being blamed.

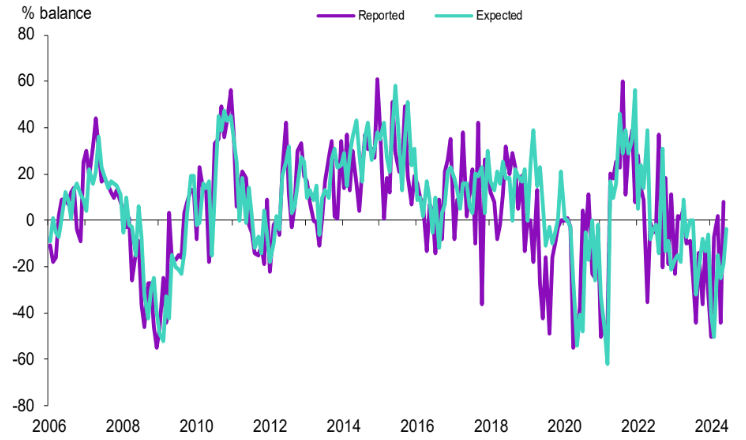

Some payback appears to be underway, with the weighted balance rising to +8% from -44%, which represents the fastest increase since December 2022.

"May's increase in retail sales adds to the swathe of data pointing to an improvement in activity over the near-term. Falling inflation, and continuing real wage growth will contribute to a healthier consumer outlook, in turn supporting the retail sector further," says Alpesh Paleja, the CBI's lead economist.

Above: Volume of sales compared to a year earlier.

The latest CBI Distributive Trades Survey also showed selling price inflation in the retail sector eased considerably in May, to its lowest since August 2020. Selling price inflation eased considerably to +20% from +54% in February and has now fallen back below its long-run average.

The data comes on the same day the British Retail Consortium (BRC) shop price index revealed inflation is back to what the BRC describes as "normal levels" after it eased sharply to a 30-month low at 0.6% y/y in May.

Economists say fading inflationary pressures can help sustain an improvement in retail sales in the coming months. Indeed, retailers said they expect sales to fall slightly next month but to remain broadly in line with seasonal norms.

Sales were seen as "average" for the time of year (+2%), which was the firmest outturn in eight months. Sales are expected to remain broadly in line with seasonal norms in June (+1%).

Orders placed upon suppliers declined moderately in the year to May (-11% from -49%). Retailers expect the cutback in orders to continue next month at a slightly faster rate (-16%).

However, retail employment continued to decline for the seventh consecutive quarter (-26%). Headcount in retail is expected to continue to contract next month, but at a more moderate pace (-18%).

"The mixed mood from our survey demonstrates just how nascent the economic recovery is. All parties should use this general election campaign to embrace policies which will embed sustainable growth, foster the investment we need to develop a labour market which delivers higher living standards, and to accelerate our transition to net zero," says Paleja.