Pound Sterling Takes Big Retail Sales Miss in its Stride

- Written by: Gary Howes

Image © Adobe Stock

The British Pound dipped against the Euro and Dollar after UK retail sales fell sharply in April, but markets look willing to look through the figures owing to the effect of inclement weather.

Another washout meant headline retail sales fell 2.3% month-on-month in April, said the ONS, undershooting the -0.4% figure expected. They fell 2.7% in the year to April, which was below the -0.2% expected by consensus.

The Pound to Euro exchange rate dipped on the release but recovered losses in the minutes following it to trade near 1.1737. The Pound to Dollar exchange rate dipped to 1.2672 before recovering to 1.2690.

The ONS said poor weather was once again to blame for the poor outcome, which can help explain the Pound's roundtrip. "Retailers were caught in the rain in April," says Phil Monkhouse, UK Country Manager at Ebury.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The short-lived drop in the Pound suggests investors are looking through the rain-impacted figures and a brighter May looks set to deliver some catchup. Furthermore, retail sales can continue to recover in the coming months, aided by a resilient jobs market and falling inflation.

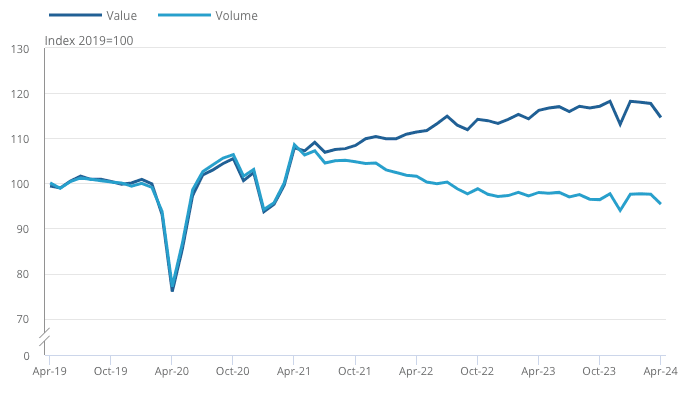

Although the value of retail sales has steadily risen in recent months, the volume of goods flowing through the country's stores continues to fall. This is the result of inflation which means costs are rising but the amount people are purchasing is falling:

Value can stabilise with inflation falling back to close to the Bank of England's 2.0% target in the coming months, while rising real incomes can unlock an uptick in volume.

The Pound will ride out any post-retail sales volatility thanks to a retreat in expectations for a Bank of England interest rate hike in the wake of Wednesday's inflation release.

"It's been an eventful week for UK markets with a slew of important data prints and a surprise general election being called. Sterling has taken it all in its stride though, mostly benefiting from the scaling back of rate cutting expectations due to services inflation coming in at 5.9%, well above forecasts," says George Vessey, Senior FX Strategist at Convera.

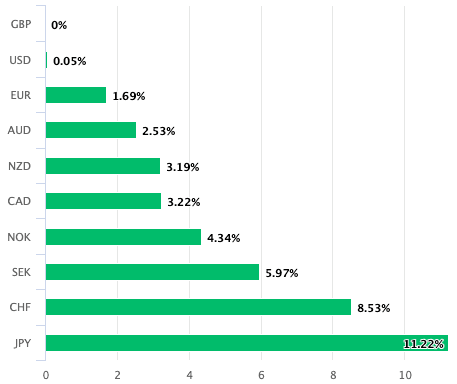

Above: GBP is the best-performing major currency of 2024. Track GBP with your own custom rate alerts. Set Up Here

The figures showed headline inflation is close to target, but underlying core inflation measures are still far too hot for a June interest rate cut. The Pound can continue to trade in firm fashion until bets for a Bank of England rate cut start to firm again.

"The pound has bounced back impressively from a small period of weakness following the Bank of England's (BoE) March meeting and is now the only G10 currency to have gained against the US dollar this year," says Michael Pfister, FX Analyst at Commerzbank.