Bank of England Rate Cuts to Come Thick and Fast, Says Goldman Sachs

- Written by: Gary Howes

Image © Adobe Images

The Bank of England's cautious approach to cutting interest rates will give way to a rapid run of interest rate cuts starting in November.

This is according to Goldman Sachs, which has updated its views on the outlook for UK monetary policy.

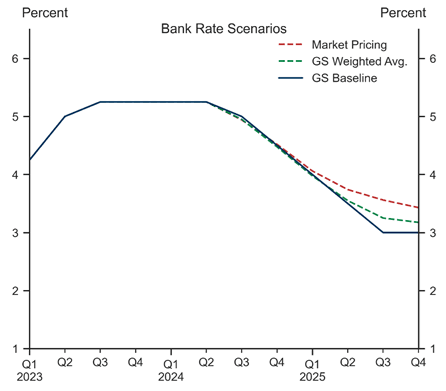

"We now expect the Bank of England to move to consecutive cuts starting at the November MPC meeting; we have left the terminal rate unchanged at 3%, below market pricing," says Sven Jari Stehn, an economist at Goldman Sachs in London.

Stehn says this new baseline expectation has a 40% probability attached.

If this prediction is correct, then financial markets are wildly misaligned, expecting a far slower pace of cuts over the coming months. The subsequent adjustment would potentially result in a weaker Pound, and we will be awaiting developments from Goldman Sachs' FX research team for signs that this shifts their expectations for the currency.

Image courtesy of Goldman Sachs.

It would also mean a sharply lower profile for UK financial products as gilt yields will fall sharply, making for some good news for mortgage holders.

Reasons to expect an acceleration in the pace of rate cuts include the view that UK wage growth is about to cool meaningfully in the coming months.

"While the level of pay growth remains high, the sequential pace of pay rises has slowed and important forward-looking indicators have cooled," says Stehn.

Inflation in the services sector, which remains stubbornly high and is a barrier to the Bank's agenda of achieving a sustainable 2.0% target, will finally fall meaningfully.

Goldman Sachs expects services inflation to decelerate to 5.0% by December 2024, 0.3pp below the BoE’s August MPR forecast, before falling to 3.8% by the end of 2025.

"Progress in 2025 is likely to be notably more rapid on measures of underlying services inflation that exclude rent and education, which is likely to provide reassurance to the MPC that price pressures are easing," says Stehn.

In addition, Goldman Sachs' calculation thinks the terminal rate at which interest rates are at an appropriate level is down at 3%, which means there is more work to be done than is the case in other similar economies where rates are already lower.

Economists attach a 40% chance to the updated baseline expectation, a 30% chance to quarterly cuts and a 20% chance to a deeper cutting cycle with 50bp increments.